Online Invoice Factoring Services Made Fast and Easy | FundThrough

FundThrough’s online funding platform lets businesses in the U.S. and Canada get outstanding invoices paid fast to unlock working capital.

What are invoice factoring services?

Invoice factoring (also known as invoice factoring services or accounts receivable factoring) is a business financing solution that covers cash flow gaps by paying invoices in days. This means instead of waiting on 30, 60, or 90 day net terms for clients to pay, you can collect on invoices right away. As business owners ourselves, we know how hard it is when you have expenses piling up and no receivables coming in.

Invoice factoring has a reputation of being a last resort for businesses in financial trouble. We’ve found from working with our clients – business owners, CEOs, and finance leads – that instead, they often need funding to take on big projects that will grow their business. Or make payroll so they can manage their thriving business with peace of mind. For many large buyers, working with a factoring company is business as usual. Learn more about how we work with your customers.

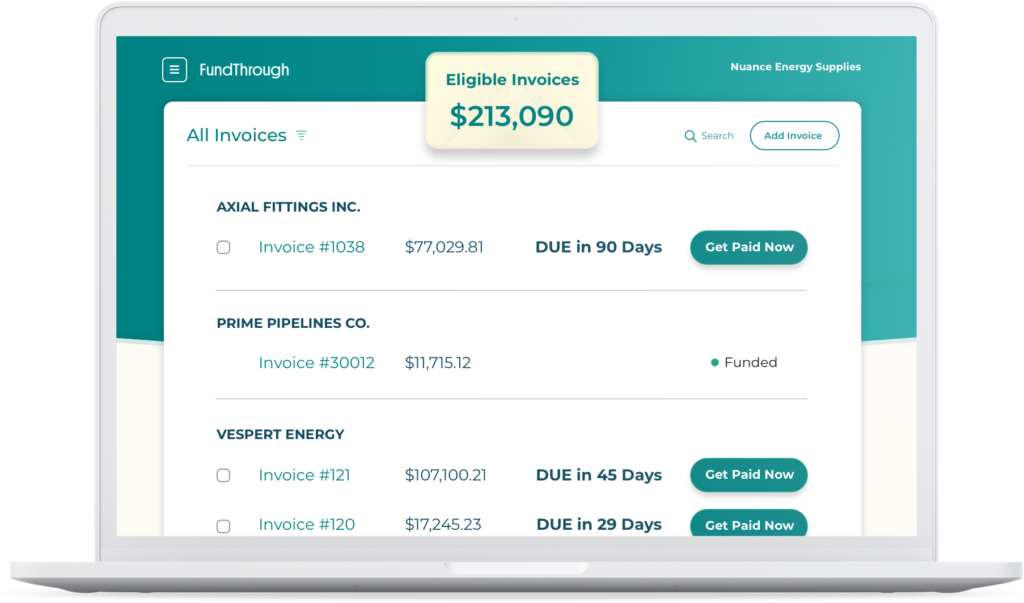

Working with a traditional factor forces you to complete time-consuming paperwork and go through slow, manual processes. Online invoice financing with the FundThrough platform enables you to submit invoices for funding, see their status, and get reporting for reconciling your accounting.

What are the advantages of invoice factoring?

The key advantage of receivable financing is to get quick access to working capital for larger contracts, equipment, payroll, and more. Other benefits include:

- Quick, easy capital. A tech-powered approach gets you funded in days. (FundThrough is integrated with QuickBooks and OpenInvoice to pull eligible invoices into the platform.)

- Debt-free funding. Accounts receivable factoring is not a business loan. Your customer pays the factoring company according to their net terms.

- No dilution. Get the funding you need without sacrificing ownership. (See our guide to non dilutive funding for more info)

- Unlimited funding. This is specific to FundThrough. You can get as much funding as you have invoices for.

- Avoid bank hassles. Many banks won’t work with companies that are too new, and it can take months just to raise a line of credit limit – not to mention all the financials that need to be prepared first.

Featured in:

Get Convenient Working Capital. Get Invoices Paid in Days.

Invoice your customer. Get paid in days. Get back to business.

Easy Access to Capital

Get funding anytime without bank hassles or limits by working with FundThrough. We offer unlimited funding, so the more you invoice, the more capital you can access. Take on growth projects, hire essential staff, and make payroll with peace of mind that you have the funding you need at your fingertips.

Fast, Flexible Funding

Skip waiting on net payment terms and get paid quickly, with a secure source of flexible funding. No debt, dilution, hidden fees, or monthly minimums mean you’re in control of your capital, instead of waiting on slow-paying customers.

Simple Funding Process

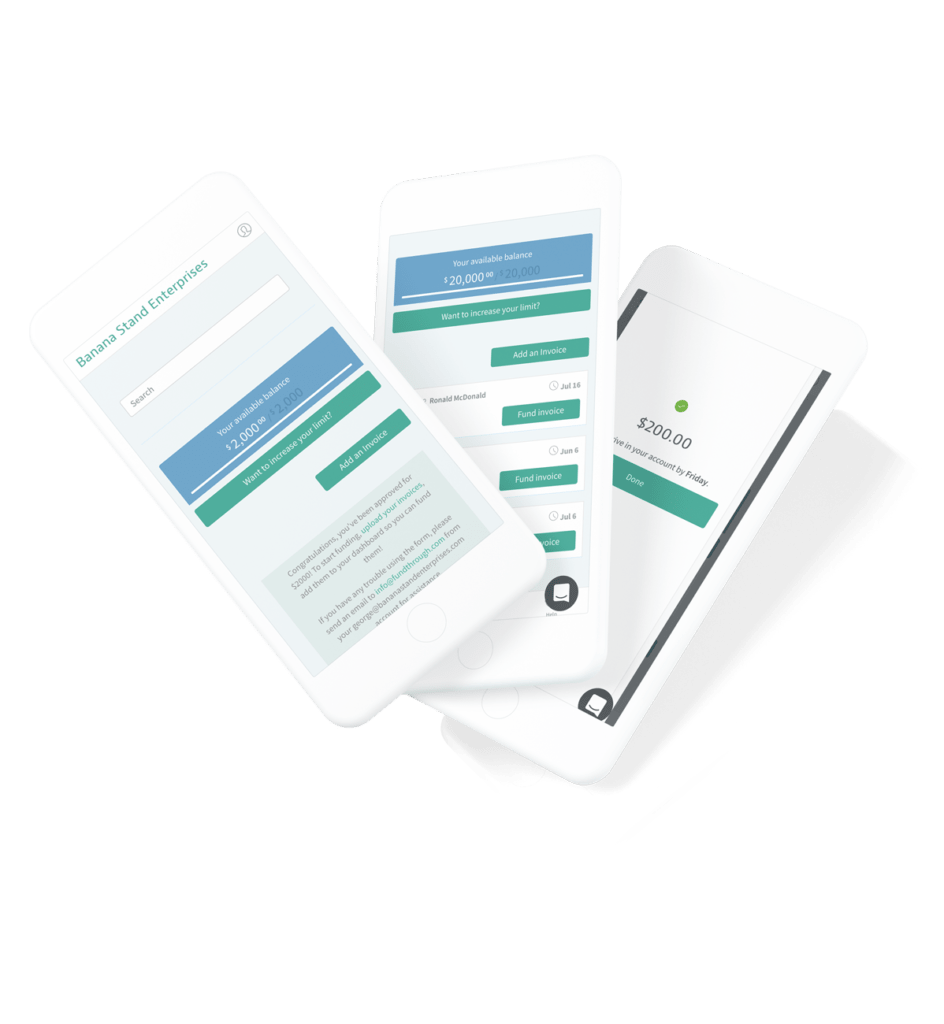

Integrations with QuickBooks and OpenInvoice combined with AI and automation make it easy to get funded and get back to business. Get a funding boost in one click (after customer setup).

How Online Invoice Financing Works

Create or connect your account in minutes

Create a free account or connect your QuickBooks or OpenInvoice account, and provide information about your business.

Choose which invoices to fund

Submit eligible unpaid invoices to FundThrough. We provide unlimited funding for your business based on the size of your outstanding invoices. Simply select which eligible invoices you want to fund, and submit them in one click (after customer set up).

Advance invoices in days

Select eligible invoices to advance. Deposits are made within days and your customer sends invoice payments to FundThrough according to the agreed upon terms.

Get funded, then get back to business

Upon approval, funds are deposited into your business bank account as quickly as the next business day. Put your capital to work for growth projects, payroll, equipment, hires, and more.

Get Your Business Funded

See if you qualify today. Stop waiting on customer payments. If approved, you can advance funds within days from our online platform.

- No paperwork

- No obligation to fund

- No hidden fees

- No effect on your credit score

Ready to take your business

to the next level?

We use bank-level encryption to protect your data.

Factoring rates starting at

2.75%

- No annual fees or funding obligation

- Responsive customer service

- Convenient capital anytime

Invoice factoring services at FundThrough

On-demand working capital for growing businesses.

FundThrough offers businesses instant access to funds from unpaid invoices on an easy-to-use, online funding platform.

Wherever a business is in its growth cycle or just needs some extra capital, FundThrough can help bridge critical cash flow gaps with fast and easy invoice factoring services.

Explore invoice factoring resources

On the Intuit Quickbooks App Store:

"I am pleased to recommend FundThrough for early stage and established small business funding for the type of products and ease of doing business." ~James R.

"I've been looking for this tool for the past few years and stumbled on FundThrough during my participation at QuickBooks Connect. They have a great software." ~Xtiane

"I really like this company, they are 1st class! They have a very nice platform and are at the top of their game! They have fast approvals and will help you along the way..." ~Unified

On Google Reviews:

"FundThrough has been instrumental in helping my company meet its cash flow needs quickly, easily and for low cost." ~Mark B.

"We started using FundThrough in August of 2017. What impressed me the most has been the quick turnaround." ~Ahmed A.

"Overall I have been quite satisfied with FT. I signed up with them about eight months ago and have used the service once. I've also recommended it to other clients." ~Stephanie

Questions about invoice factoring?

Speak with your dedicated account manager on the phone or online.

+1 (800) 766-0460

Toll-free Mon-Fri 9am-5pm ET

Chat online

Use the chat icon below