Grow your business with short-term working capital

FundThrough provides Robertson Working Capital clients unlimited access to funds from outstanding receivables to grow and invest in their businesses.

FundThrough is a trusted Robertson Working Capital partner

Robertson Working Capital has partnered with FundThrough to advance millions of dollars to businesses across the U.S. who are waiting for customers to pay invoices.

Use your invoices to access anywhere from $15,000 to $10 million to grow your business

Manage cash flow

Maintain a smooth, predictable cash flow schedule on your terms.

Pay on time

Payroll, expenses, and supplies paid promptly. Watch your suppliers smile.

Expand operations

Hire more employees, upgrade your space, and start orders right away.

Getting started with FundThrough

1. Create a free account

No obligations, just a free and simple sign-up. Connections are secured with 256-bit encryption, just like your bank.

2. Connect your online bank and accounting software

A read-only connection lets us verify your unpaid invoices, evaluate your funding limit, and deposit funds into your account.

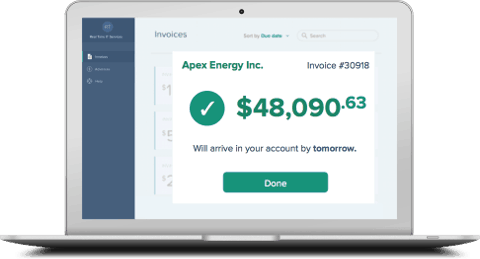

3. Choose which invoices to fund

Fund any number of invoices up to an approved limit – or factor large invoices at a preferred rate with no limit.

4. Celebrate cash flow freedom

We deposit the funds into your bank account within 24-48 hours so you can focus on getting down to business.

Grow your business today

Keeping your on-demand funding account is free forever.

FundThrough solves a problem that keeps entrepreneurs up at night.”

– Mariam, Koa Natural Foods

Frequently Asked Questions

FundThrough is integrated with Quickbooks. If you have a QuickBooks account, we highly recommend connecting your account to FundThrough to pull in eligible invoices and make funding faster and easier. If your accounting software isn’t supported, you can still certainly fund with us by manually uploading invoices.

Users have the ability to fund invoices of any size on FundThrough’s platform. Invoices must be less than 90 days old to be eligible for funding. If you connect your QuickBooks or OpenInvoice account, FundThrough will automatically pull invoices that are eligible for funding onto your dashboard.

Innovation is one of our company values! FundThrough leverages technology to automate the manual processes that many traditional financial institutions still use today.

If you need alternative arrangements to pay an invoice, reach out to our client success team who will work closely with you to find a solution that fits your business.

No. Creating a FundThrough account and advancing invoices will not affect your credit score.

We are obligated to report any bad-faith borrowing or fraudulent activity to the appropriate credit bureau.

Yes. FundThrough uses secure, bank-grade, 256-bit encryption to protect your data. We never see or store third-party usernames or passwords.

Yes, opening and keeping a funding account doesn’t cost a thing. We don’t charge hidden fees and you’re never obligated to advance invoices. Many owners simply enjoy having FundThrough in their back pocket, ready for a rainy day cash flow gap – we fit neatly next to your umbrella.

Please contact your account manager, and they will assist you in cancelling your account.

FundThrough was launched in 2014 and has since shot up to become a leader in the financial technology space, funding more than a billion dollars in invoices. Learn more about FundThrough.

Invoice factoring is a form of financing where a business owner sells invoices to a factoring company for fast access to funds. The business owner receives cash for the invoice amount, usually less fees, ahead of the payment terms. The business owner’s customer, who is responsible for paying the invoice, instead pays the invoice amount to the factoring company according to the original payment terms. Invoice factoring also goes by the terms accounts receivable factoring or receivable financing.

The reason there’s a demand for factoring is because of cash flow issues caused by long business to business (B2B) payment terms. In many industries, it’s not uncommon for standard payment terms to be anywhere from 30 to 120 days. Instead of business owners being paid right after they’ve delivered goods and/or services, they have to wait to receive customer payments. With invoice factoring, you can get quick cash to easily keep your business growing and thriving through, making payroll, buying new equipment, paying your own suppliers, hiring staff, or fulfilling large orders or projects.