Engineering Invoice Factoring

Increase your cash flow quickly with your own receivables

WHAT'S IN THIS GUIDE

The project-based nature of engineering firms’ work is a challenge that can lead to lumpy cash flow. This is on top of the 30, 60, or 90-day payment terms common within the engineering industry, which prolong the payment cycle even further. This makes it tough to keep up with expenses like labor, other operating costs, and to take on big projects that would help your business grow. We understand the difficulties cash flow challenges like this cause since we’re entrepreneurs ourselves, as well. Engineering invoice finance offers a solution to these cash flow crunches, and helps smooth cash flow so you can more easily manage your expenses and go after business growth opportunities.

What Is Invoice Factoring for Engineering Firms?

Invoice factoring for engineering firms is a financial arrangement that allows an engineering firm to improve its cash flow by selling its accounts receivable, or outstanding invoices, to a factoring company. Invoice factoring provides immediate access to funds that would otherwise be tied up in unpaid invoices, allowing engineering firms to meet their immediate financial obligations and fund their operations more effectively.

What Is Engineering Invoice Finance?

Invoice finance for engineering is a financing solution specifically designed for engineering firms to address their cash flow needs. It is similar to invoice factoring, but with some key differences.

In engineering invoice financing, an invoice finance company or lender provides a loan or line of credit to the engineering firm based on the value of its outstanding invoices. Instead of selling the invoices outright as in invoice factoring, the engineering firm uses the invoices as collateral to secure the financing from the invoice finance company. That said, often times invoice financing is simply used as another term for invoice factoring.

How Does Engineering Invoice Factoring Work?

The engineering invoice factoring process with FundThrough is actually pretty straightforward. Here’s how it works:

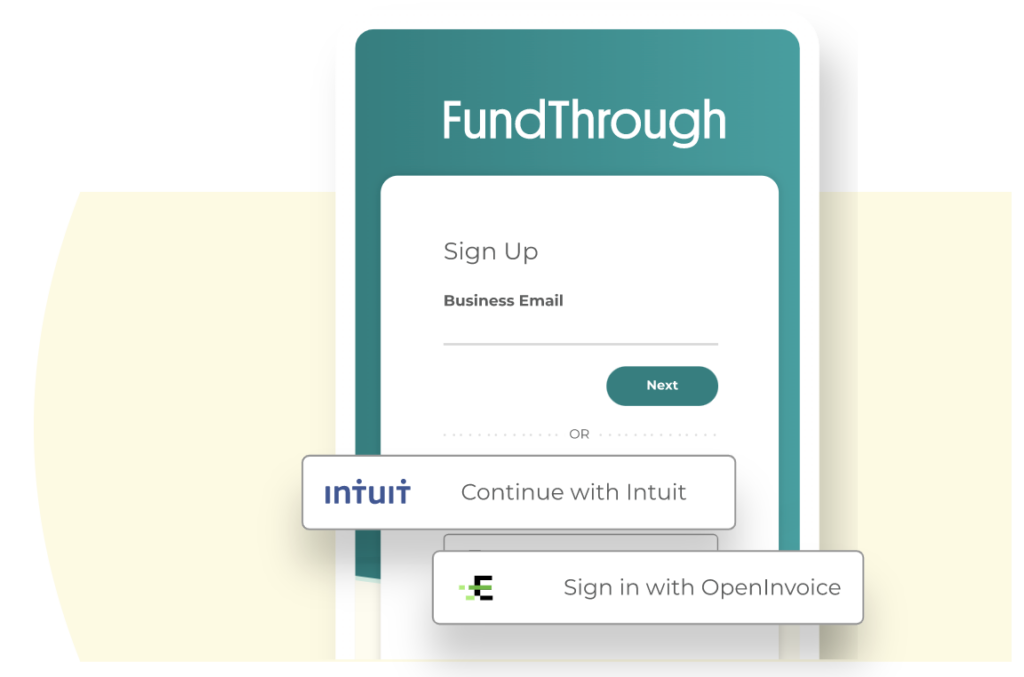

1. Create or connect your account in minutes

Create a free account or connect your QuickBooks or OpenInvoice account, and provide information about your business.

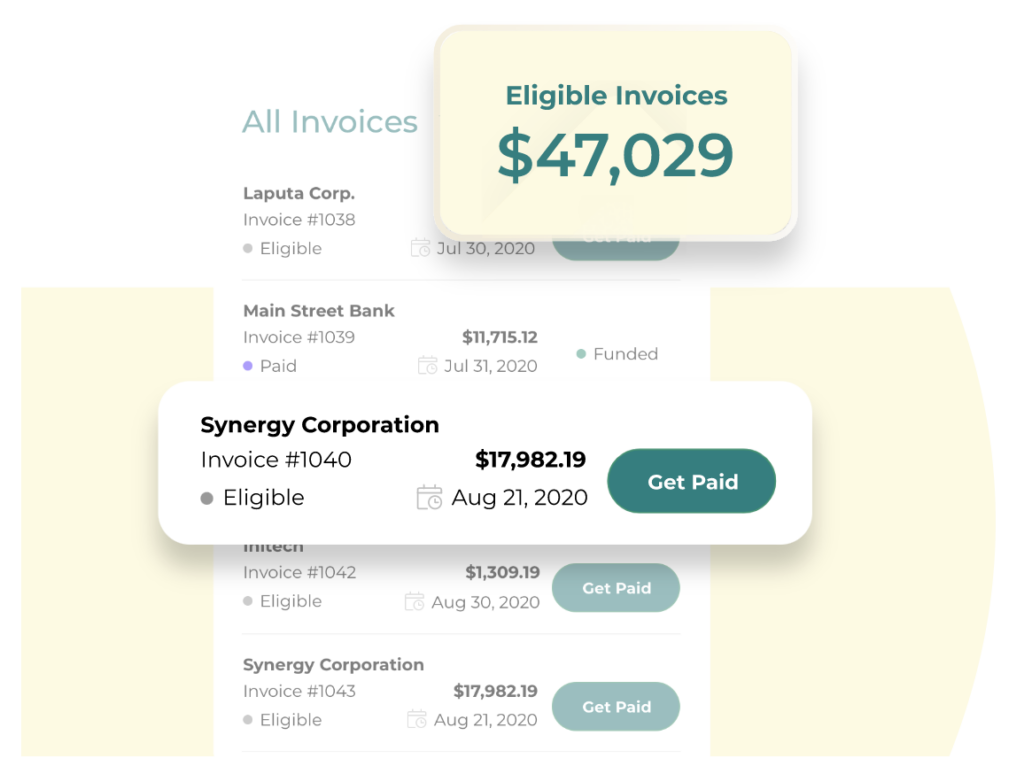

2. Choose which invoices to fund.

Upload invoices into FundThrough or pull in eligible invoices from QuickBooks or OpenInvoice. We provide unlimited funding for your business based on the size of your outstanding invoices.

Select which invoices you want to fund, and submit them in one click (after set up).

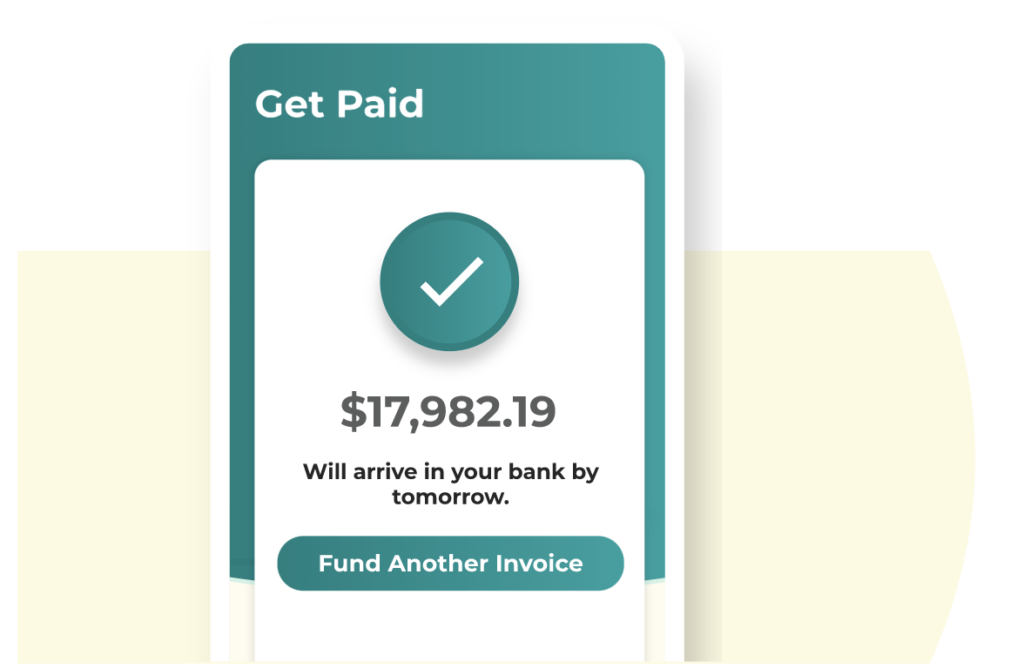

3. Get Funded.

Upon approval, funds are deposited into your business bank account as soon as the next business day.

You can then put your capital to work for growth projects, payroll, equipment, hires, and more.

Engineering Factoring Benefits

Factoring gives engineering firms access to the cash they’ve already earned. If you’re considering invoice factoring, here are just some of the benefits of invoice finance for your firm.

- Easy process. Compared to bank financing, the application process for invoice factoring is relatively quick and easy, and takes just a few minutes online.

- Quick capital. Once your invoice is approved, you’ll typically receive funds in your business bank account within 1-2 business days.

- Flexible funding. With invoice factoring, you can pick and choose when you want to fund an invoice, for a convenient funding boost when you need it. At FundThrough, we also offer unlimited funding – the more you invoice, the more funding you can access.

- Grow your business. Need an injection of cash to staff up or purchase supplies for a big project? Engineering factoring gets you cash within days for work you’ve already completed.

- No debt. Because invoice factoring is not a loan, you aren’t adding any debt to your balance sheet.

- No dilution. With engineering invoice finance, you aren’t giving away ownership or control in your company, unlike some other types of business financing.

- No bank hassles. Applications for bank financing are often lengthy and time consuming. Then there’s the waiting period to hear if your application’s been approved. Invoice finance providers have a much smoother, quicker process.

- No long-term commitment once invoice is paid. Once your customer pays the outstanding balance of the invoice according to the original payment terms, there’s no further obligation. (If you’re concerned about customer contact, see our approach to working with your customers.)

Engineering Factoring Drawbacks

Like most business funding options, engineering factoring is not without its drawbacks.

Concerns about affect on customer relationships

In the past, many factoring companies were aggressive with collecting payment from customers, which led to engineering factoring getting a bad rap. Nowadays, reputable companies work with you before contacting your customer. At FundThrough, we know how hard you’ve worked to build your customer relationships, which is why we treat your customer like our own.

Recording in bookkeeping

There’s a perception that accounting for factoring transactions in bookkeeping software can be difficult, but once you’ve seen the process broken down step by step, it’s manageable. Our blog post shows you how to record factoring transactions in QuickBooks and other accounting software.

How Does Engineering Invoice Factoring Compare With Other Kinds of Business Financing?

Until invoice factoring became an option to help small, growing businesses get funding, business bank loans, lines of credit, and credit cards were the traditional and accepted forms of financing. Depending on your situation, each of these different funding options can be appropriate. We’ve put together the pros and cons to help you choose the best way to fund your business.

Loans

Costs for a new or growing business can be significant. You may need to purchase equipment and inventory, pay employees, and keep up with rent, taxes, and marketing. You may consider taking out a business loan.

Pros

- Many business loans have relatively low interest rates when compared to many other types of funding.

- Interest can be deductible on your taxes.

- Depending on your requirements, you may have access to large sums of money to be used to grow your business.

- On-time repayments can help improve your credit rating.

Cons

- Many small, growing businesses don’t qualify for loans. They often need cash faster than the process would allow anyway.

- Most lenders have strict guidelines for loans and a lengthy review process.

- You need to have a good credit rating. Anything else and you may not qualify and if you do you’ll likely pay a higher interest rate.

- A business loan and the debt will show up on your balance sheet, which affect the valuation of your business.

Lines of Credit

A line of credit (LOC) is a lot like a credit card. You can borrow/withdraw money up to a certain maximum amount determined by your financial institution. You can cover day-to-day expenses and pay back your debt, only to borrow again when needed.

Pros

- When you’re short of cash, you can borrow only what you need as long as you don’t exceed your credit line limit.

- Making on-time payments can help improve your credit score.

- Lines of credit can have low interest rates.

Cons

- As with loans, oftentimes banks won’t give small, growing businesses a line of credit. They often need cash faster than the process would allow anyway.

- There will be limits on the maximum amount you can borrow, which might not always be enough.

- Although you pay-as-you-go, if you miss payments, are late, or move outside the terms of your agreement, you might face high fees.

- It’s easy to misuse a line of credit (just like it’s easy to misuse a credit card).

- If your business fails, you are responsible for any payments and debt incurred from using your line of credit.

- You need to have been in business at least two years, and will need to provide bank account information, financial statements, tax returns, and more to qualify.

- You have to keep up with making your payments.

Business Credit Cards

Like all forms of funding, business credit cards must be used wisely. It can be easy to overspend with a credit card.

Pros

- It’s easier to qualify for a business credit card than for a line of credit or business loan.

- You have quick access to the cash you need when you need it.

- Many business credit cards have reward programs or incentives, like cash back or airline miles.

- A business credit card can help build credit, which is helpful if you ever need to apply for a bank loan or line of credit.

Cons

- High interest, annual fees, and late charges can add up, especially if funding a large expense.

- Many business credit cards do not offer purchase protection.

- Business credit cards come with security risks like fraudulent charges from unauthorized use and stolen credit card numbers.

- You risk overspending.

Receivables Factoring

Invoice factoring pays your outstanding receivables in days, unlocking working capital you’ve already earned.

Pros

- You have access to fast cash when you need it based on the value of your invoice(s).

- Cash advances can greatly improve shortfalls in cash flow due to slow-paying clients.

- Does not require your business to have a long credit history, which is best for start-ups and new, fast-growing firms.

- Factoring relies on the creditworthiness of your customers, not yours.

- Invoice factoring is easier to obtain than most other forms of funding.

- Funding can increase with the value of your invoices.

- If your business is seasonal, factoring can infuse cash into your business to get you through the downtimes.

- Your accounts receivables are used as collateral, unlike many loans or lines of credit.

- You give up no equity or control in your business in exchange for funding with factoring.

Cons

- Invoices need to be verified (customer contact sometimes required)

- Can be complicated to account for in bookkeeping

How Do You Choose an Engineering Factoring Partner?

Choosing a factoring partner is a lot like choosing any lender. You’ll have to talk to each finance partner you’re considering to find the right fit for your business. We recommend asking these questions:

Does the factoring company work with engineering companies?

Most factoring companies work with most industries, but not all. Some factors specialize in only a few industries.

FundThrough works with engineering companies.

What advance rates does the factoring company offer?

The advance rate refers to the percentage of the invoice value that a factoring company is willing to advance upfront to the business selling the invoice. For example, if the advance rate is 80% and the invoice value is $10,000, the factoring company will provide an instant cash advance of $8,000 to the business and send the rest of the total, less their fee, once the customer pays the invoice. Advance rates can range from 60% to 100%, depending on the factoring company and sometimes the industry.

FundThrough advances 100% of the invoice amount, less a fee.

What factoring fees does the factoring company charge?

FundThrough pricing – 100% advance rates minus a flat fee. One up front price.

Does the factoring company have minimums?

A minimum is the amount you must factor every period (month, quarter, or year). Some factoring companies offer plans that require minimums, while others do not.

FundThrough doesn’t require minimums. Only fund when you need to.

Is Engineering Factoring Right For Your Business?

Cash flow is the number one problem for most start-ups and small businesses, especially if they’re growing. This is also true for engineering firms. Invoice factoring companies typically consider the following before offering you an advance.

- Nature of the business: you must be a registered business selling goods or services to other businesses.

- Service completion: invoice factoring is only available for goods or services that your clients have marked as complete or delivered.

- Encumbrance-free invoice: since invoices are the only collateral in a factoring arrangement, encumbrances such as tax liens can make it difficult to qualify for factoring. (But not impossible. FundThrough works with businesses on IRS and CRA tax payment plans all the time. We can even help you with getting an arrangement set up).

Factoring invoices is a sound financial strategy if:

- You spend time tracking down slow-paying customers and waiting 30, 60 or 90 days to be paid, which puts a tremendous burden on your business.

- You’ve delivered a product or provided a service to another business.

- You have slow times, downtimes, or your business is cyclical.

- You experience times of cash flow crunch.

- You need access to working capital to grow as a wholesale company.

- You can’t qualify for a loan.

- Your customers or clients are creditworthy.

Simple. Intuitive. Engineering Invoice Factoring.

Built For Your Business.