The Ultimate Cash Flow Guide

Cash Flow Basics and Definitions For Small Business | FundThrough

TABLE OF CONTENTS

- Calculating Cash Flow

- Cash flow formula

- Cash flow calculation methods

- How to prepare a cash flow statement

- Can cash flow be negative?

- Navigating Positive and Negative Cash Flow

- What is the cash flow break-even point?

- How can a negative cash flow affect a business?

- Can I borrow funds with a negative cash flow?

- Is positive cash flow the same as growth?

- Is positive cash flow the same as profit?

- Can I maintain positive cash flow with debt?

- What should I do when cash flow is negative?

- What is cash flow management?

- Cash Flow Management Basics

- What is cash flow analysis?

- What is a cash flow budget?

- Why do people say cash flow is the lifeblood of a business?

- Who manages a business's cash flow?

- Can cash flow management affect our financial performance?

- How does stable cash flow help with growth?

- How does your cash flow affect your customers?

- How does your cash flow affect your suppliers?

- How do late payments affect cash flow?

- How do payment terms affect cash flow?

- What's the difference between managing cash flow as a small business and as a large corporation?

- What causes a cash flow gap?

- How do I manage a cash flow crisis?

- What are the best practices in cash flow management and reporting?

- How do small business owners manage cash flow?

- What are cash flow management strategies?

- Why should we have cash flow management policies and procedures in place?

- What are some cash flow management strategies for small business?

- What are the best cash flow management models?

- What are the best cash flow processes?

- How are effective costing, cash flow management, and budgetary control connected?

- How are effective costing, cash flow management, and budgetary control connected?

- How can you pay taxes and still maintain a steady cash flow?

- Where can I learn how to manage cash flow day to day?

- Can you manage cash flow in Excel?

- Where can I learn how to automate cash flow?

- Where can I learn how to systematize cash flow management?

- Tips for Improving Your Cash Flow

- What are the steps to better cash flow management?

- What are the most common cash flow problems?

- Where can cash flow problems cause difficulties?

- Why do small businesses have cash flow problems?

- What are the top causes of cash flow problems?

- Where can I learn how to diagnose business cash flow issues?

- How does a positive cash flow improve a business?

- How can cash flow be improved?

- What are cash flow strategies?

- How can cash flow problems be overcome?

- How can the worst cash flow problems be solved?

- How can you help your customers' cash flow?

- How can you help your suppliers' cash flow?

- Cash Flow Management Tools and Applications

- Are there short-term and long-term cash flow solutions?

- Why do we need cash flow forecasting tools?

- What are the top cash flow tools?

- Are there free cash flow solutions?

- What is a projected cash flow statement?

- Cash Flow Statement Basics

- How do cash flow statements work?

- Who uses a business cash flow statement?

- Why do businesses use a cash flow statement?

- What financial questions does a cash flow statement answer?

- How can a cash flow statement be useful in my decision making?

- What are cash flow financing activities?

- Why is a cash flow statement important to investors?

- Is a cash flow statement needed to get a business loan?

- Who prepares the cash flow statement?

- Where can I learn how to prepare a cash flow statement?

- What does a cash flow statement look like?

- Cash flow statement vs balance sheet: What's the difference?

- Cash flow statement vs budget: What's the difference?

- Cash flow statement vs general ledger: What's the difference?

- Does the tax agency require a business cash flow statement?

- Is a cash flow statement mandatory for small business?

- When should a business update its cash flow statement?

- Where can I learn how to read a cash flow statement?

- Cash Flow Statement Template

- What is a cash flow statement template?

- Where can I find a cash flow statement template?

- What is cash flow forecasting?

- Cash Flow Forecasting Basics

- What are cash flow projections?

- How does cash flow forecasting work?

- Why is cash flow forecasting important?

- What's the difference between cash flow forecasting and budgeting?

- How can cash flow forecasting help a business?

- How does a small business forecast cash flow?

- Where can I learn how to forecast cash flow?

- Where can I learn how to estimate future cash flow?

- Who can help me create a business cash flow forecast?

- What is the best cash flow forecasting software?

- What are the best tips for cash flow forecasting?

Introduction

What is cash flow?

Cash flow is the measurement of net cash and cash equivalents flowing in and out of your business during a specific period of time. Cash flow indicates whether a company is able to pay its current liabilities, and is an important aspect in determining a company’s financial health.

Important Cash Flow Definitions

What is free cash flow?

Free cash flow refers to your company’s operating cash flow minus its capital expenditures. This tells investors and lenders how much cash you have after accounting for maintenance or expansion of your company’s assets.

Is cash flow the same as profit?

No. Cash flow measures your company’s ability to pay your current liabilities through the calculation of inflows and outflows of cash and cash equivalents. Profit measures your company’s financial gain as a whole.

What does 'cash is king' mean?

The expression ‘cash is king’ means that cash flow is incredibly important to the health and success of your business. Positive cash flow enables you to pay your current liabilities and invest in your company’s growth.

What is cash flow from operations?

Cash flow from operations is the amount of cash that flows into your business during a specific reporting period from your regular, ongoing revenue-generating activities, like sales.

Chapter 2

What you’ll learn in this section of our cash flow guide:

Calculating Cash Flow

Calculating your business’ cash flow is important, as it allows you to quickly assess whether your company is able to pay its current liabilities. It’s also an important aspect in determining the financial health of your business.

Cash flow formula

There are a few different cash flow formulas, depending on what type of cash flow you’re calculating — ex. free cash flow, net cash flow, operating cash flow, etc.

However, the most basic cash flow formula is this:

Total cash inflows (subtract) total cash outflows

Cash flow calculation methods

Cash flow is calculated using one of two methods.

There’s the direct method, which draws on income statement data using cash receipts and disbursements from operating activities. It adds up all of the cash payments and receipts, including cash paid to suppliers, cash receipts from customers, and cash paid out in salaries. The direct cash flow method is favored by businesses that use the cash basis accounting method.

There’s also the indirect method, which starts with your net income, converting it to operating cash flow. This method is a bit more complicated, as you need to identify any increases and decreases to asset and liability accounts. Any changes need to be added back to or removed from the net income figure, in order to identify an accurate cash inflow or outflow.

How to prepare a cash flow statement

There are five basic steps in preparing a cash flow statement.

1. Determine the starting balance. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

2. Calculate cash flow from operating activities. Using the direct method, simply take all the cash collections from operations and subtract all the cash disbursements from operations. If you use the indirect method, start with net income from the income statement and make adjustments to “undo” the impact of the accruals made during the reporting period.

3. Calculate cash flow from investing activities. This includes the buying and selling of long-term assets like real estate and equipment, and only activities involving free cash, not debt.

4. Calculate cash flow from financing activity. This includes cash flows from both debt and equity financing.

5. Determine the closing balance. Once you have the above information, you can determine the closing balance of cash and cash equivalents at the end of the reporting period. Simply take the sum of cash flows from operating, investing, and financing activities to see your change in net cash for a given period.

Can cash flow be negative?

Yes. When your cash outflows for a specific reporting period are higher than your inflows, or money coming in, you’re experiencing what’s known as negative cash flow. This doesn’t necessarily mean that your business is operating at a loss, but rather that your expenditures outweigh your income for that specific reporting period.

Navigating Positive and Negative Cash Flow

What is the cash flow break-even point?

Your cash flow break-even point occurs when your expenditures and income for a specific accounting period are equal. To calculate your cash flow break-even point, take the total cash flow from your business over a certain period of time and divide it by the total cash flow needed to sustain the business over the same period of time. The result is your cash flow break-even point as a percentage.

How can a negative cash flow affect a business?

Many businesses experience short-term negative cash flow — you’re not alone, and it is fixable. However, longer term negative cash flow can have serious business implications. The inability to pay suppliers or employees on time can damage your most important relationships. Additionally, lenders or investors who see negative cash flow over time may conclude that your operations do not provide enough income to support the business, and may decline to work with you.

Can I borrow funds with a negative cash flow?

In many cases, you can borrow funds and even grow your business in spite of negative cash flow. At FundThrough, we understand the bigger picture and take all of your operational, investment and financing activities into account. Our invoice funding service allows you to borrow funds to cover your payroll, buy inventory, purchase equipment, advertise, and expand your operations, even while you await payment from your customers.

Is positive cash flow the same as growth?

No. There are different types of cash flow: operational, financing and investing. You may be experiencing positive cash flow growth in one area but negative cash flow in another. For example, anticipating a customer paying late might lead you to sell a piece of equipment to increase the month’s investing cash flow in order to cover negative operating cash flow. Even though you’re now able to cover your immediate business expenses via positive cash flow, selling off company assets isn’t a sustainable model for growth.

Is positive cash flow the same as profit?

No. Just as negative cash flow doesn’t necessarily indicate losses, positive cash flow isn’t an indicator of profit or profitability. Because there are different types of cash flow activities (operations, financing and investing), it’s important to understand what it actually means for the health of your business. Your cash flow statement will provide better context for the effect of positive cash flow on your business.

Can I maintain positive cash flow with debt?

Absolutely. In fact, taking on debt with a term loan is a common way of generating or maintaining positive cash flow over a certain reporting period. Alternative short-term financing solutions like FundThrough’s invoice financing can help you to manage cash flow and grow your business even while you await customer payments, without incurring additional debt.

What should I do when cash flow is negative?

It’s important to get back to a state of equal or positive cash flow as soon as possible. Not only do you need to take care of immediate expenses like payroll, equipment, and supplies, but negative cash flow over time can be an indicator to potential investors and funders that your business isn’t thriving.

Chapter 3

What you’ll learn in this section of our cash flow guide:

- What is cash flow management?

- Cash Flow Management Basics

- What is cash flow analysis?

- What is a cash flow budget?

- Why do people say cash flow is the lifeblood of a business?

- Who manages a business’s cash flow?

- Can cash flow management affect our financial performance?

- How does stable cash flow help with growth?

- How does your cash flow affect your customers?

- How does your cash flow affect your suppliers?

- How do late payments affect cash flow?

- How do payment terms affect cash flow?

- What’s the difference between managing cash flow as a small business and as a large corporation?

- What causes a cash flow gap?

- How do I manage a cash flow crisis?

- What are the best practices in cash flow management and reporting?

- How do small business owners manage cash flow?

- What are cash flow management strategies?

- Why should we have cash flow management policies and procedures in place?

- What are some cash flow management strategies for small business?

- What are the best cash flow management models?

- What are the best cash flow processes?

- How are effective costing, cash flow management, and budgetary control connected?

- How can you pay taxes and still maintain a steady cash flow?

- Where can I learn how to manage cash flow day to day?

- Can you manage cash flow in Excel?

- Where can I learn how to automate cash flow?

- Where can I learn how to systematize cash flow management?

What is cash flow management?

Cash flow management is the process of tracking the cash coming into and going out of your business. Cash flow management helps you to predict how much money will be available to your business in the future. Proper cash flow management is important, as it helps show whether a company is able to pay its current liabilities and is an important aspect in determining the company’s financial condition.

Cash Flow Management Basics

What is cash flow analysis?

Cash flow analysis determines a company’s working capital — that is, the amount of money available to run business operations and complete transactions. Your working capital is the difference between your current assets and your current liabilities.

What is a cash flow budget?

A cash flow budget estimates your cash receipts and expenditures for a specific period of time in the near future. Preparing a cash flow budget, or cash flow forecasting, helps you identify negative cash flow situations in your near future so you can proactively use cash flow solutions to prevent it.

Why do people say cash flow is the lifeblood of a business?

People say that cash flow is the lifeblood of a business because having adequate cash flow is vital to the survival of any business. You need adequate cash flow to ensure you can not only cover daily operating expenses, but turn a profit and grow the business. Cash pumps into and out of your business, and if the system is not working properly, it can threaten your company’s survival.

Who manages a business's cash flow?

In sole proprietorships and small startups, as the owner, you will almost certainly need to manage your business’s cash flow with the help of cash flow forecasting tools and software. Once a finance team is in place, they will do the work of preparing cash flow statements, which you and/or the executive team should review regularly as part of an ongoing cash flow management strategy. Some businesses hire a part-time controller to help manage cash and payments.

Can cash flow management affect our financial performance?

Absolutely. Regular cash flow analysis and management are critical to your company’s financial performance, growth, and even reputation. The inability to meet your financial obligations can cripple your business in a number of ways: from preventing investment and growth, to hurting your employees, to causing your suppliers to stop doing business with you.

How does stable cash flow help with growth?

Stable cash flow is key to your business’s growth and ability to plan ahead. Cash flow can help with growth by attracting investment, funding new equipment and capital asset purchases, increasing payroll to help you attract and retain talent, covering an expanded inventory, and more. A stable cash flow lets you respond to problems quickly and with ready, available capital.

As an individual, just having the reassurance of a stable and predictable cash flow can present serious benefits to your ability to think strategically and plan ahead. A cash flow problem is typically a short-term crisis, which can distract you from thinking strategically and taking calculated risks to grow your business.

How does your cash flow affect your customers?

You might be surprised at the number of ways your cash flow can affect your customers. With positive cash flow you can scale to meet demand. You can ship sooner. You’re more able to extend credit to your customers. You can honor payment terms, or even look the other way if a payment is a bit late.

Conversely, negative cash flow might mean losing key accounts, the inability to fulfill a large order, or having a supplier cancel a customer’s order because you are behind on payments. Having too little cash could mean you’re understaffed and unable to provide adequate customer service.

How does your cash flow affect your suppliers?

Your cash flow not only has an effect on your bottom line and your customers, it can also affect your suppliers. If you don’t have the necessary cash on hand to pay your suppliers on time, they might stop doing business with you. If you can’t pay your suppliers, you can’t get inventory. If you can’t get inventory, you can’t run your business. Cash flow and late payments can really create quite the ripple effect throughout the supply chain, if not carefully managed.

How do late payments affect cash flow?

Any business has inflows and outflows – it’s only when outflows outpace inflows that it creates a cash gap. While waiting on invoice payments, you don’t have that cash available to fund activities — meaning you’re short for your own obligations. It’s possible to create a bit of a ripple effect throughout the supply chain if one payor pays late. Late payments are one of the top reasons small businesses operate with a negative cash flow.

How do payment terms affect cash flow?

Payment terms tell your customers how long they have to pay your invoice. You might require that all invoices are “Due On Receipt,” or you could extend a period of credit to your clients with Net 30, Net 60, Net 90 or even longer payment terms. However, you won’t have that free cash flow to buy inventory, pay your employees and suppliers, or invest in growing your business unless you solve that negative cash flow with a tool like invoice funding.

What's the difference between managing cash flow as a small business and as a large corporation?

Large corporations are more likely to have reserves and greater liquidity, enabling them to withstand longer periods of negative cash flow from operations. Small businesses, on the other hand, rely on free cash flow across operations, investments, and financing in order to not only grow but survive.

What causes a cash flow gap?

Large corporations are more likely to have reserves and greater liquidity, enabling them to withstand longer periods of negative cash flow from operations. Small business often don’t have a rainy day fund or quick access to funds in terms of unused earnings.

A cash flow shortage is caused by more money leaving your business than you have coming in over a specific period of time — aka your inflows and outflows. Consider a case when you have $8,000 in outstanding invoices due for payment on the 15th, but you need to pay your suppliers $5,000 by the 10th. Even with more money in receivables than in payables, you simply won’t have the cash to meet your obligation on the 10th. You run a high likelihood of facing a negative cash flow situation where you do not have the cash to pay your liabilities.

How do I manage a cash flow crisis?

Managing a cash flow crisis requires an immediate injection of cash to allow you to resolve your current liabilities and meet all of your financial commitments. Selling capital assets or investments creates liquidity, but these activities can negatively impact your long-term ability to generate revenue. That’s why more and more entrepreneurs and founders are turning to invoice funding, to create free cash flow out of outstanding invoices.

What are the best practices in cash flow management and reporting?

The top cash flow best practices include invoicing customers immediately following orders, using short payment terms, incentivizing early payment, following up on outstanding invoices, and paying your own bills on time. Automating your invoicing and processing activities is a great idea, so you can stay organized and improve your cash flow easily and often.

How do small business owners manage cash flow?

Small business owners manage cash flow on an ongoing basis by forecasting cash flow and making sure they’re collecting enough payments from revenue generating activities to cover their expenses. Despite their best efforts and intentions, this simply isn’t always possible. When cash flow is negative in the short term, solutions like cost cutting and invoice funding can help. Over the longer term, invoice funding can ensure a steady stream of operational cash flow, freeing up funds for investment, inventory and assets, and other revenue generators.

What are cash flow management strategies?

Cash flow management strategies are the steps you take to forecast cash flow, monitor cash flow on a regular basis, and solve for any issues that arise.

Why should we have cash flow management policies and procedures in place?

You should have cash flow management policies and procedures in place to take the guesswork out of solving negative cash flow. Having a prescribed set of tools you can use when negative cash flow appears in your forecast allows you to quickly resolve the issue and get back to doing what you do best: running your business.

What are some cash flow management strategies for small business?

Cash flow forecasting, invoicing immediately and using short payment terms, monitoring expenditures, and invoice factoring are all effective cash flow management strategies for small businesses.

What are the best cash flow management models?

The best cash flow management model is the one you’re actively involved in. Even if you have an accountant or bookkeeper to manage your financial statements and records, make sure you are regularly seeing a cash flow forecast so you can anticipate potential major cash flow issues and put your management strategies to work.

What are the best cash flow processes?

The best cash flow processes are: a) cash flow forecasting, to keep you one step ahead of negative cash flow issues; b) a cash flow management strategy with pre-approved policies and procedures, to empower you to prevent or resolve negative cash flow quickly; and c) cash flow solutions like invoice factoring, to give your business an immediate injection of cash for payroll, supplier invoices, and growth activities.

How are effective costing, cash flow management, and budgetary control connected?

Effective costing ensures you’re getting the best pricing possible on the supplies and services required to run your business. Cash flow management allows you to see where money is coming into and out of your business at a given point in time. Budgetary control allows you to effectively mange your cash flow. They’re all related aspects of maintaining a business that help you manage your spending most effectively, and maintain your bottom line.

How can you pay taxes and still maintain a steady cash flow?

Speak with your accountant about your tax strategy to come up with ways you can remove your tax withholdings and obligations from your free cash flow. This prevents you from mistaking tax withholdings from cash flow. If you need an immediate source of funds to make a tax payment and are waiting on payment from clients, you can use invoice funding to cover the gap in your cash flow.

Where can I learn how to manage cash flow day to day?

Work your way through our Ultimate Cash Flow Guide, practicing the cash flow forecasting and management techniques you learn along the way. If you find yourself craving an in-depth, instructor-led course, try Running a Profitable Business: Understanding Cash Flow. It’s led by Jim Stice, Distinguished Teaching Professor of Accounting in the School of Accountancy at BYU, and Earl Kay Stice, PricewaterhouseCoopers Professor of Accounting at the Marriott School of Management.

Can you manage cash flow in Excel?

Yes. If you input all of your current invoices and receipts for a specific accounting period into an Excel spreadsheet, you can manually forecast your cash flow. Use the following formula, and see Calculating Cash Flow for more.

Operating Cash Flow Ratio = Cash Flow from Operations / Current Liabilities

Where can I learn how to automate cash flow?

Automating your cash flow forecasting and management can free up time for you to look into your cash flow more often, helping you to make smarter decisions about your business. You can automate other aspects of your cash flow, as well. For example, enabling direct deposit and making bill payments online can help you move cash around faster. You can learn how to automate cash flow in different ways throughout our Ultimate Cash Flow Guide.

Where can I learn how to systematize cash flow management?

Systematizing your cash flow management keeps data in a centralized location, which makes it easy to assess the financial health of your business at any given time. Managing cash flow on a PC is possible using Excel. Managing cash flow on a Mac gives you the option of using Numbers, and with either a PC or a Mac, you can use Google Sheets or a similar cloud-based spreadsheet software to input your sales and expenses, to calculate cash flow. You can further automate your bookkeeping and produce meaningful financial statements and records using software like QuickBooks or Simply Accounting.

Chapter 4

What you’ll learn in this section of our cash flow guide:

- Tips for Improving Your Cash Flow

- What are the steps to better cash flow management?

- What are the most common cash flow problems?

- Where can cash flow problems cause difficulties?

- Why do small businesses have cash flow problems?

- What are the top causes of cash flow problems?

- Where can I learn how to diagnose business cash flow issues?

- How does a positive cash flow improve a business?

- How can cash flow be improved?

- What are cash flow strategies?

- How can cash flow problems be overcome?

- How can the worst cash flow problems be solved?

- How can you help your customers’ cash flow?

- How can you help your suppliers’ cash flow?

- Cash Flow Management Tools and Applications

- Are there short-term and long-term cash flow solutions?

- Why do we need cash flow forecasting tools?

- What are the top cash flow tools?

- Are there free cash flow solutions?

Tips for Improving Your Cash Flow

What are the steps to better cash flow management?

1. Practice cash flow forecasting regularly.

2. Develop and implement a cash flow management strategy.

3. Create cash flow policies and procedures to guide your solutions to different types of cash flow issues and save time when you need it most.

4. Use cash flow management solutions like invoice funding to ensure that you always have steady positive cash flow to pay your bills, attract new investment, and grow your business.

What are the most common cash flow problems?

The top business cash flow problems can dramatically impact your ability to grow, and they’re more common than you may think. Negative cash flow happens when a business is putting more cash out than it is taking in, often due to out of sync credit terms. When a business extends longer terms to its customers than it receives from its own suppliers, a cash gap appears during the difference in those payment terms. Other common cash flow problems include an inability to pay immediate liabilities, inability to move inventory, short-sighted decision-making, and an inability to grow the business.

Where can cash flow problems cause difficulties?

Cash flow problems cause difficulties in every facet of your business, from affecting payroll to causing missed supplier payments to giving investors cause to doubt your business planning.

Why do small businesses have cash flow problems?

Small businesses often have cash flow problems because they haven’t yet been able to put money aside for reserves. Growing your company requires that you constantly invest funds back into the business. Small businesses might also have more stringent payment terms with suppliers than they are able to extend their own customers. This leaves less cash flow available to fund reserves.

What are the top causes of cash flow problems?

Cash flow problems occur when your company’s cash output is greater than your inputs. Top causes of cash flow problems include late or slow invoice payments, necessary capital expenses and investment, a lack of forecasting and planning, carrying excess inventory, disorganized bookkeeping, and more.

Where can I learn how to diagnose business cash flow issues?

You can learn how to begin forecasting your cash flow here. Making cash flow forecasting a regular and integral part of your business planning helps you foresee and diagnose both minor and major cash flow issues so you can take a proactive approach to solving them.

How does a positive cash flow improve a business?

Positive cash flow improves your business by not only enabling you to meet your current commitments, but also by freeing up funds for growth-positive activities like investments in talent, equipment, and inventory.

How can cash flow be improved?

Learning how to improve cash flow may be easier than you think. Once you’ve incorporated cash flow forecasting into your routine, you’ll be able to see your cash flow needs and any potential shortcomings in advance. You can then take the necessary steps — cutting costs, boosting revenue, etc. — in order to improve your cash flow.

What are cash flow strategies?

Cash flow strategies help you manage your cash flow, to ensure you’re always able to pay your bills and maintain the growth of your business. Once you recognize a potential shortfall, cash flow strategies like asking for a deposit, requesting longer payment terms from your suppliers, or invoice funding can help prevent negative cash flow.

How can cash flow problems be overcome?

The key to overcoming cash flow problems is prevention. Cash flow forecasting helps you identify potential shortfalls and understand their causes, so you can proactively find solutions.

How can the worst cash flow problems be solved?

Typically, the worst cash flow problems are solved with an immediate injection of cash into your business. A cash flow solution like business loans or invoice factoring can get you through a negative cash flow situation without having to sell off capital assets, miss payroll or jeopardize your valuable vendor relationships.

How can you help your customers' cash flow?

Depending on your company type and the unique needs of your business, you may be able to help your customers manage their cash flow by offering more flexible payment terms. However, your top priority must always be keeping your own cash flow positive, so you can grow your business.

How can you help your suppliers' cash flow?

Your suppliers, especially if they are smaller businesses, may experience cash flow issues of their own. You can help their cash flow management by paying your invoices promptly, which of course requires that you have your own cash flow management under control.

Cash Flow Management Tools and Applications

Are there short-term and long-term cash flow solutions?

Yes. Long-term cash flow solutions require that you identify the causes of your negative cash flow and correct those issues, but that doesn’t solve your immediate need. Be careful to avoid short-term solutions that impose payday loan-style fees on small businesses for one-use loans. An invoice factoring solution designed specifically for businesses like yours smooths over the gaps in your cash flow, and has the additional benefits of low fees, and repayment terms that allow you to grow while solving your short-term negative cash flow.

Why do we need cash flow forecasting tools?

When it comes to your cash flow, an ounce of prevention is definitely worth a pound of cure. You can manually calculate your cash flow forecast in Excel if you have time. Or, try more powerful, automated cash flow forecasting tools to save time and enable you to run different types of projections. A subscription-based option like DryRun, for example, lets you run if/then scenarios to measure the impact of different activities on your projected cash flow.

What are the top cash flow tools?

The top cash flow tools close the gap between invoicing and your receipt of cash for that invoice, enabling you to carry on with the important business activities that help your company grow. Top cash flow tools like FundThrough solve for small business negative cash flow and empower entrepreneurs to focus on running their business, instead of trying to collect payments.

Are there free cash flow solutions?

Absolutely. In fact, FundThrough accounts are free forever, with an innovative repayment structure designed to suit the unique needs of small businesses. You pay a small fee for our invoice factoring service, which boosts cash flow quickly rather than making you wait 30, 60, or 90 days for client payment. Right away, you can process payroll, buy inventory, advertise, and more.

Chapter 5

What you’ll learn in this section of our cash flow guide:

- What is a projected cash flow statement?

- Cash Flow Statement Basics

- How do cash flow statements work?

- Who uses a business cash flow statement?

- Why do businesses use a cash flow statement?

- What financial questions does a cash flow statement answer?

- How can a cash flow statement be useful in my decision making?

- What are cash flow financing activities?

- Why is a cash flow statement important to investors?

- Is a cash flow statement needed to get a business loan?

- Who prepares the cash flow statement?

- Where can I learn how to prepare a cash flow statement?

- What does a cash flow statement look like?

- Cash flow statement vs balance sheet: What’s the difference?

- Cash flow statement vs budget: What’s the difference?

- Cash flow statement vs general ledger: What’s the difference?

- Does the tax agency require a business cash flow statement?

- Is a cash flow statement mandatory for small business?

- When should a business update its cash flow statement?

- Where can I learn how to read a cash flow statement?

- Cash Flow Statement Template

- What is a cash flow statement template?

- Where can I find a cash flow statement template?

What is a projected cash flow statement?

A projected cash flow statement shows the difference between your company’s net cash inflows and outflows for a specific reporting period.

Cash Flow Statement Basics

How do cash flow statements work?

Cash flow statements work by alerting business owners to potential gaps in cash flow before they happen. This enables you to prepare and apply positive cash flow management strategies like invoice funding, so you can avoid a cash flow crisis and continue growing your business.

Who uses a business cash flow statement?

As a small business owner or entrepreneur, you’ll use your cash flow statement often to ensure that you always have enough free cash flow to pay employees and suppliers, buy inventory and equipment, and otherwise invest in the success of your business. Your accountant, potential investors, and loan officers might also request a copy of your business’s cash flow statement as it helps them evaluate your financial health.

Why do businesses use a cash flow statement?

Businesses use cash flow statements as a critical financial management and business planning tool. Cash flow statements are important because you need to know if, at any given point, you are going to have enough liquidity to pay for your current liabilities like payroll, inventory, capital assets, and more.

What financial questions does a cash flow statement answer?

A cash flow statement primarily answers the question: “Will we have enough money coming into the business to cover what’s going out for this period?” If you see a cash flow shortage in your future, your cash flow statement can also help you answer the question: “Where can we find the cash to meet those financial obligations?” For example, if you see that you are going to have a negative cash flow situation next week, but you have invoices out that could cover the gap that aren’t due until the week after, you can use a tool like invoice funding to create the cash flow to get you through.

How can a cash flow statement be useful in my decision making?

A cash flow statement can be incredibly useful in your decision making as it highlights both potentially hazardous cash flow situations, but also opportunities for your business to grow. It’s critical that you understand where and how cash is flowing into your business so you can put it to work in the areas that matter.

What are cash flow financing activities?

Cash flow from financing activities refers to the cash and cash equivalents coming into and going out of your business from the issuance of debt and financing. Issuing new stock, paying out dividend payments, and repurchasing stock from your shareholders are all examples of cash flow from financing activities.

Why is a cash flow statement important to investors?

A cash flow statement is important to investors because it helps them understand the financial health and growth potential of your company. If a potential investor sees consistently negative cash flow over time, they may question your ability to meet your financial obligations. On the other hand, negative cash flow from investing activities coupled with positive cash flow from operations might tell investors that your company is investing in its growth. Cash flow is just one aspect of your business investors will want to see, but it’s an important one. You can learn more about the different types of cash flow in this guide.

Is a cash flow statement needed to get a business loan?

Most lenders and investors will want to see your cash flow statement as part of their evaluation of your business before approving any business loans.

Who prepares the cash flow statement?

As a small business owner, you may not yet have the support of an in-house finance team. Thankfully, cash flow forecasting is fairly simple to do, so you won’t need to pay an accountant every time you want to see a cash flow statement. You can learn how to prepare them yourself in our Calculating Cash Flow section.

Where can I learn how to prepare a cash flow statement?

You can learn how to prepare a cash flow statement in our Calculating Cash Flow section. Additionally, QuickBooks offers a rundown on how to prepare a cash flow statement (including a free template!) here.

What does a cash flow statement look like?

Your cash flow statement, or statement of cash flows, contains the following:

- Your company name

- The date range being evaluated

- Your net income broken out across three categories:

- Cash provided by operating activities

- Cash provided by financing activities

- Cash provided by investing activities

- Adjustments to reconcile your income to the actual amount of cash flowing into the business, which might include accounts receivable, cash payments, credit card payments in processing, taxes payable, etc.

- Your net increase or decrease in cash, measured over the term of the reporting period

All of this shows you whether your cash flow over a specific period was positive or negative. If you would like to use cash flow projections to anticipate cash flow in future, try cash flow forecasting.

Cash flow statement vs balance sheet: What's the difference?

A cash flow statement shows the difference between your cash inflows and outflows over a specific period of time. Your balance sheet is a statement of your assets, liabilities and capitals at a specific point in time.

Cash flow statement vs budget: What's the difference?

Your business’s cash flow statement shows how much money flowed in and out of your business over a specific period of time. A budget tells you the amount of money you can spend over a period of time, given your revenue, assets, and liabilities.

Cash flow statement vs general ledger: What's the difference?

Your general ledger is your company’s main accounting record and consists of all of your numbered accounts, typically categorized by assets, liabilities, owner’s equity, revenue, and business expenses. Your cash flow statement is a report that shows your cash inflows and outflows over a specific period.

Does the tax agency require a business cash flow statement?

Yes. Your business’s cash flow statement is a key financial document (alongside your balance sheet, income statement, and statement of owner’s equity) which tax agencies require.

Is a cash flow statement mandatory for small business?

Yes. Your cash flow statement is the official record of cash and cash equivalents flowing into and out of your company.

When should a business update its cash flow statement?

If you are using an automated bookkeeping solution like QuickBooks or Xero, your cash flow statement will be updated each time you run a new report, so long as you have been inputting all transaction data. You might run your cash flow statement monthly to review with your executive team or financial planner/accountant, but you can run this report as often as you’d like to see it. Don’t confuse your cash flow statement with a cash flow forecast — you’ll want to see cash flow projections often so you can make informed decisions for your business.

Where can I learn how to read a cash flow statement?

Working your way through our Ultimate Cash Flow Guide will help you become comfortable with the terminology and accounting principles necessary to read a cash flow statement.

Cash Flow Statement Template

Cash is King, and understanding how and when that cash is going to be available to your growing business is mission critical. Invoice payment takes an average of 61 days in North America, according to the 2017 edition of the Atradius Payment Practices Barometer. What’s more, 92.6 percent of businesses reported late payments from customers in 2017.

While cash flow forecasting is an effective tool for predicting a potentially negative cash flow situation before it becomes a crisis, your cash flow statements give you a concrete cash flow history over time. Not only are they an important business planning tool, but your cash flow statements tell potential investors (and those interested in acquiring your company) important stories about the long-term health and viability of your business.

What is a cash flow statement template?

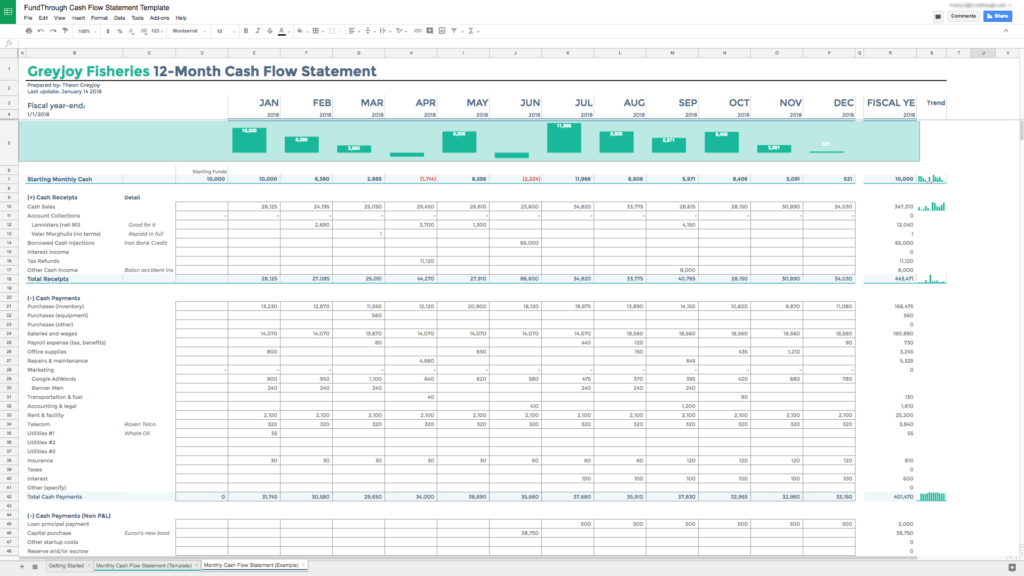

A cash flow statement template enables you to more quickly and accurately prepare cash flow statements in manual bookkeeping operations. If you’re using accounting software like QuickBooks or Xero, cash flow statements are one of the reports you can generate automatically using the transaction data you’ve already input within the system. You can also find pre-made cash flow statement templates online. Here’s an example of what a cash flow statement looks like in Google Sheets:

How can you prepare a statement of cash flows if you aren’t yet using automated bookkeeping software? Follow these 5 simple steps to get started:

1. Record your cash flow statement date range.

2. Input your cash inflows and outflows from each of the three major types of cash flow activities: Operating, Investing, and Financing.

3. Calculate the total for each type of cash flow activity, then add these three figures together to arrive at your Net Cash Flows.

4. Record your balance of cash at the beginning and at the end of your cash flow statement date range to arrive at your Net Change in Cash for Period.

5. Compare the sum of your Net Cash Flows with your Net Change in Cash for Period. These sums should be equal.

Where can I find a cash flow statement template?

As part of our Ultimate Cash Flow Guide, FundThrough offers a free, downloadable cash flow statement template for Microsoft Excel and Google Sheets to get you started. You can either download it to use with Excel desktop, or edit it online with Google Sheets.

Chapter 6

What you’ll learn in this section of our cash flow guide:

What is cash flow forecasting?

Cash flow forecasting is the process of comparing your company’s anticipated cash inputs and outputs for a specific period of time in the near future, to see whether you will have enough cash flow to pay your current liabilities.

Cash Flow Forecasting Basics

What are cash flow projections?

Cash flow projections is another way to talk about cash flor forecasting. Both are methods used for projecting the financial future of a business.

How does cash flow forecasting work?

Cash flow forecasting works to help you anticipate and prepare for any periods of negative cash flow. If your cash flow forecast shows that you won’t have enough free cash to make payroll next week while you wait for clients to pay invoices, for example, you can avert a cash flow crisis by using a tool like invoice factoring to cover the gap.

Why is cash flow forecasting important?

Cash flow forecasting is important for all companies, but especially for small and growing businesses, because it enables you to avoid a cash flow crisis. When you see negative cash flow looming in your near future, you can take steps to avoid missing payroll, bouncing a preauthorized payment, harming a supplier relationship, etc.

What's the difference between cash flow forecasting and budgeting?

Cash flow forecasting and budgeting are two very different but important activities. Budgeting tells you how much you’ll have to spend in different areas of your business over a specific period of time. Cash flow forecasting tells you whether you’ll have the free cash flow to pay your current liabilities at any given point in time.

How can cash flow forecasting help a business?

Cash flow forecasting helps your business meet its financial obligations while still ensuring that you have free cash flow for investment and growth activities. Regularly forecasting your cash flow allows you to spot potential gaps in cash flow before they happen, so instead of dealing with a crisis like missing payroll, you can focus on running your business.

How does a small business forecast cash flow?

There are a number of great tools out there to help you automate the process of forecasting cash flow, so you can do it more often with greater precision. Check out our Cash Flow Management Tools & Apps section to help you get started.

Where can I learn how to forecast cash flow?

Learning how to forecast cash flow is easier than you might think. You’ll find the cash flow formula, different cash flow calculation methods, and more in our Calculating Cash Flow section.

Where can I learn how to estimate future cash flow?

At times, it might be helpful to quickly estimate your future cash flow rather than sitting down to make precise cash flow forecasting calculations – when you’re in a client meeting and need to set payment terms on the fly, for example. You can learn how to estimate future cash flow by committing the cash flow formula found in our Calculating Cash Flow section to memory.

Who can help me create a business cash flow forecast?

Your accountant or bookkeeper can help you create your business’s cash flow forecast, or you can prepare one on your own. Everything you need to get started, whether you’re going to calculate cash flow manually, on a PC or a Mac, or using an automated or cloud-based solution, is in our Calculating Cash Flow section.

What is the best cash flow forecasting software?

Many business owners prefer cash flow forecasting software that uses data from their accounting platform, to reduce the manual work of inputting data and bringing records up to date. Applications like Float and DryRun can do this for you, and they integrate with accounting software programs like QuickBooks and Xero (both of the aforementioned cash flow forecasting software options are subscription-based with monthly fees).

What are the best tips for cash flow forecasting?

The best tip for cash flow forecasting is that you make it a regular part of your business management activities. It’s important that you always have a clear picture of your company’s actual cash inflows and outflows so you can make payroll, pay your suppliers, buy capital assets and equipment, and grow your business. Keep exploring our Ultimate Cash Flow Guide to learn more.

Chapter 7

What you’ll learn in this section of our cash flow guide:

How does invoice factoring help cash flow?

You’re getting ready to launch a new product and really want to make a splash in your target markets. It’s time to strike while the iron’s hot. Unfortunately, your largest customer has a 60-day payment cycle. Your cash flow is dead in the water for at least another month…

The word is getting out there. You’re providing a great service and getting inquiries about larger projects. You’re nervous, though. You need free cash flow to shoulder the additional business expenses of these larger projects that are key to your growth, at least until you can get a few of them under your belt…

Your business is a constant juggling act. You can see that there are sales opportunities there if you can increase your inventory, but it’s so hard when you need to make payroll and your cash flow is dependent on how long it takes clients to pay you…

If you’re experiencing challenges like this in your own business, you’re not alone. Free cash flow is critical not only to the growth of your business, but to its very survival. Running out of cash is one of the top reasons small businesses fail. In fact, 27 percent of startups die at the hands of a cash crisis.

Cash Flow Factoring

How can invoice factoring help solve for cash flow?

Bank loans and investors can help fund your company’s growth, but they tend to want to see a pattern of healthy cash flow before they’ll get behind your business. And while crowdfunding is great for those whose campaigns go viral, they’re but a tiny minority (recent research shows that 97 percent of seed or crowdfunded consumer hardware startups, for example, die or become zombies).

How can you create positive cash flow without heavy financing fees or losing control of your business?

Invoice factoring is a cash flow strategy that allows you to create positive cash flow without heavy financing fees or losing control of your business. It works by converting your outstanding invoices into immediate payments. You can end the nail-biting, hair-pulling cycle of stress that goes along with trying to predict and plan around when your customers might pay their invoices.

You don’t have to wait to buy inventory, take on new business, or cover your payroll.

FundThrough empowers you with access to funds when you need it, to pay for the business activities that sustain and grow your business.