Grow My Business

Working Capital Management

How Alt-Finance Companies are Disrupting the Financial Space in Canada

Occasionally, a product so unique and revolutionary comes along that it disrupts an entire industry, forever changing the way we work, play or live. Think of the iPhone, robotic appliances, or the Internet of Things and connected appliances. Far more often though, the greatest innovations aren’t about reinventing the wheel. They’re about finding new ways to solve persistent, troublesome problems.

This is the innovation of alt finance, an alternative to the traditional business financing models that have proven incapable of keeping pace with the needs of modern day startups. You’ve probably heard plenty of buzz about alt finance and fintech, the financial technology that often supports its more flexible, agile services. But what does it mean for entrepreneurs, and how can you put alternative finance to work for you?

Let’s take a look at the different ways alt finance and fintech are disrupting the way we do business in Canada:

1. Fintech Solutions Are Built To Serve Specific Niches

Financial technology supports all types of applications, each built to serve the needs of a different niche. Typically, the purpose of each fintech-powered product or service is to solve a specific problem for entrepreneurs.

For example, through invoice factoring and the fintech that enables it, we are solving cash flow issues for startups and small businesses. These companies often weren’t able to access funding to solve cash flow in any other way, unless they were willing to give up some control of their business or pay high interest rates to banks (if they could even get approved for a loan).

Invoice factoring helps small business better manage their cash flow by freeing up capital for payroll, expanding inventory, making capital purchases and more.

Another example is Zensurance, which tailors commercial insurance policies to specific business needs via an online portal. Mobile POS system TouchBistro is another fintech solution you might be familiar with as a customer–have you seen servers taking orders on tablets right at the table?

In each case, these solutions are disrupting industries and processes that hadn’t changed in decades, by solving age-old problems with new technology applications.

2. Alternative Financing Options are Proving More Cost Effective for SMBs

Business systems like payroll and payment processing are critical to the success of your business, but were traditionally cost-prohibitive for small businesses. Automating meant buying into enterprise software, employing people who knew how to install and maintain it, and training staff to use it. Today, alt finance powered by fintech is making it possible to effectively replace slow, bloated systems without that large overhead inherent to organizational change.

Solutions like Collage.co and WagePoint.com, for example, have revolutionized payroll and benefits for small businesses. Finally, you can buy only what you need, and it’s all managed within a simple, intuitive dashboard. For mobile payments, you can look to a fintech solution like Dream Payments, which enables you to accept the same payment methods as large retailers, without the contract or monthly fees. Wave Accounting even offers a free plan for SMBs.

Don’t be turned away by the concept of custom or enterprise pricing, either. Find a plan that fits you.

3. Alt Financing Provides Alternatives to the Covenants of Banks

There’s a widely held misconception that alt finance is for entrepreneurs and companies that weren’t ‘good enough’ to get financing through the bank. In fact, alt finance companies allow for highly customized, more flexible financing solutions than the banks are willing or able to provide.

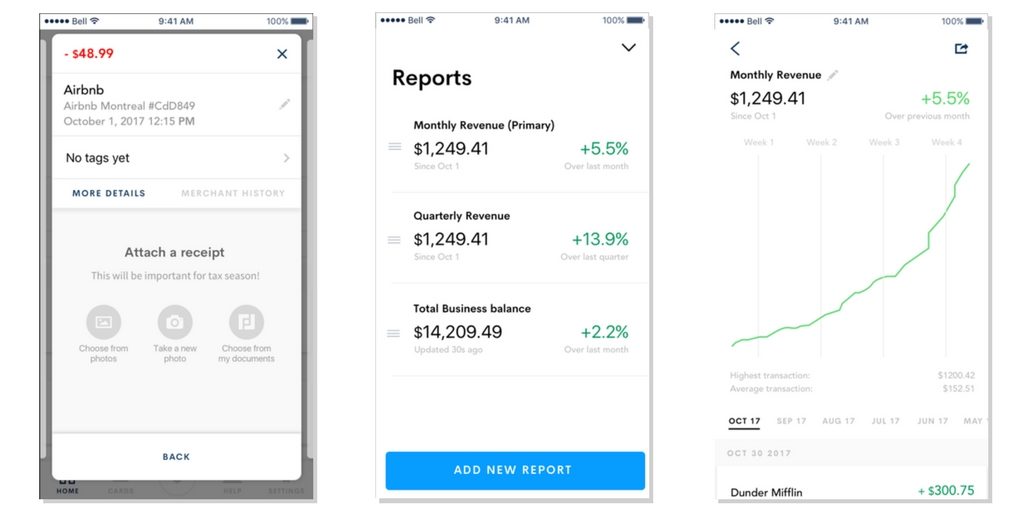

NorthOne.io is an alternative financing solution that incorporates banking with the financial reports small businesses need most. Images: NorthOne.io

Take NorthOne.io, for example; it’s a mobile banking solution built specifically for SMBs. It integrates with popular business software, offers transparent pricing, and works within a universal platform you can access from all your devices. Here at FundThrough, we offer invoice factoring so you don’t have to go through a lengthy credit approval process; your funding is based on the work you’ve already done and invoiced for.

The truth is, traditional big banks just aren’t agile enough to keep up with SMBs in the age of constant connectivity. Alt financing and fintech are powering better solutions, pricing and service to entrepreneurs and startups who need time to focus on their business instead of jumping through hoops for banks.

4. Alt Finance Leverages Technology to Reduce Paperwork

The days of showing up on your accountant’s doorstep with a shoebox full of receipts are (thankfully) long over. Online finance management saves you time and money, while doing good for the environment by dramatically reducing the volume of paperwork you have to manage.

Now, you can use a solution like HelloSign to send contracts back and forth, securing legally binding approvals without a single piece of paper being produced. You can use a tool like SmoothCommerce.tech to deepen your connection with your customers via mobile payments, pre-orders, loyalty rewards, offers and more, all within a single app. And solutions like HubDoc securely store all of your financials in one place and convert it into usable data, so you can kiss repetitive, redundant data entry goodbye.

5. Finally, Sales as a Marker of Credit-Worthiness (Rather Than Your Credit Score)

Banks and many other types of investors want to see a long-standing personal and/or credit history before they’ll even consider financing your business. Lacking this lengthy track record, entrepreneurs and startups are turning to alt finance solutions that are willing to look deeper into their company’s potential.

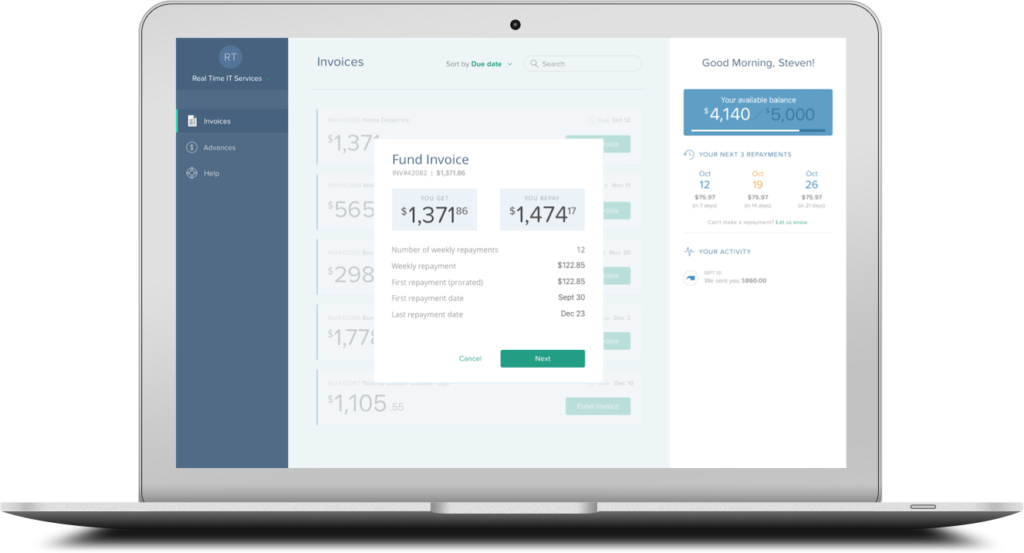

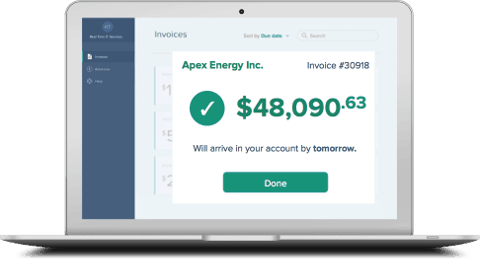

Alt finance companies might look at your online presence, sales records, the size of average invoice, payors’ credit history and more in evaluating your application. They aren’t only looking at your ability to pay back a loan, as banks are; they’re looking at your ability to grow, scale and succeed. At FundThrough, for example, you complete a simple online application and connect to your invoicing app. In less than 24 hours, we let you know how much funding you qualify for and deposit it straight to your account. Repayment terms are transparent and manageable, and your pre-approved financing amount goes up on regular review as the amount of business you’re invoicing grows.

“FundThrough was able to help when my bank couldn’t because they looked at the credit of my customers, not my business. I’ve been able to increase my inventory, maintain service levels, and not worry about cash flow. It’s really been a great service.”

Steven Jiang, Owner – ImSent Inc.

You can’t afford to spend a few years plodding away, trying to build credit. And you don’t want to give up control or ownership of your business to VCs. So why would you?

6. Fintech Can Help You Grow Your Global Business

The benefits of fintech go far beyond our country’s borders. Expand your business in new markets with tools like Plooto.com, which both manages receivables and payables, and enables you to accept international transfers.

You can also use a service like Curexe for foreign exchange, which eliminates wire transfer fees and reduces the exchange rate on currency conversions. Your funds are still secured through the Canada Deposit Insurance Corporation, but now cross-border payments are a snap.

7. Alt Finance Companies Provide Non-Dilutive Capital

If you’ve been trying to secure funding to help grow your small business, you’ve probably already wrestled with the benefits and drawbacks of equity financing. VCs and angel investors might be more willing than banks to take a chance on you, but they typically expect a share in ownership, in exchange.

Alt finance companies don’t require that you give up control or ownership of your business. And where these solutions are powered by fintech, accessing the funds you need to grow your business is simple and fast. With invoice factoring, you can extend credit terms to your clients and still use the money you’ve earned to make payroll, buy inventory, and expand your business. You don’t need to wait 30-45 days for your customers to pay before you can put that money to work for you.

Your business is innovative and progressive. Why shouldn’t your financing keep pace? Fintech-powered alternative financing solutions can help automate your funding, uncover new financing opportunities, and allow you to focus on doing what you do best: running your business.

Want to learn more?