Debt-free, non-dilutive funding

Grow and manage your business with short-term working capital

FundThrough provides Borrowell clients unlimited access to funds from outstanding receivables to grow and invest in their businesses.

FundThrough is a trusted Borrowell partner

Borrowell has partnered with FundThrough to advance millions of dollars to businesses across the U.S. who are waiting for customers to pay invoices.

Flexible funding without bank obligations

Get Funded Faster Than the Bank

Unlock funds in accounts receivable in days. No need to wait months just to raise a line of credit limit – or get rejected because your business is too new.

Control Your Growth with Flexible Funding

Get an easy working capital boost anytime without any funding obligations. Take on any growth project with unlimited funding available.

Easy Experience with Technology

AI, automation, and QuickBooks integration make your funding experience easy, so you can get back to business.

Getting started with FundThrough

1. Create or connect your account in minutes

Create a free account or connect your QuickBooks or OpenInvoice account, and provide information about your business.

2. Choose invoices to fund

Upload invoices into FundThrough or pull in eligible invoices from QuickBooks or OpenInvoice. Select which invoices you want to fund, and submit them in one click (after customer set up).

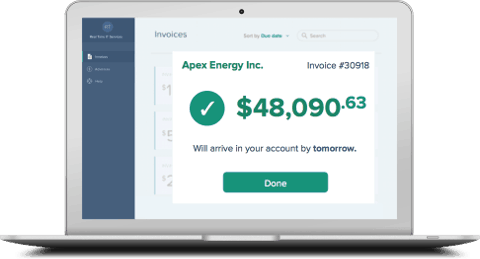

3. Get Funded

Upon approval, funds are deposited into your business bank account as soon as the next business day. Put your capital to work for growth projects, payroll, equipment, hires, and more.

Control your growth with flexible funding

Get fast, flexible funding anytime. No hidden fees, funding obligations, or limits.

"FundThrough solves a problem that keeps entrepreneurs up at night."

– Mariam, Koa Natural Foods

Frequently Asked Questions

FundThrough is integrated with Quickbooks. If you have a QuickBooks account, we highly recommend connecting your account to FundThrough to pull in eligible invoices and make funding faster and easier. If your accounting software isn’t supported, you can still certainly fund with us by manually uploading invoices.

Users have the ability to fund invoices of any size on FundThrough’s platform. Invoices must be less than 90 days old to be eligible for funding. If you connect your QuickBooks or OpenInvoice account, FundThrough will automatically pull invoices that are eligible for funding onto your dashboard.

Innovation is one of our company values! FundThrough leverages technology to automate the manual processes that many traditional financial institutions still use today.

If you need alternative arrangements to pay an invoice, reach out to our client success team who will work closely with you to find a solution that fits your business.

No. Creating a FundThrough account and advancing invoices will not affect your credit score.

We are obligated to report any bad-faith borrowing or fraudulent activity to the appropriate credit bureau.

Yes. FundThrough uses secure, bank-grade, 256-bit encryption to protect your data. We never see or store third-party usernames or passwords.

Yes, opening and keeping a funding account doesn’t cost a thing. We don’t charge hidden fees and you’re never obligated to advance invoices. Many owners simply enjoy having FundThrough in their back pocket, ready for a rainy day cash flow gap – we fit neatly next to your umbrella.

Please contact your account manager, and they will assist you in cancelling your account.

FundThrough was launched in 2014 and has since shot up to become a leader in the financial technology space, funding more than a billion dollars in invoices. Learn more about FundThrough.

Invoice factoring is a form of financing where a business owner sells invoices to a factoring company for fast access to funds. The business owner receives cash for the invoice amount, usually less fees, ahead of the payment terms. The business owner’s customer, who is responsible for paying the invoice, instead pays the invoice amount to the factoring company according to the original payment terms. Invoice factoring also goes by the terms accounts receivable factoring or receivable financing.

The reason there’s a demand for factoring is because of cash flow issues caused by long business to business (B2B) payment terms. In many industries, it’s not uncommon for standard payment terms to be anywhere from 30 to 120 days. Instead of business owners being paid right after they’ve delivered goods and/or services, they have to wait to receive customer payments. With invoice factoring, you can get quick cash to easily keep your business growing and thriving through, making payroll, buying new equipment, paying your own suppliers, hiring staff, or fulfilling large orders or projects.