How multiple B2B industries get invoices paid quickly and easily

Unlock funding for growth & expenses from your outstanding receivables

Learn How FundThrough Helps Multiple B2B Industries Conveniently Access Capital

Protect your cash flow by getting your invoices paid early – no bank obligations or physical assets needed.

Small business invoice factoring can help businesses with cash flow problems. Find out about small business invoice factoring with FundThrough.

You can get cash without giving away equity in your new company and without a long financial history.

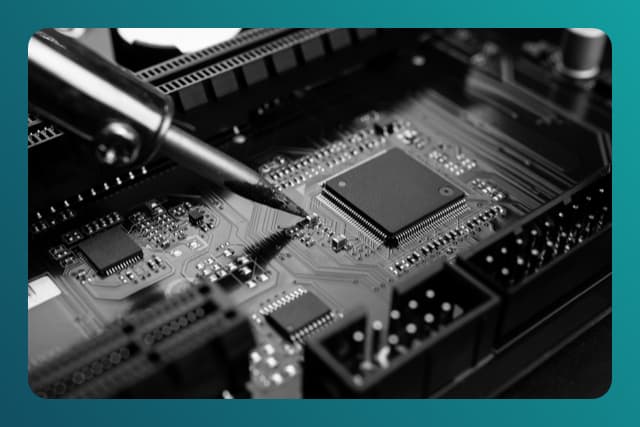

Find out why invoice factoring is a cash flow hack for I.T. companies like yours.

Build your business by turning invoices into quick cash for payroll, projects, and growth.

Make your money work for you with faster cash flow. Find out how you can get invoices paid in days – not months.

See why speeding up cash flow by getting invoices paid quickly fits the apparel industry.

Protect your cash flow by getting your invoices paid early – no bank obligations or physical assets needed.

Stop wasting time waiting to get paid and start speeding up your cash flow.

Drive growth for your B2B automotive business. Accelerate cash flow by turning invoices into cash.

Education-related companies are speeding up cash flow by putting invoice factoring to the test.

Make your cash serve you better by getting it faster, so you can pay daily expenses and seize growth opportunities.

Small business invoice factoring can help businesses with cash flow problems. Find out about small business invoice factoring with FundThrough.

Create more hospitable cash flow by speeding it up. Pay expenses and take on more projects with fast invoice payments.

Boost cash flow for your agency by getting invoices from facilities paid in days – not months.

Find out how you can maintain strong cash flow with oilfield factoring for oil and gas companies with FundThrough.

Pre-qualify in less than 3 minutes

The bottom line is if you invoice businesses, we can reduce the wait.

Are you a B2B Marketplace, App, or Ecosystem?

Enabling your customers to get their invoices funded in days is an easy way to add value and stickiness to your platform. Explore a partnership with us today.