Grow My Business

Sell now, Collect Now: The Embedded Finance Approach Making Waves With B2B Marketplaces, Portals & Apps

By FundThrough

It’s no secret that embedded finance is transforming multiple industries. (We even wrote our own post on embedded finance use cases!) Many of the examples that get attention are B2C: think insurance premiums, paying for parking within Google Maps, and ride-sharing apps. Now, embedded finance is making its way into the B2B landscape through the many marketplaces, portals, and apps that are being established. These platforms are taking the process of finding professional services and supplies – and paying for them – online.

Exciting as it is, this emerging change to how B2B companies buy and sell is bringing its own set of new market problems.

The Payment Problems Facing B2B Marketplaces, Portals, and Apps

While the need for embedded finance in this space is clear, the specific features of any financing method will need to solve a few major problems.

- Excluding payments from the experience decreases stickiness and value. Handling payments offline makes it more complicated for the buyer to complete the transaction, reducing the likelihood they will follow through and decreasing platform stickiness.

- Buyers want to pay later. Suppliers and platforms want to get paid now. Payment terms of 30, 60, or 90 days are a given in B2B transactions, and buyers (or anyone paying an invoice through a portal) still expect them. On the other side, suppliers and the platforms themselves want to be paid immediately.

- Increased risk for platforms. In an effort to win supplier loyalty, many marketplaces and portals have been extending the usual credit terms to buyers while paying suppliers quickly. This puts the credit risk on the platforms themselves, forcing them to do their own underwriting.

- Many players don’t want to use their own capital. Extending credit to buyers ties up capital that many marketplaces, portals, and apps need available, especially if they are growing quickly.

While those are the immediate issues facing B2B marketplaces, portals, and apps, the problems are compounded by larger overall trends.

Global trends compound the payment problems

Among them are:

- COVID-19 is (still) disrupting supply chains. Portals and apps selling directly to businesses need to fulfill orders for goods in a timely manner; having cash available to preorder goods enables them to overcome supply chain issues caused by the pandemic. Even in 2022, supply chain shortages are still causing these headaches.

- Millennials prefer buying and selling online. Many of today’s B2B decision-makers are part of the Millennial generation. They prefer to complete an entire transaction online, whether they are paying the invoice or are receiving payment. Manual processes slow down both.

- Data enables an improved and personalized experience. Marketplaces, portals, and apps are no different from other businesses in their need for data. The payment process is another avenue for gathering information they could analyze for improvements to their experience and ways to personalize offerings to buyers so that they can drive more stickiness and transactions.

A technology-focused approach solves these trends and challenges while enabling suppliers to sell now and net now.

Curious about getting your platform paid faster? Learn more

Sell now, Collect now: Embedding instant invoice payments enable flexible buyer payments and fast supplier and platform payments

While the industry is buzzing about every company becoming a fintech company, not every company should become a fintech. Invoice financing as an embedded finance solution enables these companies to avoid cumbersome requirements of becoming a fintech while still reaping the benefits of payments within their experience:

- Embedded invoice financing gives buyers and sellers what they want. The way invoice financing works lends itself well to solving mismatched payment expectations. A supplier sells their invoices to an invoice financing company. The supplier receives cash for the invoice amount, usually less fees, ahead of the payment terms. The buyer pays the invoice amount to the invoice funding company (or to the platform, who then pays the invoice funding company) according to the original payment terms. Embedding this process into marketplaces, portals, and apps also takes away their credit risk, but only if they have a partner to do their underwriting.

- Cash flow increases. Without having cash tied up in extending credit to buyers, those marketplaces, portals, and apps can use their cash to grow and compensate for COVID-19 supply chain disruptions. Their balance sheets also look healthier since they’re not carrying extra debt financing.

- Stickiness and value improve. Being able to buy on credit or get paid immediately are value-adds for both buyers and sellers respectively and provide a point of differentiation. Because buyers stay within the experience to pay, they’re more likely to follow through with buying and to buy more.

- An additional revenue stream is created. With an approach to embedded finance that appeals to users (and therefore is more likely to be used), B2B marketplaces, portals and apps can earn passive revenue from the transactions.

Explore embedded instant invoice payments

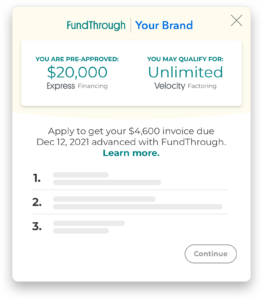

FundThrough invoice financing solution can be embedded into marketplaces, portals, and apps. Here’s how it works to get you and your suppliers paid fast.

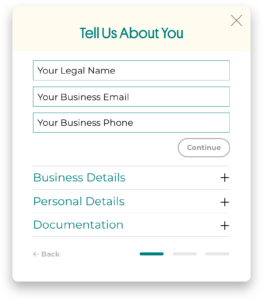

First, the client (a supplier) provide basic information to verify their identity, business, and the invoice they want to fund.

The FundThrough team gets to work and communicates next steps.

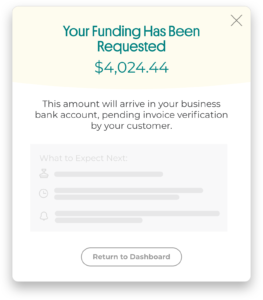

AI technology generates automated funding offers in minutes for the client to choose from. Upon approval, they can get their funds in as little as 24 hours.

While payments are causing pain for many marketplaces, portals, and apps, embedding instant invoice payments solves them while adding more value for buyers, suppliers, and platforms alike.