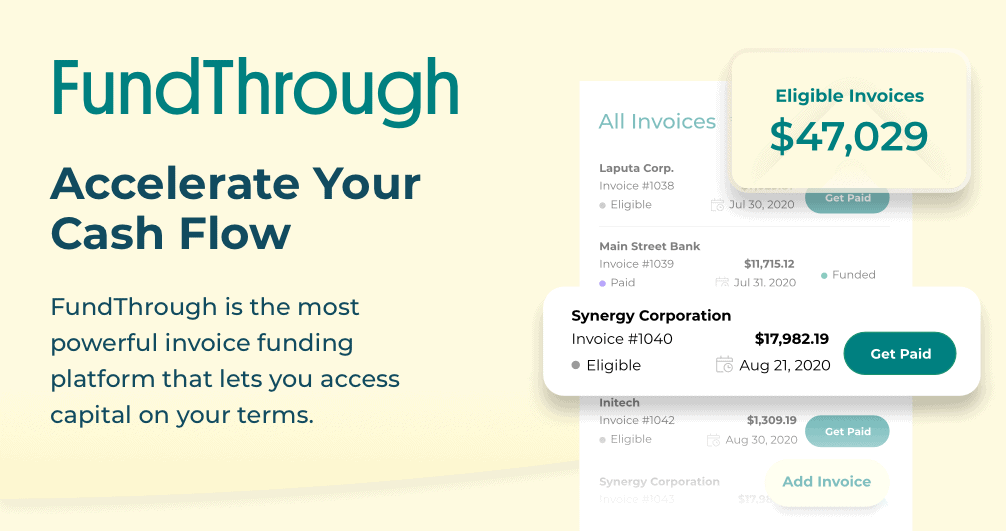

FundThrough Announcements

Discover What’s New: FundThrough’s June 2025 Feature Releases

READ

Accounting for Factoring Receivables: How to Record Factoring Transactions

READ

How to Become a Vendor in 9 Simple Steps

READ

Factoring Companies in Canada: 8 Best Options for Business Funding

READ

Invoice Factoring Rates: How to Find the Best Deal for Your Business

READ

Top Embedded Finance Companies: 8 Options for B2B Marketplaces, Apps, Ecosystems

READ

QuickBooks Invoice Factoring: Complete Guide

READ

READ

READ

READ

READ

READ

READ

READ

READ

READ

READ

READ

READ