Small Business Lending: How to Pick the Best Option

Get an overview and comparison of small business lending options so you can make the best choice for your business.

Why Small Business Lending Is Challenging for CEOs and Owners

It can be challenging to get funding for small- and medium-sized businesses, whether you’re a new business in the startup stage or an established business in the growth stage. It’s something we understand first-hand as entrepreneurs ourselves here at FundThrough. We know what it’s like to need working capital for payroll or growth, and not know what your options are. Securing bank financing can leave you feel like you’re jumping through hoops, what with the lengthy application processes and all that paperwork. On top of that, traditional bank financing requires your business to have a solid financial track record and good credit, something many new and growing businesses might not have. Banks often don’t want to work with new businesses, and even growing businesses can get denied a limit raise on their business line of credit. The solution to these challenges for many businesses is to create a mix of funding sources from options outside the traditional banking system, like equity financing and alternative funding methods. If that’s you, read on to get an overview of several small business lending options along with their pros and cons so you can make the best small business lending decisions for your company.

The Top 4 Small Business Lending Options: What Types of Small Business Loans Are Available?

Consider these aspects of your situation when evaluating financing options. This list isn’t exhaustive, but will give you an idea of what to take into account and help you get the best value from your business financing options:

- How fast you need the funding. Some forms of funding are faster than others. Invoice factoring can get you working capital in 2-3 business days, while the P2P business lending process can take weeks.

- What you need the funding for. If you need to boost your cash flow to cover unexpected expenses, you might a different small business lending solution than if you need to purchase or repair a piece of equipment.

- Your ability to repay. Some business financing solutions require monthly payments or a fixed repayment schedule. Others offer more flexible repayment options. Consider your needs and ability to repay when comparing options.

- Ability to use long-term. Some forms of funding (like a bridge financing loan) are meant to be used to cover short-term business cash flow issues. Others, such as invoice factoring, provide a flexible financing option for businesses.

Invoice factoring

Invoice factoring is a type of small business lending. Since invoice factoring is not a loan, it doesn’t require you to give up equity in your business or take on any debt in order to secure funding. (See more alternatives for non-dilutive funding.) How it works is that a business sells outstanding invoices to a factoring company for access to business capital. The factoring company then works with your customer to settle the invoice according to the original payment terms. You get access to funds in a few business days, while the factor manages the collections process on your behalf. Many of our clients factor invoices when they need cash upfront for a big growth opportunity, cover business expenses, or even peace of mind about making payroll.

Pros:

- One benefit of invoice factoring is the speed. Once set up and approved, you can get funding for unpaid invoices directly to your business bank account in a few business days. FundThrough’s simple application process can be done online in just minutes.

- Flexible terms. Invoice factoring (with FundThrough, at least) lets you pick and choose the unpaid invoices you want to fund, so you have access to business capital when you need it most.

- Non-dilutive capital. You’re not giving away equity in your business when you factor invoices, so you remain in control of your company. And because it’s not a loan, you aren’t adding any debt to your balance sheet.

- Unlimited funding (depending on the factoring company). With factoring, the more you invoice the more funding you can access. Your funding grows as your business grows.

- Less admin hassle. The factoring company handles the collections process, so you don’t have to spend valuable time chasing down payments.

- Less strict requirements than traditional business loan options means that businesses with bad credit or little business credit history can qualify. There’s also no minimum revenue requirement, or minimum personal credit score requirement.

Cons:

- Some business owners have worries about their customer’s perception if they choose to factor invoices. You might worry that your customers will think your business is in financial trouble, however, this couldn’t be further from the truth. Many businesses use factoring for growth, and having access to capital means your business can serve its customers better. Factoring is common practice in many industries and many large organizations are used to redirecting payment. You might also worry about damage to customer relationships, especially if you’ve had a negative experience with factors in the past hounding people for payment. At FundThrough, we always work with you before contacting your customer. See how we work to maintain your relationships with customers if this worries you.

- Can be complicated to account for in bookkeeping. See our post with step-by-step instructions (which apply even if you don’t use QuickBooks, as that post references).

- Some factoring companies aren’t transparent about their factor rate, or charge hidden fees such as advance fees, monthly maintenance fees, processing fees, or a minimum volume fee.

Bridge financing loan

Bridge financing loans can be a useful option for businesses looking to fund short-term needs. It can help you cover expenses until more traditional long-term funding can be secured. You might also use bridge financing to speed up the payment cycle instead of waiting on lengthy net terms. A bridge financing loan helps to literally bridge the gap between rounds of investor funding, when loan applications or business lines of credit are denied or delayed, or during an IPO.

Pros:

- Bridge financing loans can be approved and funded relatively quickly, providing necessary funds they need to cover immediate expenses.

- Flexibility. Bridge business term loans can be used for a variety of purposes, such as inventory purchases, making payroll, or covering unexpected expenses.

- The short-term aspect of bridge loans is both a benefit and a disadvantage. On the upside, you can pay off the loan amount quickly and avoid long-term debt. On the downside, you may still need long-term funding and have to take on additional business debt.

- If used strategically, you can use a bridge financing loan to improve your business credit rating. If you’re able to cover short-term expenses and pay it back quickly, this can help to improve your credit rating.

Cons:

- Bridge financing loans can come with higher interest rates compared to other forms of small business lending, which can be costly for many small businesses.

- You may also be required to pay additional fees, such as origination fees or prepayment penalties, which can add to the cost of the loan.

- If you are unable to pay back the loan amount in a set period of time, you may face additional penalties or even default on the loan, which can damage your credit rating and cost your business assets.

- Because bridge financing loans are designed for short-term needs, and may not be suitable if you’re looking for long-term financing solutions.

Consider these bridge capital factoring alternatives if a bridge financing loan is not the right small business lending option.

Marketplace or peer-to-peer (P2P) lending

In a marketplace lending (AKA peer-to-peer lending) platform, the decision-making structure is decentralized. This is in contrast to personal and small business banking, which operate under centralized decision-making structures. Each online lender sets their own lending standards with borrowers directly, and makes their own choices about who to approve within the loan program. As such, the limits of loans can be adjusted as a borrower’s needs change. There are also platforms and online lenders that cater specifically to businesses with bad credit or no credit history.

Pros:

- P2P lending platforms are typically quick and easy to use, with convenient online applications and fast processing times. (Though it may still take several business days for a funding decision).

- Additionally, P2P small business lending can offer more competitive interest rates compared to traditional lenders, especially if your business has good credit.

- P2P small business loans are flexible, and can be used for a variety of business expenses, such as inventory purchases, equipment upgrades, or marketing campaigns.

- P2P lending allows you to connect with individual investors, which can lead to long-term relationships and additional funding opportunities.

Cons:

- A P2P business loan carries a higher risk of default compared to traditional bank lending, as small businesses may not have the same level of creditworthiness and financial stability as larger companies.

- Many P2P lenders charge fees for loan origination, late payments, and other services, which can increase the total cost of the loan.

- Limited funding. P2P lending may not provide enough funding for larger projects or long-term financing needs.

- Since P2P lending is not regulated in the same way as traditional lending, it can lead to higher risk and uncertainty for borrowers.

- You may be limited to a smaller pool of investors on P2P lending platforms, which can make it more difficult to secure funding.

Venture capital

Venture capital (VC) is a type of private equity financing that is typically provided by high net worth individuals, institutional investors, or investment banks to start-up or early-stage companies with high growth potential.

Pros:

- Venture capital let you access funds in high amounts that may not be available through other startup business loan sources.

- In addition to high funding amounts, venture capitalists can provide you with valuable expertise, networks, and business relationships that can help you grow and succeed.

- Because venture capital investors typically have a long-term commitment to their investments, this can provide stability and support for your business needs.

- Venture capital funding can be seen as a validation of your business’s potential and can help to attract other investors or customers.

Cons:

- Venture capitalists often require a significant ownership stake in your business and may have a say in how it is run, which can lead to a loss of control for small business owners.

- Investors expect high returns on their investment, which can create pressure to grow quickly and meet aggressive targets.

- VC funding can dilute the equity ownership, reducing your stake in the company and your potential for long-term profits.

- Small business lending from VCs is typically only available to start-ups and early-stage companies with high growth potential, which means that it may not be a viable option for more established businesses.

- Venture capital funding is often seen as high-risk, as many start-ups fail to deliver the expected returns and may not be able to repay the investment.

FAQs

How do small business loans work?

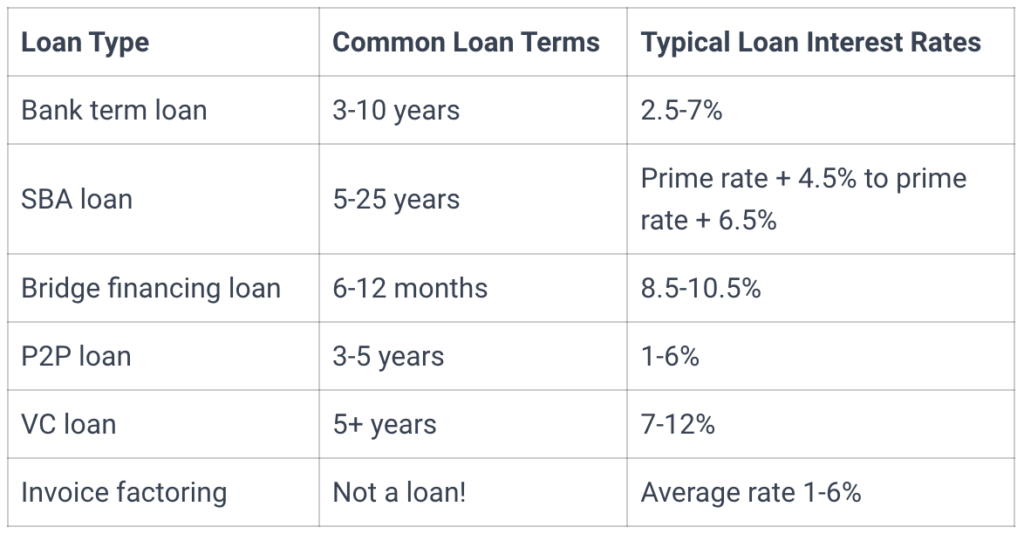

Here’s a brief, high-level explanation of how small business loans work: You research the various business financing options available and find one that meets your business needs. From there, you to submit an application outlining your business plan and financial history in order to be approved for the loan. In our experience, many of our small business clients are denied for various loan types and often have to look for other types of financing and small business lending to meet their needs. If you meet the business loan requirements and your application is approved, you will receive the loan funds and be required to start your repayment term according to the terms of the loan. Depending on the type of loan, you may have a repayment period that could span from months to years, with actual interest rates ranging from single digits to double digits depending on your credit score and other factors. See the table below for more insight on actual interest rates.

How to successfully get a small business loan?

The most important step towards getting approved for a small business loan is to ensure that you have a complete and accurate application. Depending on the type of small business lending you’re applying for, you may also need several years worth of financials that show growth, a strong cash position, and a good credit score.

What kind of loan is good for small business?

The best kind of loan for a small business is one that meets your unique business needs, has flexible repayment options, the lowest interest rate, dedicated customer service, and is specifically designed for small businesses. Look for ones with favorable repayment terms such as no prepayment penalties or balloon payments.

What is the minimum credit score to get a small business loan?

The minimum credit score for a small business loan can vary greatly depending on the type of lender you work with. While some lenders require excellent credit scores of at least 680+, some business lenders with programs for bad credit will work with borrowers with credit scores that are less than ideal. Invoice factoring doesn’t require a credit check. Your customer’s creditworthiness is more important than your own, since the factoring company depends on them to pay their invoice.

Ready to Get Easy Small Business Funding?

See if you qualify to fund an invoice now.

Questions?

Speak with your dedicated account manager on the phone or online.