Working Capital Management

Funding Oil and Gas Projects: How to Choose the Best Options

By FundThrough

When exploring funding for oil and gas projects, it’s crucial to weigh various options that suit your business’s stage and needs. The right choice hinges on several factors, underscoring the importance of a multi-faceted funding strategy. This is especially true in the oil and gas industry, where SMBs often grapple with cash flow challenges due to long payment terms and overdue invoices. A recent Statista report reveals that alternative lenders have higher approval rates for small business loans compared to big banks, underscoring the need for varied funding strategies in sectors like oil and gas, where cash flow challenges are prevalent.

At FundThrough, we’re well-versed in these struggles, offering invoice factoring solutions to provide the essential funding businesses require. This post unpacks different funding avenues, emphasizing the need for diverse strategies to navigate the unpredictable oil and gas sector. We’ll guide you through choosing the best funding solutions, from conventional loans to alternative options like invoice factoring, tailored to support your business amidst the industry’s fluctuations.

Options for Funding Oil and Gas Projects

The first step in choosing the best funding for oil and gas projects is to know what options are available to you. There are a number of different options when it comes to funding oil and gas projects, from the more traditional to alternative financing options. Let’s look at some of the available funding options.

Master Your Cash Flow

Invoice Factoring

Invoice factoring (aka invoice funding) is a popular choice for funding oil and gas projects, as it allows companies to unlock capital tied up in accounts receivable for work that has already been completed. Oftentimes, business owners have to wait 30, 60, 90 or even 120 days for customers to pay, leading to cash flow issues.

First, how does factoring work? An invoice factoring company advances the total of your invoice (less fees) way ahead of the payment terms, and works with your customer to collect payment according to the original invoice terms. The result is increased cash flow for making payroll, paying suppliers, and taking on large projects, without negatively impacting your customer relationship. (See how we work with your customers at FundThrough.)

Pros

- Quick Funding: Access funds within days, bypassing lengthy bank processes.

- Flexible Capital: Choose which invoices to fund with no long-term commitment.

- Seamless Process: Modern factoring offers easy online applications and software integration.

- Easier approval: Skip strict bank criteria since factoring is based more on customer credit.

- Business Growth: Leverage quick capital to take on larger projects and scale.

- No Debt: Factoring doesn’t add liabilities to your balance sheet.

- No Dilution: Maintain full control without diluting equity.

- Cash Flow Stability: Manage operations smoothly with reliable cash flow.

- Less Admin Work: Let the factoring company handle payment collection.

- Integration with Enverus: If you work with FundThrough, you can pull eligible invoices into your account from OpenInvoice.

- Unlimited Funding: FundThrough offers as much funding as you have in eligible outstanding invoices–no worries about not having enough capital to fund your project.

Cons

- Bookkeeping difficulty: Can lead to complicated bookkeeping if your accountant or bookkeeper isn’t familiar with recording factoring transactions. See this post for step-by-step instructions.

- Technology requirements: Working with FundThrough requires using our platform, which may not be suitable for businesses relying on other systems or processes.

Invoice factoring is not just an emergency funding option, but a routine financial strategy for oil and gas companies. FundThrough, with its deep understanding of the oilfield invoice funding challenges, (and integration with popular invoicing software, OpenInvoice by Enverus) offers unlimited funding to prevent capital constraints for small businesses in this volatile and capital-intensive industry. Our expertise and seamless integration make us a preferred choice for energy companies looking to maintain steady growth without the stress of financial bottlenecks.

Ready to get funding for your oil and gas startup?

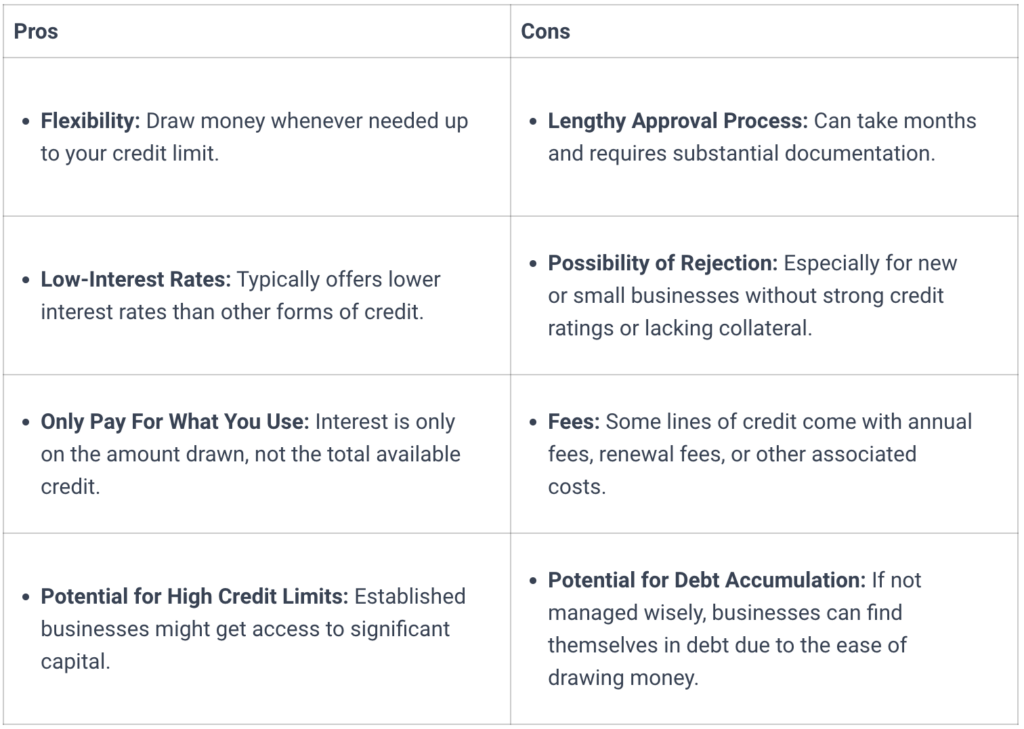

Line of Credit

One of the more popular traditional financing options is a business line of credit, especially for the energy industry where access to cash can be pivotal. This type of financing is a popular choice for gas businesses due to its versatility and flexibility, offering a relatively inexpensive way to manage cash flow. It’s particularly useful for businesses that may not need funds immediately but want the ability to draw on them quickly if necessary. While the convenience of a line of credit is appealing, there are important considerations for businesses, particularly those in sectors like oil and gas where the financial landscape can be complex.

Firstly, the application process for a line of credit can be lengthy, which might not be ideal for businesses needing quick access to cash. It’s not unusual for the process to take weeks or even months from application to approval. Additionally, businesses, including those with bad credit, need to demonstrate profitability with financial statements from at least a couple of years. This is crucial because the credit limit will be based on these historical financials rather than any forecasted growth, which could be a limiting factor for businesses looking to scale rapidly in the energy industry.

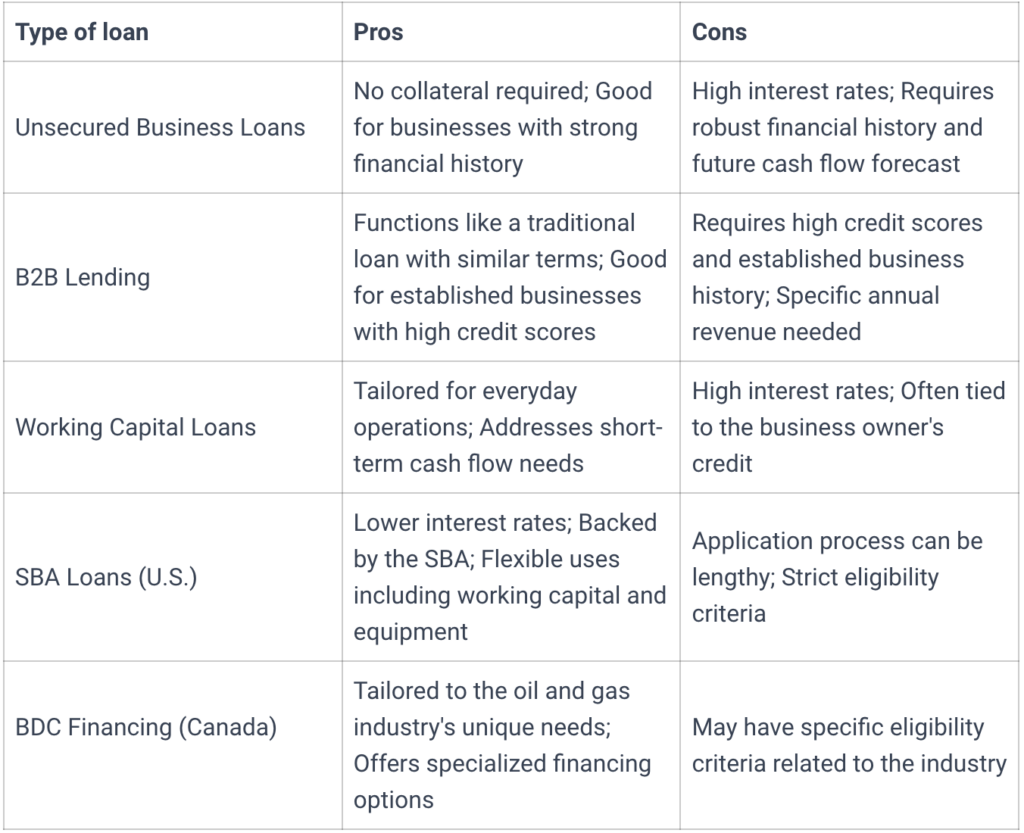

Business Loans

For businesses in the energy industry, particularly those involved in oilfield services or the gas business, unsecured business loans offer a viable route to access to cash without requiring significant personal or business assets as collateral. However, these loans demand evidence of strong financial health and future cash flow projections, often coming with high interest rates that make them a costlier option for financing.

B2B lending emerges as another business loan type, akin to traditional bank lending, where one business extends funds to another. This approach necessitates a solid credit score and a proven business track record, mirroring the requirements of a traditional loan but tailored for the volatile markets of the energy sector.

Working capital loans, tailored for short-term capital financing needs like capital for oil projects, can help businesses overcome temporary cash flow dips due to growth or project initiation. Despite their utility, the average rate of interest and the dependency on the owner’s credit history can pose challenges, emphasizing the need for additional funding avenues, such as angel funding or affordable funding solutions like SBA loans in the U.S. and their equivalents in Canada, offering a lower approval rate but more favorable terms for energy companies seeking capital expenditure support.

For those in the United States, SBA loans offer a viable option with typically lower interest rates, backed by the Small Business Administration. The SBA’s 7(a) loan program, for example, can be used for working capital, equipment, and more, providing a flexible funding solution for various business needs. In Canada, oil and gas companies can explore specialized financing options tailored to the industry’s unique needs, such as those offered by the Business Development Bank of Canada (BDC).

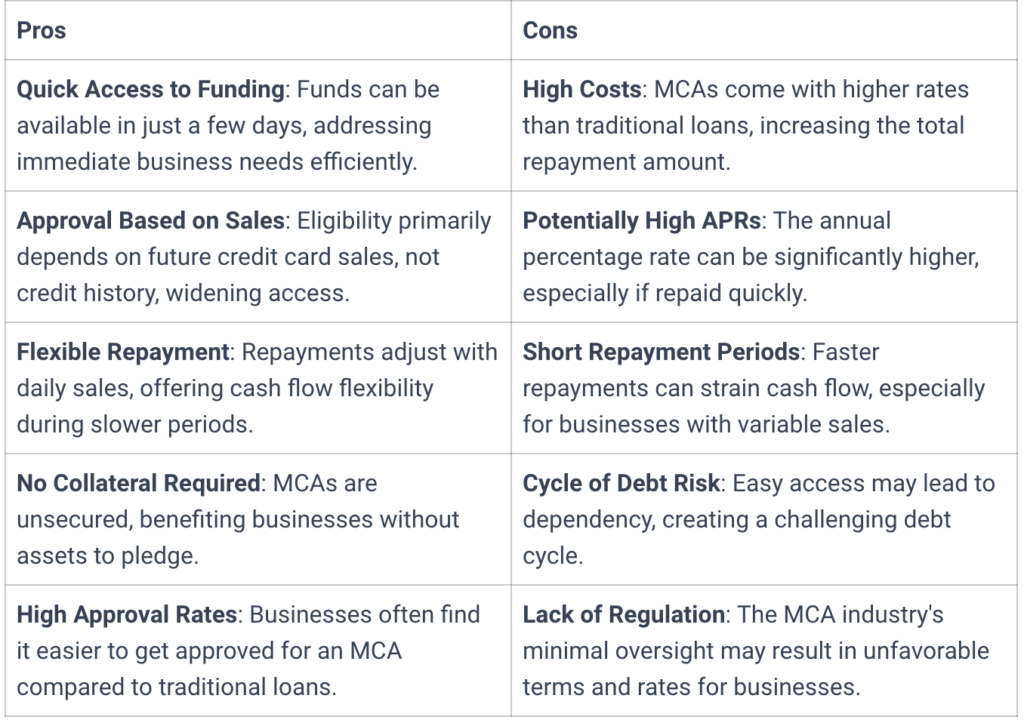

Merchant Cash Advance BDC Financing (Canada)

A merchant cash advance (MCA) is an alternative lending option that is gaining traction with small businesses where a business is advanced a loan against its future credit card sales. Basically, the business agrees to sell a fixed percentage of its future credit card sales (with interest) for an immediate cash advance. A MCA is often available to companies with little credit history, and doesn’t require additional collateral. Unfortunately, these less stringent requirements come with high interest rates that make MCAs much more expensive than if a business were to take out a traditional bank loan.

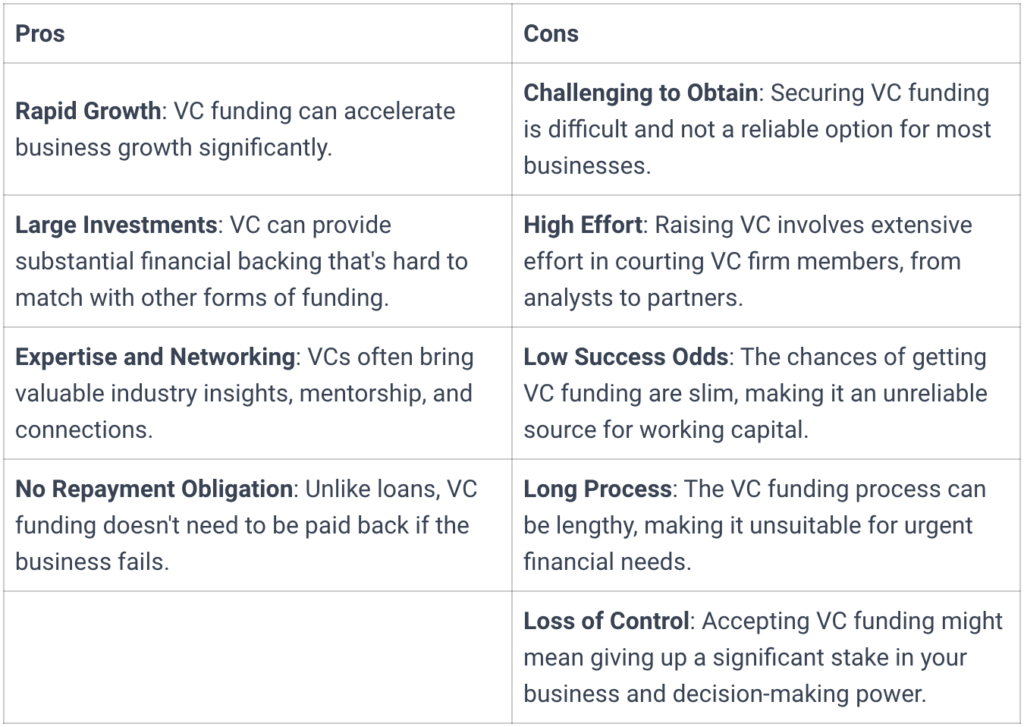

Venture Capital

Venture capital, or VC funding, can help businesses grow at an incredible rate. Unfortunately, those companies you see raising millions are exceptions, rather than the rule. Finding venture capital is easier said than done, and isn’t necessarily a reliable option for most businesses. The process of raising VC funding involves a lot of time and effort courting employees at VC firms from the low-level analysts to the partners themselves.

For most businesses, especially those in the oil and gas sector or those requiring capital for oil projects, the reliability of VC funding as a steady source of working capital or as a solution for bridging cash flow gaps is limited. The process is less about the immediacy of financial needs and more about aligning long-term business visions with the interests of major players in the venture capital ecosystem.

Funding Oil and Gas Projects: How to Choose the Best Options

When it comes to choosing the best options for funding oil and gas projects, here are a few pointers to keep in mind.

- Fees: One of the most important factors businesses consider when comparing funding options are the fees. Different financing options will have different costs of borrowing or funding. Be sure to compare the fees between different funding sources when looking at which is best for your business needs. You want to be sure that the cost doesn’t eat too deep into your margins. And don’t forget hidden fees. Ask the lender for their fee schedule.

- Funding need: Another thing to consider when looking at funding oil and gas projects is what exactly you need the funding for. For example, you could use your line of credit on normal expenditures like inventory, payroll, and marketing. While you’re growing you could use another financial tool designed for fast access, like credit cards, a merchant cash advance, or invoice financing to fund more purchase orders. By having multiple options for fast, flexible financing, you can get the cash to fund new work so you can grow without going into debt – or have more options ready in case your original funding application doesn’t get approved.

- How quickly you need access to funding: Some of the more common types of funding types (like business lines of credit) take time to set up and get access to. Others (like invoice funding) can get cash in hand in a matter of days. Consider how quickly you need access to working capital when comparing your options for funding oil and gas projects.

- Ease of application and approval: Many oil and gas funding options have strict eligibility requirements and call for an extensive financial history (including annual business revenue) and excellent personal and business credit scores to qualify. A lot of businesses simply haven’t been around long enough to establish the credit history necessary to qualify for these funding options. Thankfully, there are other types of funding available for these new and growing companies.

- Type of agreement:It’s best to have the flexibility to choose how and when you use different funding options. Technology-enabled factoring companies like FundThrough have revolutionized agreements such that you don’t need to be locked to long-term contracts to access the best rates.

Exploring different funding avenues, it’s clear that there’s no one-size-fits-all approach, especially in the complex world of oilfield services and the broader energy business. Embracing a variety of funding approaches, from the more traditional loans and business credit cards to specialized options tailored to the energy sector, can create a well-rounded financial strategy. This approach is pivotal, particularly when tackling the inherent fluctuations and capital-intensive nature of the industry.2

It’s essential to work closely with your financial team to pinpoint exactly what your business needs to thrive. By weaving together a plan of financial solutions—each selected for its strengths and compatibility with your business model—you can craft a funding plan that not only sustains but also propels your growth. This tailored mix, informed by a deep understanding of your operational goals and the unpredictable energy market, is your gateway to not just surviving but thriving amid the industry’s ebb and flow.