Newsroom

FundThrough launches integration with FreshBooks, brings one click invoice funding to freelancers and business owners across Canada

Our integration with FreshBooks is here and we couldn’t be more excited!

Small businesses are born out of passion and the desire to do something you love. It also means getting paid! But if your business relies on invoicing to get paid then you’re often waiting 30, 60 or maybe even 90 days to get paid. For any business owner looking to make a go of it that’s a long time to wait. For a business looking to grow, it also puts a massive wrench in their cash flow machine.

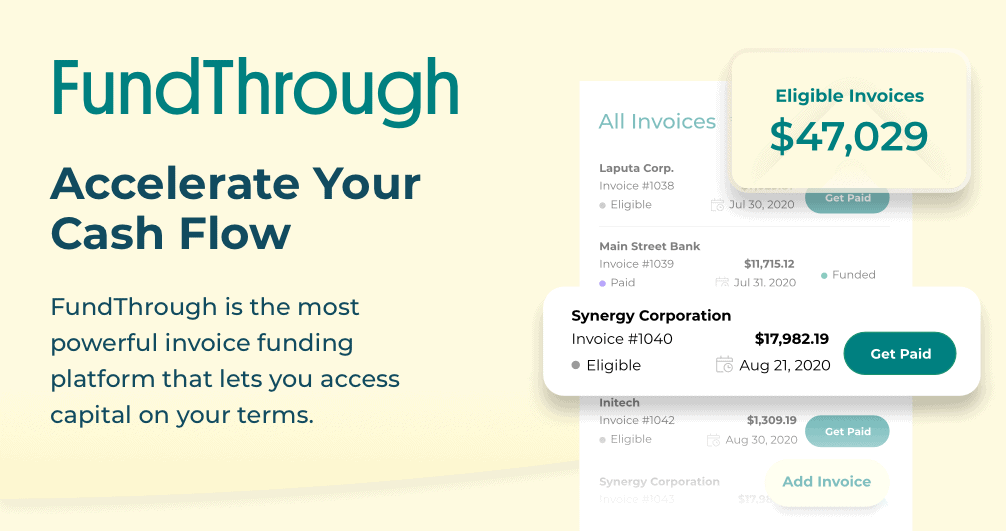

What most business owners don’t realize is that they don’t have to wait. At FundThrough, we see unpaid invoices as an asset and we can advance you those funds with one click knowing that the invoice payment will eventually arrive. Your customer still pays when they normally do, you get the funds right away, your customer doesn’t even know, and we make a small fee. Everybody wins!

In June of this year we launched our new FundThrough Express service in response to high demand from business owners that were looking to fund anywhere from $500 in invoices up to $250,000. They were tech savvy and they wanted something that worked like real software. That meant easy, fast, and fully automated. FundThrough Express was born!

Our initial integration with QuickBooks Online has already been a smashing success which is why we are excited to now integrate with Canada’s own FreshBooks (it also doesn’t hurt that their office is just down the street!).

With FundThrough Express, FreshBooks users can view all of their unpaid invoices and, with one click, get them paid in full with the funds going directly into their bank account. Repayment is done automatically and over 12 weeks of equal repayments. Users are free to repay the full balance at any time and save on all the remaining fees. It really puts the business owner in full control of when they get their payments and how they pay back.

In addition to being ridiculously easy to use, our Express customers are telling us that FundThrough has been the only option they have found that allows them to invest in their growth faster without taking on debt and that works in a way that makes total sense for them. They know they are going to get paid eventually, but having those funds now makes a huge difference in how they are able to run and grow their business.

To that we say touché!

Put FundThrough to work for your business

We help small business owners navigate cash flow hurdles every day. Sign up in just 3 minutes and receive a credit limit approval within a business day.