Embedded finance has arrived; it’s a trend that’s making its way into the finance ecosystem and will be here to stay. Having financial services built-in to so many online transactions is business as usual for B2C. Now it’s becoming that way for B2B.

Eventually, embedded finance options will become expected, even for B2B purchases that have traditionally been handled offline. Before the pandemic, 70% of B2B decision makers reported being open to making fully self-serve or remote purchases valuing over $50,000. 27 percent of those were open to spending more than $500,000. It’s also becoming a way to increase customer engagement and loyalty.

Because this change in how people are making purchases isn’t going away (and it’s a growing addressable market for so many industries), we’re exploring a variety of embedded finance use cases. But before we get to that, let’s back up and discuss what embedded finance is.

What is embedded finance?

Embedded finance is about enabling companies who are not financial institutions to include financial services or finance products in their digital products. It makes buying products faster and easier for customers while providing opportunities to streamline back-end processes for businesses. It’s also giving rise to embedded fintech, which is when finance companies embed fintech options into their products and customer channels. And these are both different from the buy now, pay later (BNPL) trend that’s happening in the finance space.

Buy now, Pay Later (BNPL)

You’ve likely experienced the Buy Now, Pay Later (BNPL) trend for yourself. If you make an online purchase of a consumer product, oftentimes you can choose a finance product in the form of a payment program to make weekly or monthly payments from your bank account instead of paying up front. These point of sale loans are exploding in popularity, and are key drivers to elevating the user experience and customer loyalty through repeat purchases.

Embedded Finance Use Cases: Invoice Financing in B2B Marketplaces

One of the most obvious uses of embedded finance is invoice financing in B2B marketplaces. Some marketplaces extend 30 to 90 days of credit to eligible buyers as one of their value propositions. They also allow suppliers to get paid right after the order. By doing so, these marketplaces are taking on the credit risk of a buyer not paying in time to foster greater supplier loyalty.

If you’re familiar with invoice financing, it’s easy to see why it’s a perfect solution to keep delivering these benefits to buyers and suppliers while taking the credit risk off of the marketplace. If you’re not familiar with invoice financing, it’s a financial product where a business owner sells invoices to a factoring company.

The business owner receives cash for the invoice amount, usually less fees, ahead of the payment terms. The business owner’s customer, who is responsible for paying the invoice, instead pays the invoice amount to the factoring company according to the original payment terms.

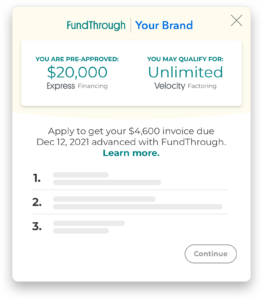

It’s also possible for FundThrough’s invoice financing solution to be embedded into the payment experience of B2B marketplaces. Here’s how it could look in your marketplace.

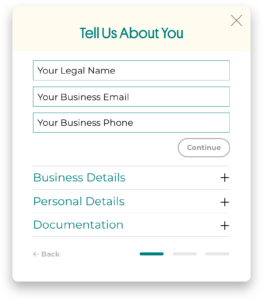

It’s a simple process that asks for basic personal and business information to verify the existence of the individual, business, and invoice.

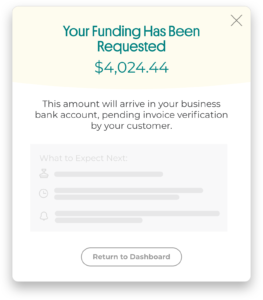

And finishes with a confirmation that we got their information.

FundThrough is embedded directly into the experience, enabling flexible payment terms for buyers and fast payment for suppliers. Invoice financing embedded in B2B marketplaces:

- Increases platform stickiness

- Attracts users

- Differentiates the platform in the market

- Offers unlimited funding & next day payments

According to Forrester, U.S. business-to-business (B2B) ecommerce transactions are expected to reach $1.8 trillion by 2023. This would account for 17% of all B2B sales in the country. For anyone running or building a marketplace, it makes sense to facilitate payments in any way possible.

Of course, invoice financing in B2B marketplaces isn’t the only embedded finance use case. There are many more that we’ll explore.

Professional services: Online hiring for B2B companies

If you’ve ever hired anyone from Thumbtack or Fiverr, you’re familiar with professional service marketplaces. But now, instead of hiring a wedding florist, you could use a marketplace to browse professional service offerings to hire an insurance carrier, a trucking company, financial services, or any other business service.

From finding companies, getting quotes, and talking to your finalists, the whole transaction can take place in the platform. It’s a one-stop customer journey. And suppliers get the chance to target qualified buyers, grow their market share, and make more sales through an additional revenue stream.

Oil and Gas: Unmatched vendor variety

The oil and gas industry relies on specialized equipment and labor at every stage of production. Marketplaces dedicated to the unique and varied needs of this industry are now offering the opportunity to easily comparison shop for heat exchangers, drill bits, piping, and other materials. They also enable service providers to easily respond to RFPs without leaving the experience. Both buyers and suppliers find potential vendors and clients that they might have never known about from their own networks or internet searches.

Construction: Find specific materials faster and easier

Like oil and gas, the construction industry has very specific needs. For example, finding a replacement part for a specific make and model of an excavator can be difficult, even when searching the internet. B2B marketplaces made just for construction make it easy, providing a wide range of choices for buyers and sales opportunities for suppliers.

Grocery & Food Service: Shopping apps and niche marketplaces

If you’ve ever ordered groceries for pickup or delivery and paid for them within the app or website, you’ve experienced embedded finance for grocery stores. The same is true if you’ve paid for a meal at a restaurant by swiping your card on a tablet at your table. Both give consumers more options to pay – and now the trend is making its way into the B2B side of the food and beverage business.

Multiple marketplaces are popping up for players in the food and beverage industry. Many of them specialize beyond simply grocery stores or restaurants. Examples include organic food, fruits and vegetables, wholesale food, and packaged food. Niche marketplaces give grocers and restaurateurs maximum flexibility and choice in food to stock on their shelves or offer on their menus. They’re also useful for finding rare ingredients.

Healthcare: Solving the financial problems of patients and providers

The potential for embedded finance in healthcare is huge, especially in the U.S. where many patients have to pay out-of-pocket for medical expenses. Major hospitals and health systems now offer payment services and other financial services such as embedded lending, allowing patients to pay medical bills in mobile and desktop apps.

There’s potential to offer up-front pricing for preventive care so that patients can plan for the cost. New players are also entering the space: fintech startup PayZen pays patient invoices to hospitals upfront while offering patients no interest, no fee payment plans. Innovations like this could lower costs for doctors, patients, hospitals, and health insurance providers.

Insurance: Faster claims and payment processing

Embedded finance solutions make it faster and easier for insurance companies and customers to manage their insurance options, policy claims and process payments. Automation reduces the need for manual workflows, and there’s the potential to offer customers multiple ways to pay their deductible, coinsurance, or premiums. Embedded finance ultimately improves operational efficiency and the overall customer experience.

Digital wallets: Convenient consumer payments

Many embedded finance use cases make life easier, especially digital wallets. These are mobile apps that contain digital versions of your credit and debit cards (but not your actual account numbers and other sensitive information.)

Tech companies such as Google Pay, Apple Pay, and Samsung Pay are notable examples, enabling you to hold your phone up to contactless terminals at store checkout lines and ATMs. With online retailers that offer digital wallets as a payment method, you can choose a digital wallet to pay without entering in card information, in addition to paying directly through the app.

Automotive: embedding payments and insurance

In a way, embedded finance has always been a part of the automotive industry. Dealerships offer their own financing, and drivers have been paying their leases and loans through digital channels for some time.

Now it’s being taken to a new level by some industry players. Tesla drivers can now purchase an insurance policy from the company’s own insurance company, providing an alternative to a third-party insurance provider. It’s expected to deliver 30 to 40 percent of the company’s future value. They also pass savings along to Tesla drivers with discounts of 20 to 30 percent.

Retail bank services: Payment plans for retail purchases

Your debit card, credit cards, and PayPal aren’t the only embedded finance companies for online purchases anymore, and loans are no longer just for a major purchase. You might’ve noticed while shopping online that major retailers now offer third party banking services to pay for a purchase in several installments – even for small purchases.

Retail customers can apply for the loan and get approved without leaving the original website where they shopped. This embedded banking feature shortens the customer journey, making it easier for consumers to buy and increasing the likelihood of future purchases. Suffice it to say that if you need a loan nowadays, the bank isn’t your only option.

Investments: Getting returns for all skill levels

Managing the investing process takes time, expertise, and experience – unless you have an embedded finance solution. There are online platforms and apps galore for different goals and skill levels. Experienced investors can still evaluate the values of stocks and buy on their own. People new to the practice can automate these financial decisions, investing a set dollar amount or even spare change every month via an automatic bank draft.

Ride-Sharing Apps and the Gig Economy: Paying for work at the point of purchase

The gig economy is exploding in popularity. In Canada, more than one in 10 adults are part of the gig economy; in the U.S. it’s 36 percent. Examples of embedded finance with this type of work are everywhere.

Uber and Lyft offer an end-to-end experience in their app, from requesting a ride and paying for it with a credit or debit card on file. Same with food delivery services like UberEats and GrubHub. And it’s easier than ever to hire a freelancer on Thumbtack or Fiverr and pay for their services.

Google Maps: Purchasing parking with one click

Google Maps allows users to find participating street parking near their destination and pay for it within the app using Google Pay, combining several digital services. This solution makes paying for parking (and avoiding get towed or ticketed!) faster and easier than the manual process of feeding bills into a machine.

This list of embedded finance use cases isn’t exhaustive. However, it should give you an idea of how versatile and useful this growing trend is for anyone that buys or sells anything.

Interested in embedding FundThrough in your B2B marketplace?

See what embedded finance can offer.

Learn more about our approach to embedded invoice financing and talk to us about how to embed FundThrough today!

Ready to factor an invoice?

Get started by creating a free FundThrough account, or connecting your QuickBooks, OpenInvoice, or WorkBench account to start funding an invoice.