Pump Up Your Cash Flow

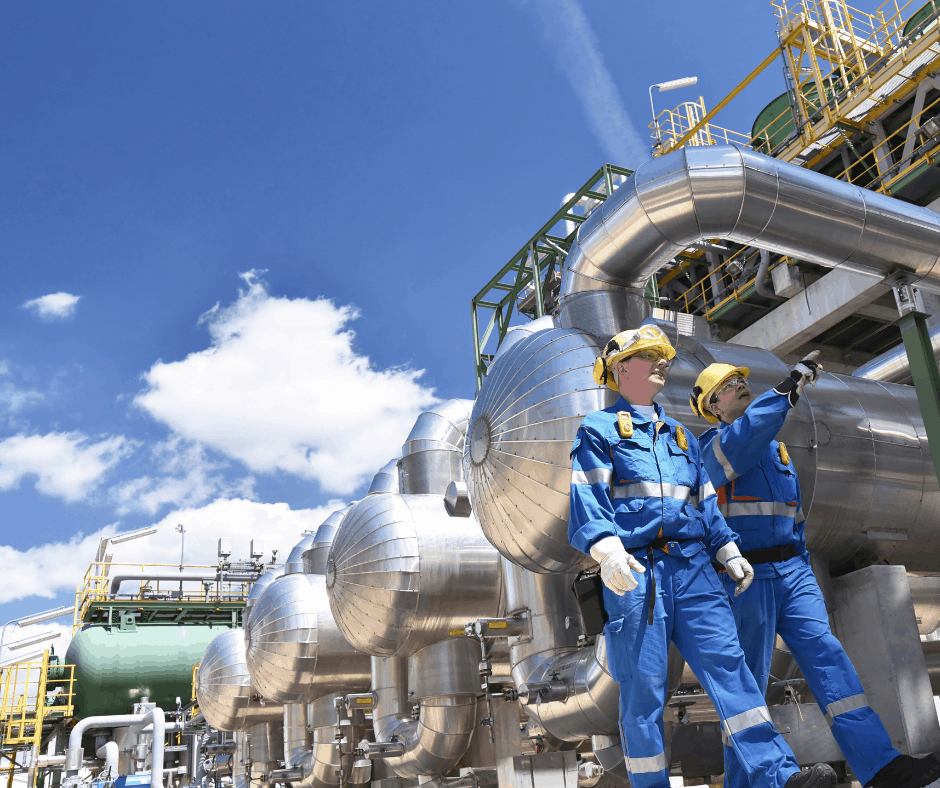

FundThrough is a trusted partner of the Cortex Workbench network.

Enverus has partnered with FundThrough to advance millions of dollars to suppliers across North America who are waiting on payments.

Your Hard-earned Funds at Your Fingertips

Business expenses don’t stop while you’re waiting to get paid. Funding your unpaid invoices lets you end the wait and get back to running your business.

Manage cash flow

Maintain a smooth, predictable cash flow schedule on your terms.

Pay your staff

Meet payroll while your team works – not after you get paid.

Get equipped

Purchase the equipment you need to take on new business.

Save money

Pay vendors on time and access bulk discounts.

How It Works

1. Link your Workbench account to FundThrough

Sign-up is quick and easy. You link your Workbench account and we get to work on pulling in your invoice data.

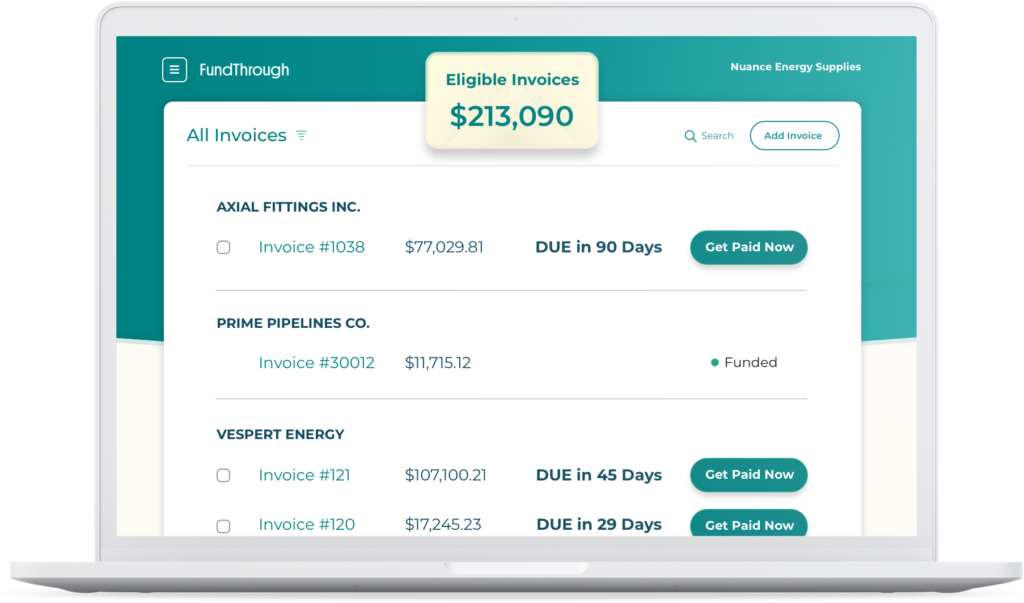

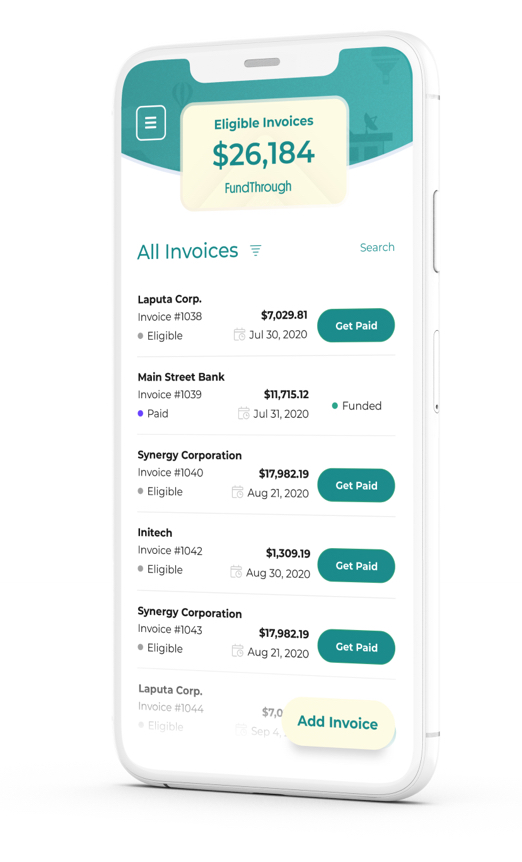

2. Select the invoices you want to advance

Fund as little or as much as you need, with any buyer on the Workbench network. Advance specific invoices or your entire book of receivables.

3. Get your funds, less fees, within one business day

You get the full face value of your invoice, less fees, right away while we wait for your customer to pay us directly.

“FundThrough has been instrumental in helping my company meet its cash flow needs quickly, easily and at a low cost. A few clicks and funds are on their way.”

Mark Baker, Google Review

See more reviews here.

Simple and Affordable Pricing

Flat upfront fee

For each invoice you choose to advance, you’ll pay a small fee equal to 2-5% of the invoice value.

No surprises or hidden fees

You’ll always see the full cost of funding upfront, before you decide to fund. Plus, there are no monthly or annual fees — your account is free forever.

No obligations or contracts

Fund as little or much as you need. There are no contracts, minimums, or limits on how much funding you can advance.

“If [the pipeline project] is two miles or 50 miles long, we have money to start that project. It feels safer getting money today instead of waiting between Net 45 and Net 60 days. We’re also able to broaden our clientele and go after bigger projects.”

Anna Garcia

Co-owner, Global Pipeline

Get Access to On-Demand Funding Today

- No obligations or contracts

- Your account is free forever

- Flexible, simple, and affordable

Get Started Today

Questions?

We’re here to help! Our dedicated OpenInvoice Supplier Management Team can answer all of your questions and help get you on your way to cash flow freedom.

Call +1 (888) 813 4547

Toll-free Mon-Fri 9am-5pm ET

FAQ for Suppliers

FundThrough charges a flat fee of 2-5% of the invoice value.

An exact rate per customer is given once you authorize sharing your invoicing data with FundThrough. Once the rate is given, you may immediately fund the invoice for 95% to 98% (depending on the flat fee) of its value without paying any other fee.

The exact rate for a given customer is based on three factors: Who is your customer? What are your terms/relationship with them? How long do they typically take to pay?

When you click to Fund a given invoice, the exact price will always be displayed in full transparency for your review before you confirm the funding.

FundThrough has no limits on the amounts you can fund. For OpenInvoice suppliers, the company has funded invoices from as little as $500 to $10 million!

Generally speaking, FundThrough will fund invoices that are ‘Approved’ in OpenInvoice; however they do make exceptions for Operators that do not use the approval workflow.

Funding takes three easy steps. Once you connect your OpenInvoice account to FundThrough you will simply:

Log in to Workbench

Find the Approved invoice you want to fund

Click the ‘Pay Me Now’ button on the invoice to fund

Funds will be sent via EFT and arrive within 1 business day.

Yes, invoices to any of your buyers are eligible for this program, as long as they don’t already offer you an Early Pay program through OpenInvoice – you can even fund invoices from buyers that you invoice outside of the OpenInvoice network.

This program is enabled by OpenInvoice in partnership with FundThrough, independently of any buyer-run financing programs you may be eligible for. FundThrough will work with you and your individual buyers to get you set up and enable funding.

The first time FundThrough funds one of your customers’ invoice, they will send your buyer’s AP department a document called a Notice of Assignment, you will be copied on that communication. This document instructs the operator to redirect payments to FundThrough until further written notice.

Redirection of invoice payment is common practice for most operators’ A/P departments. Once the redirection of payments is complete, all present and future invoice payments will be made to FundThrough at the time your invoices are due. When FundThrough receives payment on an invoice you did not choose to fund, they will immediately pass the full amount directly to you. This is called a pass through – it happens automatically and there is no cost or fees associated with it.

FundThrough understands different customers have different policies when it comes to payment timing. Receiving payment one or two weeks early or late is not uncommon; however, if the invoice remains unpaid for an extended period of time outside of your customer’s payment terms, FundThrough may ask you to substitute for another invoice of the same value or pay the outstanding balance.

Unlike factoring contracts, FundThrough has no contracts, minimum quota, annual fee, or credit limit that you must follow. FundThrough gives you a self-service experience where you have the power to decide which invoices you want to fund.

Furthermore, FundThrough and OpenInvoice offer a unique product called NetZero, where you receive 95-98% of the invoice value right away, and do not have to worry about how long the invoice is outstanding. Once you fund, there is typically nothing else to do but to use the money to help your business succeed!

FundThrough connects directly to Workbench and OpenInvoice. Made for users of these networks, FundThrough eliminates the need for complex and expensive factoring. It is available right from within your Workbench and OpenInvoice experience, when viewing any eligible Invoice.

Absolutely! You can contact FundThrough’s support teams for any questions at 1 (888) 813-4547 or by email at [email protected].

FAQ for Operators/Buyers

Suppliers will see a “Pay Me Now” button on their approved invoices.

Suppliers can click on the button to learn more about FundThrough and actually fund approved invoices.

Invoices with an Early Pay program in Workbench or OpenInvoice will not have this option available.

Suppliers are in control to choose individual invoices to fund and can revoke the invoice assignment at any time.

Invoice funds are advanced directly to them within 24 hours.

They can revoke invoice assignment at any time (was said in first bullet point of this section).

FundThrough uses the invoice approval status as part of its funding eligibility logic. On occasion, FundThrough may decide to fund invoices before approval, however it is FundThrough’s responsibility to work with suppliers regarding any invoices that are disputed, short-paid or not paid. Buyers are not on the hook for invalid invoices.

Disputed invoices are usually “covered” with another valid invoice (to same Buyer, or another Buyer), or with cash. It is the suppliers’ obligation to respond to issues regarding any invoice they have funded.

We have kept this process simple for both buyers and the suppliers. Because suppliers can choose which invoices to fund, we send them any payments on unfunded invoices directly, immediately, and in their entirety. Buyers always pay to the same account and their process remains unchanged.

If additional visibility is required, please discuss this with your OpenInvoice Account Manager. We are always happy to help and aim to make life as easy as possible.

We include our suppliers on any conversation with you, including as carbon copy (CC) on emails.

All our emails are electronically signed with industry-standard authenticity certificates.

We provide a dedicated verification line for operators to speak with a FundThrough Rep. If you have any concerns whatsoever, do not hesitate to call us directly at 1 (866) 423-0410.

Your supplier has chosen to manage his or her Accounts Receivables (A/R) through FundThrough. With A/R Financing through OpenInvoice-FundThrough, you get visibility into the payment of these invoices and, unlike other options your suppliers could use, we give you access to an audit trail showing that payments have been forwarded to suppliers.

Our recourse is with your supplier if you don’t pay an invoice. Should a situation arise where you have fulfilled your commitment to the supplier by paying FundThrough and the supplier actions on the lien, the supplier’s documentation with FundThrough should cover your liability.

Unlike other A/R Financing options, the FundThrough program is designed to minimize administrative work and disruption to your processes.

The only step involved for buyers is to fill out a “Notice of Assignment” the first time a supplier finances their A/R. When you receive this document you:

1. Update your remit-to details on your Account Payables (A/P) systems (details are included in the letter).

2. Add [email protected] to your Remittance Advice notifications

Once this is done, you continue your A/P processes and make payments as usual.

Note: With typical A/R Financing offers, A/P departments must make payments to different parties on an invoice-by-invoice basis. With FundThrough, operators simply pay FundThrough on ALL invoices. If payment is made on an invoice that the supplier has not funded, FundThrough will pass that payment on to the supplier immediately, in full, and with no fees (“Pass-Through Payment”).

Absolutely! You can contact FundThrough’s dedicated buyer line at 1 (866) 423-0410 or email [email protected] for any questions.