QuickBooks Cash Flow Planner & Forecast: A Guide to Your Cash Flow

It doesn’t take much time running any type of business to figure out the importance of cash flow for your company’s financial health. Even if

By Deepak Ramachandran

Updated July 2022

Home » FundThrough Blog » Accounts Receivable Cycle Explained: Everything You Should Know

A deep understanding of the accounts receivable cycle is critical for much more than just good accounting — it’s the key to fostering a profitable business.

Do you know the definition of “accounts receivable“? More importantly, do you understand how the accounts receivable cycle impacts your business finances? These balance sheet items can make or break your venture.

Deep knowledge of accounts receivable (A/R) can help you improve your cash flow management, capitalize on time-sensitive opportunities, and maintain flexibility.

Let’s explore the essentials and particulars of the accounts receivable cycle, and how they impact your bottom line. We’ll also discuss key financial terms like accounts payable, trade receivables, and notes receivable.

Accounts receivable is the amount of money your business has a right to collect in exchange for goods or services (on credit) already provided to a customer.

The longer your accounts receivable last (i.e., the longer you don’t collect your money), the longer you face limits to investing in production for your next order. Uncollected payments tie up working capital and lead to longer business cycles.

In the world of cash flow best practices, you should collect all due accounts as soon as possible. Failure to do so will choke up available cash flow for other business purposes.

What does an example of the accounts receivable cycle look like? A common accounts receivable cycle example is the billing practices of utilities companies.

Think about the accounting practices of an electricity or water company. These companies provide services to customers and then bill them after usage. While the companies await payment for the utilities delivered, they will record unpaid invoices in the accounts receivables portion of their balance sheet.

Let’s dig a little deeper into the various aspects of accounts receivable to and how they can improve your business’ health.

If your cash flow slows to a trickle, your company will face a cash crunch. It’s essential to monitor your finances regularly. That starts with two balance sheet basics:

As noted above, the account for accounts receivable is tied to the money owed to a business for goods and services that have been provided.

The accounts receivable is recorded by an accountant or small business owner as a “current asset.” This means that the customer will be paying the account balance within the next 12 months or less.

This is an important accounting distinction. If the accounts receivable is not set for payment within 12 months, it will be registered on the balance sheet as a long-term asset.

In accounting, accounts payable and accounts receivable are opposites. The following definitions provide a brief description of their differences.

This is the amount your company owes a third party for purchasing stock or services on credit.

This is the amount your company has the right to collect from clients for providing them with goods or services on credit.

Sure, accounts receivable and receivables sound similar, but they’re very different.

On the balance sheet, A/P falls under liabilities. A/R are part of your assets.

Beyond simply balancing the two, creating a healthy business requires a deeper understanding of A/P and A/R and plenty of planning.

On the balance sheet, A/P falls under liabilities. A/R are part of your assets.

Beyond simply balancing the two, creating a healthy business requires a deeper understanding of A/P and A/R and plenty of planning.

Any money that is due to a company for products or services that they have delivered to customers is considered a current asset – so long as the payment will come within 12 months. Any payment that is not set to be paid in full within that time frame is considered a “long-term asset.”

Accounts receivable are considered an asset account. This is different from a revenue account. Once a payment has been made on an asset account, it converts into revenue.

While the terms appear to be similar, they don’t always refer to the same thing. You need to understand the differences when reviewing financial papers.

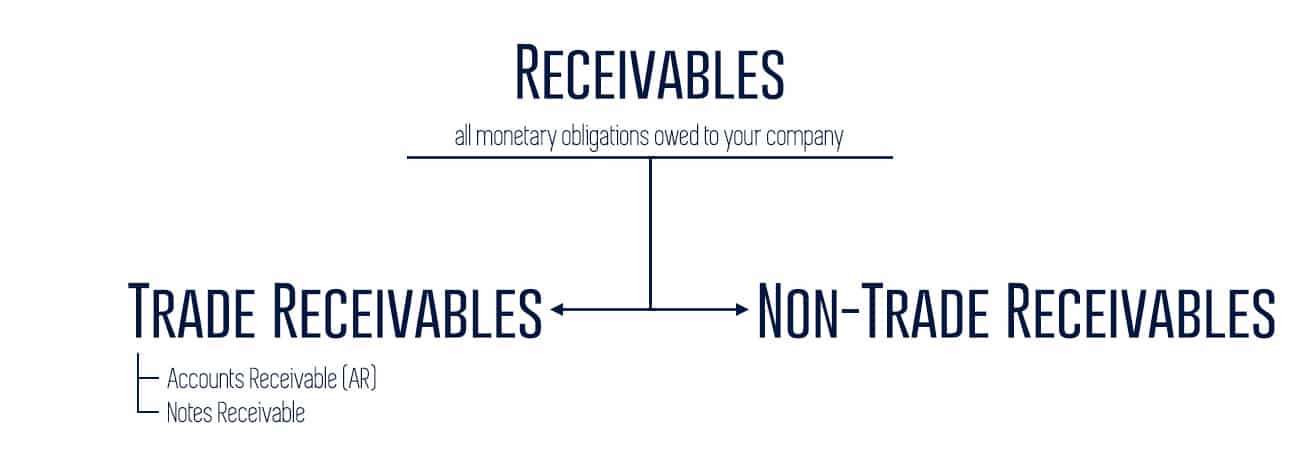

These include all monetary obligations owed to your company. This is the biggest blanket category. There are two types of receivables: trade and non-trade receivables.

These encompass all credits owed to your company by customers who’ve purchased merchandise or services. This usually results in an accumulation of assets (hence the name trade receivables). Accounts receivable are included within trade receivables and are reported as current assets on a company’s balance sheet.

Non-trade receivables are a result of transactions outside the standard line of business of offering goods and services. They include insurance reimbursements, employee advances receivables, tax refunds, or insurance claims receivable.

Accounts receivable are considered a receivable, but not all receivables are considered A/R. Let’s dig a little deeper into why.

Businesses always face the risk that a customer may not pay them for products or services delivered.

In accounting, net accounts receivable is the net amount of money that remains in an account after a business subtracts any provision for debt that will not be paid.

This is primarily used by businesses that sell on credit.

These are the amounts billed by your company to your clients when you’ve completed the delivery of goods or services. This kind of credit is like a gift to your customer until the outstanding invoice has been cleared.

It is important to note that trade receivables don’t carry interest (thus the gift analogy).

When you file an invoice, your accounting software creates a debit to the A/R account and a credit to the sales account. However, this doesn’t mean you have that cash. You only actually receive cash when the invoice is paid.

Once the amount due has been cleared, a cash receipt transaction is registered by the system. This translates into a credit to the A/R account and a debit to the cash account.

For a better view of your trade receivables, you can always take a look at your A/R aging report.

When your customer gives you a written promise to pay their credit, you’ve just received a notes receivable. Such credits give you (the lender) more legal options when collecting overdue accounts relative to other accounts receivable options.

This is because notes receivable are taken into consideration when extending credit to a new client, especially one with bad or no credit history. The debtor is usually required to pay interest.

It is no secret that investors are always looking for ways to improve the returns on their portfolios. At the same time, many companies struggle to maintain a healthy level of working capital. Fortunately, there are great opportunities for investors and businesses to work together to solve both problems.

Trade receivables financing refers to when parties collaborate by exchanging liquid assets in anticipation of future profits. If your business struggles to collect its payments or the operating cycle is just too long, this kind of external financing can be the difference between success and failure.

Here, a finance company buys some of the supplier’s invoices at a discount. The factor then has to collect payment from the supplier’s clients when the accounts are due. In this type of financing, the supplier receives immediate payment.

Accounts receivable factoring, typically just known as factoring, is a practice where a company sells its accounts receivable to another business in exchange for cash.

Invoice discounting is very similar to factoring, with the major difference being that the supplier is involved in the collection process. The debtor may not be aware of the fact that third-party financing was used. This type of funding ensures discretion.

Your company relies on your ability to collect all accounts promptly. Keeping track of how often this happens will give you a clear picture of how effective your company is at collecting its debts. Companies can use accounts receivable financing to help solve any accounts receivable cycles problems.

Your accounts receivable turnover defines the number of times per year your business collects its average A/R. A low turnover ratio is characteristic of companies with low-quality customers and/or poorly functioning collection departments and should tell you some changes need to be made. Read on how factoring accounts receivable can help with turnover.

To have a high turnover rate, you need to be able to issue credits efficiently and collect your cash within a reasonable time frame. Taking care of this problem is a critical component of having a healthy and successful business.

The average accounts receivable turnover is 31 days. The accounts receivable turnover ratio formula is net credit sales divided by the average accounts receivable.

A higher A/R turnover is better for a company’s finances. The higher the number, the more efficient that a company’s finances become. The high figure indicates that a company’s customers pay their debts quickly.

The 6 best ways to increase your accounts receivable turnover ratio:

The accounts receivable process is one of the most important elements of any successful business. It keeps track of all your business’ sales as well as payments for goods and services. Accounts receivable (A/R) refers to the balance of money due to a business based on its outstanding invoices. The A/R collections process is the term used for recording and collecting payment for those invoices.

Traditionally, the accounts receivable cycle begins when a customer makes a purchase for a product or service, and ends once any outstanding payment has been collected. The step-by-step process taken to record and collect the debt is what’s known as an accounts receivable workflow or A/R process.

How each business handles its A/R process will look different, but there are generally four main steps involved.

Sale. There’s usually some sort of initial communication with the customer regarding a product or service that results in a sale.

Invoice. Once the sale takes place, the A/R department sends an invoice to the customer. This may happen before or after the service or product has been delivered.

Payment collection. Customers typically have either 30, 60, or 90 days to pay from the date of invoice.

Reconciliation. This process begins again as soon as payment is received.

Additional steps in the accounts receivable process may include:

By optimizing your own accounts receivable cycle, you can ensure prompt payment and efficient operation. Here are some best practices to follow when optimizing your A/R process.

If you’re still working with paper and pen, or using a patchwork invoicing and tracking system, the first step to optimize your A/R process is implementing a digital collections system and establishing a database. This allows you to easily see the status of any invoice within your workflow.

Ideally you want your customer to pay on receipt, but that’s unfortunately just not the reality for a lot of businesses. Buyers often request payment terms of 30, 60, or 90 days (or more!) leaving suppliers waiting on payment. You might want to consider “bucketing” your customers into timeframes based on how long their invoice has been outstanding. This way, your team can implement various collections strategies depending on which bucket the customer is in, to help stay on top of collections.

The success of an A/R flow is measured by creating access to reliable cash flow. By focusing on high-value accounts – those invoices that make up the bulk of your outstanding receivables – you can maximize the return on your efforts.

Finally, consider automating your A/R processes to optimize the overall flow. It can be an overwhelming and costly process to keep track of invoices and manage collections. Consider implementing an A/R management system so that you aren’t spending valuable time chasing down late payments, or partnering with a finance company that handles the legwork for you.

Whether you’re a first-time business owner or a seasoned MBA graduate, it’s good to know all your options when it comes to accounts receivable. As a concept, A/R is deceptively simple, leading too many businesses to neglect associated opportunities.

We help small business owners boost cash flow every day. If you’re interested in getting started with accounts receivable factoring in Canada and the United States, FundThrough can help. See if you qualify for our invoice funding solution.

It doesn’t take much time running any type of business to figure out the importance of cash flow for your company’s financial health. Even if

Small business owners have more financing options available to them than ever before, including invoice factoring. Whether you’re looking for an invoice factoring solution that

If you’ve ever shopped for any kind of business funding, one of the first questions you’ll have is about the rates. You have to know

Interested in possibly embedding FundThrough in your platform? Let’s connect!