Invoice Financing With No Credit Check

Get Invoices paid in Days for Easy Funding

Learn how you can get working capital for your business in the U.S. or Canada, even if you have no credit history, bad credit, or a low credit score.

How Does Invoice Factoring Work?

We understand that as a small business owner and/or CEO, it’s common to face this difficult catch-22: you often need a good business credit score to secure business financing, but you need financing in order to grow your business and build (or rebuild) your business credit. Traditional lenders and financial institutions won’t even consider your traditional bank loan or term loan application without a couple of years’ financials under your belt. This creates a vicious cycle and fewer funding option for businesses. As entrepreneurs ourselves, we’ve been there. Even if you’re just starting out and have no credit, or you currently have bad credit history, invoice factoring can help. That’s because with invoice factoring no credit check is required, making the approval process easier. Invoice financing companies help businesses in all types of industries streamline invoice payments, secure business funding, and solve cash flow issues.

Invoice financing is another name for invoice factoring or receivable financing. Here’s how the general process for invoice financing with no credit check works:

Get approved with a factoring company. Complete the application process and approval steps with your invoice finance company of choice to get started. With FundThrough, this means seeing if you’re qualified by signing up for a free account using our easy online application. (See if you qualify.) Make sure you compare invoice factoring agreements.

Select invoices to fund. Submit the unpaid invoices you want to fund to the factoring company for approval. With the FundThrough platform, you can sync your QuickBooks or OpenInvoice accounting software to pull in eligible invoices (so convenient!) or upload them manually.

Verify invoices and client. As part of the funding process, the factoring company will send an NOA, otherwise known as a Notice of Assignment, to your customer. This is just so your customer is aware they need to redirect payment to the factoring company. The factor will also verify that any eligible invoices are real. At FundThrough, your client’s credit is more important. So even with a bad credit score, you can still qualify. We also treat your customer like our own, since we know how important your relationships are.

Get funded. On approval, funds are deposited to your business bank account as quickly as the next business day (minus any factoring fee). You’ve now got peace of mind that you have the funding you need to cover expenses like payroll or go after a big project that will grow your business. (This is our favorite part!)

You get back to business. The factoring company waits for your customer to pay the invoice according to its original terms, and manages the accounts receivable process, while you get to focus on your business instead of worrying about your access to cash flow. No more stressing over late payments, keeping track of individual invoices, or cash flow gaps.

Do You Need Good Credit for Factoring?

No, you don’t need a good business credit score in order to qualify for factoring. You might even wonder, do factoring companies do credit checks? Not exactly. Factoring companies are more focused on the creditworthiness of your customer, since they need to ensure they can rely on the customer to pay their invoice in full and on time. That means that with when you apply to work with a factoring company, your business can qualify for invoice financing with no credit check. With traditional business lenders, you may be required to have excellent credit in order to secure business funding like a traditional loan or even a business credit card.

Is Invoice Financing Easy to Get?

It depends on the factoring company you work with, but having creditworthy customers goes a long way toward making it easier. In this case, your business credit rating and even your time in business is less important. See if you meet FundThrough’s qualification requirements. Compared to other short-term business financing options for growing SMBs, invoice financing is quite easy to get. Invoice financing is actually a pretty genius way to get working capital without credit for new and growing businesses.

Does Invoice Factoring Create Additional Debt?

That’s just one of the many advantages of using an invoice factoring service — it doesn’t create any additional debt. Invoice factoring companies simply give you an advance or cash upfront for your outstanding invoices for work you’ve already completed. Unlike bank financing, it’s not a traditional business loan or credit product, so you’re not adding debt to your balance sheet when you finance an invoice. It’s also a source of non-dilutive funding, meaning you’re not giving up any equity or control of your company in order to secure funding.

Featured in:

Get Convenient Working Capital. Get Invoices Paid in Days.

Invoice your customer. Get paid in days. Get back to business.

Easy Access to Capital

Get funding anytime without bank hassles or limits by working with FundThrough. We offer unlimited funding, so the more you invoice, the more capital you can access. Take on growth projects, hire essential staff, and make payroll with peace of mind that you have the funding you need at your fingertips.

Fast, Flexible Funding

Skip waiting on net payment terms and get paid quickly, with a secure source of flexible funding. No debt, dilution, hidden fees, or monthly minimums mean you’re in control of your capital, instead of waiting on slow-paying customers.

Simple Funding Process

Integrations with QuickBooks and OpenInvoice combined with AI and automation make it easy to get funded and get back to business. Get a funding boost in one click (after customer setup).

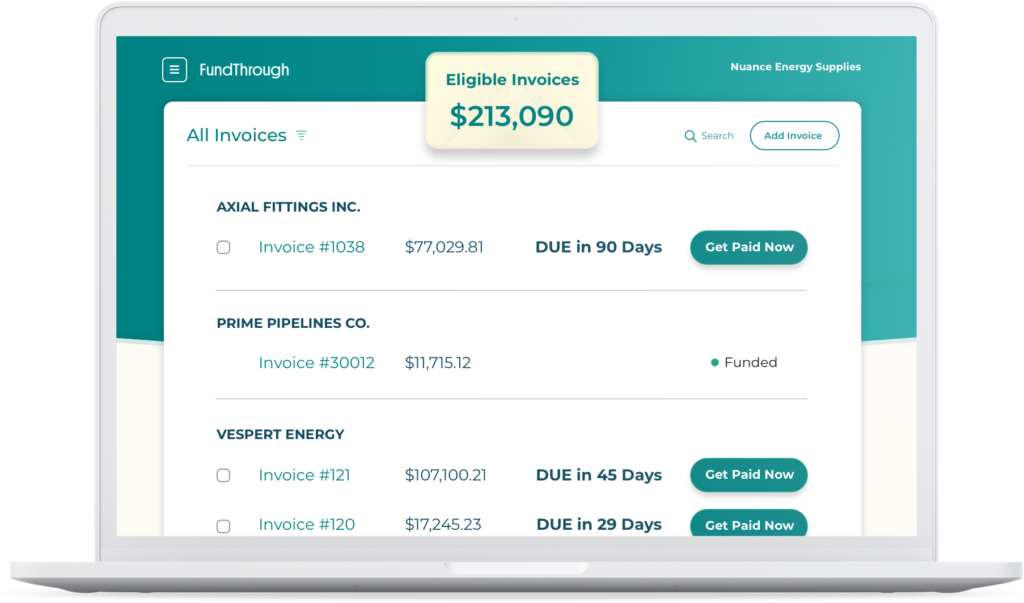

How Online Invoice Financing Works

Create or connect your account in minutes

Create a free account or connect your QuickBooks or OpenInvoice account, and provide information about your business.

Choose which invoices to fund

Submit eligible unpaid invoices to FundThrough. We provide unlimited funding for your business based on the size of your outstanding invoices. Simply select which eligible invoices you want to fund, and submit them in one click (after customer set up).

Advance invoices in days

Select eligible invoices to advance. Deposits are made within days and your customer sends invoice payments to FundThrough according to the agreed upon terms.

Get funded, then get back to business

Upon approval, funds are deposited into your business bank account as quickly as the next business day. Put your capital to work for growth projects, payroll, equipment, hires, and more.

Get Your Business Funded

See if you qualify today. Stop waiting on customer payments. If approved, you can advance funds within days from our online platform.

- No paperwork

- No obligation to fund

- No hidden fees

- No effect on your credit score

Ready to take your business

to the next level?

Invoice factoring services at FundThrough

On-demand working capital for growing businesses.

FundThrough offers businesses instant access to funds from unpaid invoices on an easy-to-use, online funding platform.

Wherever a business is in its growth cycle or just needs some extra capital, FundThrough can help bridge critical cash flow gaps with fast and easy invoice factoring services.

Invoice Factoring Articles from the FundThrough Blog

[2025 Update] Accounts Receivable Factoring vs Financing: Which is Best?

Advancing Your Cash Flow: Should You Opt for Early Invoice Payments from Your Client?

Delayed Dollars: The Impact of Late Payments on Growing Oil & Gas Companies

7 Funding & Business Resources for SMBs Affected by Hurricane Idalia

Seattle Factoring Companies: 3 Best Options

On the Intuit Quickbooks App Store:

"I am pleased to recommend FundThrough for early stage and established small business funding for the type of products and ease of doing business." ~James R.

"I've been looking for this tool for the past few years and stumbled on FundThrough during my participation at QuickBooks Connect. They have a great software." ~Xtiane

"I really like this company, they are 1st class! They have a very nice platform and are at the top of their game! They have fast approvals and will help you along the way..." ~Unified

On Google Reviews:

"FundThrough has been instrumental in helping my company meet its cash flow needs quickly, easily and for low cost." ~Mark B.

"We started using FundThrough in August of 2017. What impressed me the most has been the quick turnaround." ~Ahmed A.

"Overall I have been quite satisfied with FT. I signed up with them about eight months ago and have used the service once. I've also recommended it to other clients." ~Stephanie

Questions about invoice factoring?

Speak with your dedicated account manager on the phone or online.

+1 (800) 766-0460

Toll-free Mon-Fri 9am-5pm ET

Chat online

Use the chat icon below