QuickBooks Cash Flow Planner & Forecast: A Guide to Your Cash Flow

It doesn’t take much time running any type of business to figure out the importance of cash flow for your company’s financial health. Even if

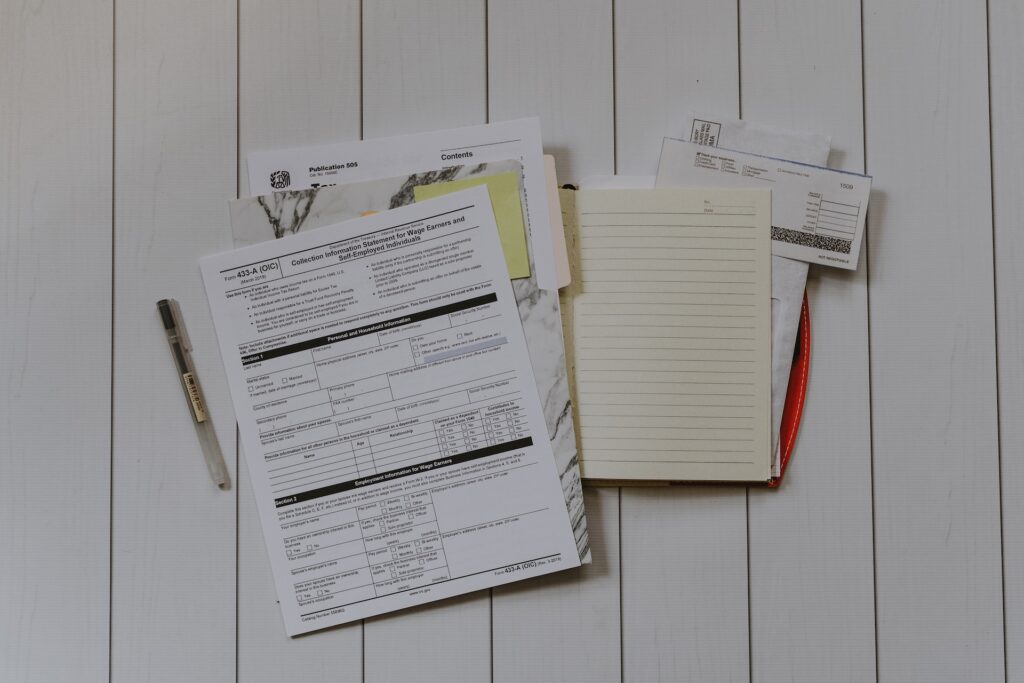

No matter what form of funding you seek for your small business, you’ll likely need to provide tax information to secure the money. But just why do factoring companies ask for tax documents?

While a request for tax information might be concerning at first, rest assured that it is simply a common practice across the financial sector. Although it’s true that invoice factoring doesn’t rely heavily on a business’ credit history, funding companies will still ask for certain tax documents. Financial companies ask for tax documents for a few reasons, including to verify the financial health of your business, among others.

We break down why your tax history matters, why factoring companies ask for tax documents, and what else to expect throughout the application process. We’ll also explain why invoice funding can be an intelligent solution to addressing any outstanding tax payments you may owe to the government.

Typically, when a financial institution is considering a loan to a small business, tax documents are critical to its decision. After all, tax returns offer a glimpse into the small business’ financial health, verify previous income, and show that you have fulfilled your obligations in both filing and payment. A small business funding company may want to see IRS Form 941 (for U.S.-based companies) or CFA Form T1013 (for Canada-based companies), and examine your most recent quarterly payments.

These documents will also tell a financial institution or funding provider if you have any outstanding balance with the government.

An invoice funding company is interested in whether a business has an outstanding balance with a government entity. After all, a government has the right to levy your assets. An existing payment owed to the agency will supersede any contract that you might reach with an invoice factoring company.

If you have not paid your outstanding tax bill, a tax agency can place a lien on your assets. A lien is a security interest over assets that are used as collateral for funding. This lien would make it possible for the government to collect your accounts receivable, ahead of any other creditor.

If a tax agency places a lien on your outstanding invoices, this would make a small business unable to fund invoices with a factoring company because payment for those invoices is already promised to the government.

Additionally, if a business has tax liens, it may also have other liens against its assets. These liens can prevent a business from using their assets as collateral. In this case, a factoring company may be hesitant to provide financing in the event they cannot ensure repayment.

Having access to your tax documents provides insight into the health of your business and ability to repay any financing.

Invoice funding companies will ask you for a Tax Information Authorization (typically Form 8821 in the United States or Form T1013 in Canada), which gives permission to request your tax history.

With this authorization, a factoring company or other lender will have access to your business’ tax history. They’ll be able to see previous income, as well as your payment history. This helps them to be able to make a determination on the health of your business, and whether you are a good candidate for financing.

A lender will also want to know if you have an outstanding tax balance, as the government will have first position when it comes to debt repayment. The government can also levy your assets, or place a lien on your account, which would affect any other repayments to other lenders such as a factoring company.

Your business’ tax history is just one part of the credit evaluation process when you’re looking to work with a factoring company. Other aspects of your business finances will also be reviewed. You may still be able to work with an invoice funding company even in some situations where you have tax liens.

If your business has tax problems, you likely also have cash flow problems. Even if you’ve missed your tax payments, some invoice funding companies may still be able to assist your business.

At FundThrough, we’ll often work with businesses to clear off any outstanding tax balance, or come up with a payment plan to fit your needs. This allows us to still be able to fund your invoices, while providing you the ability to fulfil your tax obligations.

Yes! Your tax and other financial information is secure with FundThrough. We use secure, bank-grade, 256-bit encryption to protect your data. Additionally, we never see or store third-party usernames or passwords. Anyone we partner with must also follow the same high level of security and privacy.

Consider FundThrough a resource when it comes to your tax obligations and payments. We can discuss issues related to how the IRS or Canada Revenue Agency might impact your funding sources. We can also help you come up with a repayment plan to help take care of any outstanding tax balance you may have with the IRS or CRA. (We work with the IRS and CRA to help businesses sort out their payments all the time!)

FundThrough’s invoice factoring services can also allow you to stay ahead of your taxes by advancing against your account receivables, which can help you avoid hefty fines and other penalties from tax agencies.

If you’re interested in learning more about invoice factoring, our Complete Guide to Invoice Factoring is chock full of information, and contains answers to 45+ questions you might have about invoice factoring.

If you’re ready to get started with invoice factoring in Canada and the United States, FundThrough can help. See if you qualify for our invoice funding solution.

It doesn’t take much time running any type of business to figure out the importance of cash flow for your company’s financial health. Even if

Self Care Catalysts (SCC), a Canadian health-tech firm, has developed a leading platform to gain a holistic view of the patient’s health journey to enable

Franchiser of Must Boutique Stores Gives FundThrough Two Perfect Reviews for Invoice Funding Solutions. Many small business owners have similar memories after the economy’s first

TORONTO – FundThrough, North America’s leading invoice funding solution for small businesses, has announced it will provide $10 million in free funding for clients as

With parts of the North American economy reopening, you might be eager to rebuild your business and get back to work. It’s important, however, to

FundThrough is an alternative finance company that specializes in invoice funding for small businesses across the United States and Canada. We have a large number

Interested in possibly embedding FundThrough in your platform? Let’s connect!