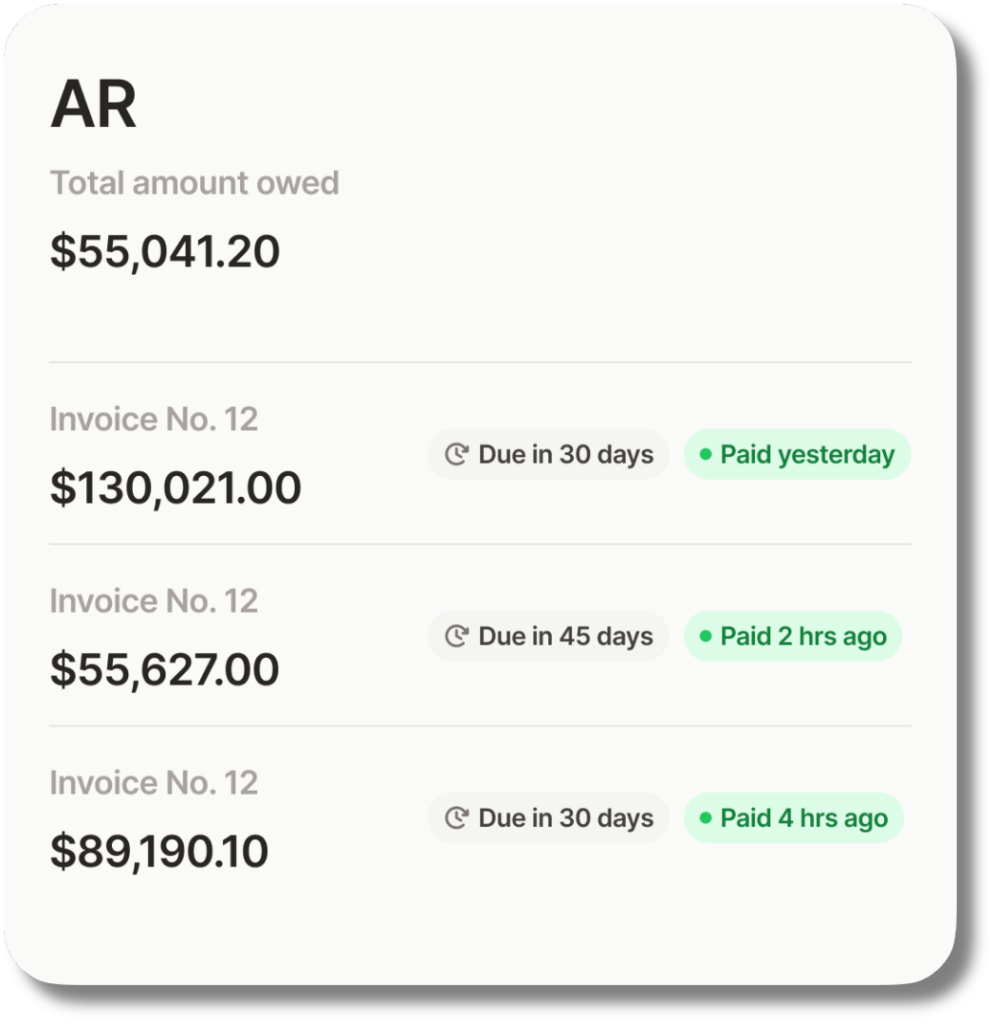

Get Your Invoices Paid Early

Unlock fast, flexible funding for growth and everyday expenses with account receivable financing and factoring

- Get funding as you need it

- No hidden fees, no funding limits

- QuickBooks integration available

4.6 stars on Google

Best Overall Factoring Company

Named By Forbes Advisor

97%

Reduction in wait to get paid*

*per FundThrough customer data

Billions

Of dollars advanced to SMBs

The Most Flexible

Accounts Receivable Financing You’ll Find

Capital on demand

Choose invoices to get paid early as a source of fast funding anytime.

Grow without limits

Get as much funding as you have in eligible invoices for one flat fee–no hidden fees.

Easy experience

Our simple platform and dedicated support make early payments easy.

“FundThrough helped me manage cash flow for my deals, which was crucial. I was able to bring in more deals and buy more product from my suppliers”

– Jermaine Kelly, Founder, Run Veggie

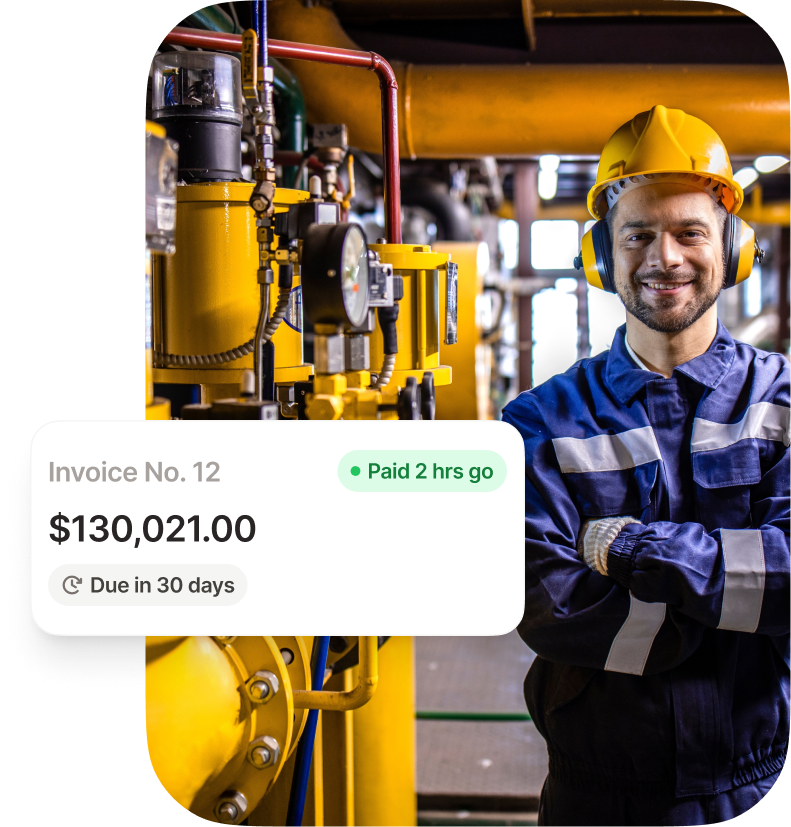

“With FundThrough, we land bigger projects without having the stress about making money for payroll right away. If [the pipeline project] is two miles or 50 miles long, we have money to start that project.”

– Anna Garcia, Co-Owner, Global Pipeline

“Banks couldn’t keep pace with the rapid decision- making needed in our industry...Banks were slow to respond to our requests, and it just felt like they weren’t really ready to fund a small, quickly growing business because they support so many large corporations”

– Lauralee Sheehan, Founder & Chief Creative Officer, Digital 55

How It Works

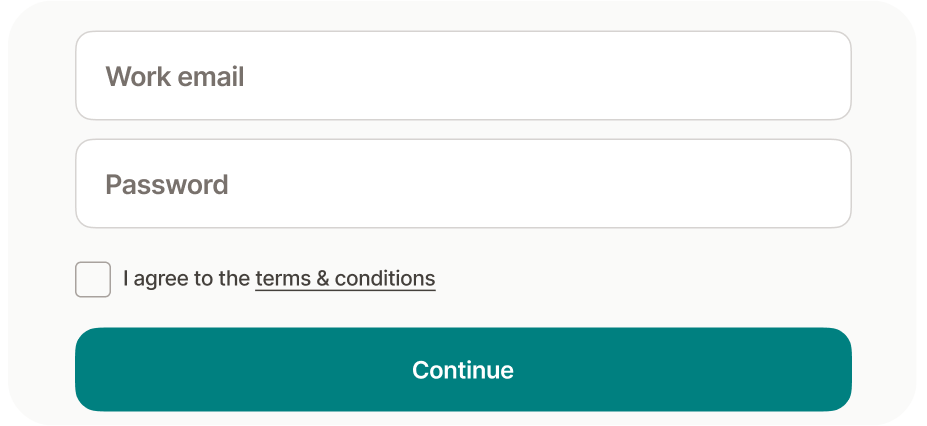

Create your account or sync your QuickBooks to automatically pull in eligible invoices and business information. We’ll make a quick qualification decision and a customized funding offer.

Pick which invoices you want paid quickly. We’ll verify the invoice and your customer to give you peace of mind about your payments.

You’ll see payment in your linked bank account the day after invoice approval. We’ll handle your accounts receivable and inform you when your customer pays their invoice.

How we work with your customers

Your customer relationships are critical to your success. That’s why our team treats them professionally and minimizes their role in the funding process.

Your customer will verify that they’ve accepted your invoices and send all future payments to FundThrough. We’ll send any future invoice payments you don’t fund to you as we receive them.

Why Accounts Receivable Financing with FundThrough?

Here’s what sets us apart compared to other accounts receivable financing companies:

No Hidden Fees

Keep your costs predictable with one flat fee for your accounts receivable factoring. We believe in transparent pricing, so you can focus on growing your business without unexpected charges.

100% Advance Rates

Get more of your invoice value upfront, providing you with the capital you need, when you need it.

Unlimited Funding Potential

Scale your financing in tandem with your business growth. With FundThrough, there’s no cap on funding, offering you unlimited potential to support your business’s expansion.

No Paperwork Hassle

Our streamlined, technology-powered process ensures you get the funding you need without getting bogged down in AR funding paperwork.

No Obligation to Fund

Enjoy the freedom to choose when and how much you fund. With FundThrough, you’re in control, free from the pressure of a minimum funding volume.

Speed and Ease

Access funds faster and more easily than through traditional banking channels. Our efficient process minimizes wait times, getting you the funding you need without delay.

Unmatched Flexibility

Our services are designed to adapt to your unique business needs. Whether it’s funding U.S. or Canadian invoices or adjusting to your financial requirements, we offer the flexibility you need to thrive.

Personalized Service

Experience service that goes beyond transactions. Our team is committed to understanding your business and providing personalized support, ensuring solutions that truly fit.

Advanced Technology Platform

Leverage the power of our tech-driven platform for a seamless funding experience. From application to funding, our intuitive platform makes managing your AR factoring easy.

FAQs

Accounts receivable financing, also known as invoice financing or factoring, receivable financing solution, or sale of receivables, is a financial arrangement in which a company uses its outstanding customer invoices as collateral to receive immediate cash from a financial institution or a receivable financing company. Unlike business loans or lines of credit, this type of financing doesn’t create debt and is non-dilutive, making it an excellent short-term funding method for businesses across a variety of industries that need cash on their balance sheet.

In this financing method, the company typically sells its accounts receivable to a third party at a discount for a quick cash flow boost. The factor advances a percentage of the invoice value to the company upfront, providing immediate working capital. The factor then collects the full payments from customers and pays the remaining balance, minus a fee or discount, to the company who financed the invoice(s).

Accounts receivable financing can provide several benefits to businesses, such as improving cash flow, enabling faster access to cash, reducing the risks associated with customer non-payment, and allowing the company to focus on core operations instead of chasing unpaid invoices. However, it’s important to carefully consider the costs and terms associated with this receivable financing option, as the factoring fees and discount rates can vary depending on factors such as the creditworthiness of the customers and the volume of invoices being financed.

Accounts receivable financing a.k.a., receivable factoring, works through the following steps:

1. Application: The company seeking financing submits a receivable financing application to a financial institution or a factoring company. The application typically includes information about the company, its customers, and the outstanding invoices.

2. Due diligence: The receivable financing provider conducts due diligence on the company’s financial health, creditworthiness of its customers, and the outstanding receivables themselves in order to come to a financing decision. This process may involve reviewing financial statements, credit reports, and verifying the validity of the invoices.

3. Agreement: If approved, the company and the financing provider enter into a receivable financing agreement that outlines the terms and conditions of the financing arrangement. This agreement may include details such as the advance rate (the percentage of the invoice value provided upfront), the financing fee or discount rate charged by the financing provider, and any recourse or non-recourse provisions.

4. Invoice submission: The company submits its eligible invoices to the financing provider. Eligible invoices are typically those that are not past due, not disputed, and do not involve other collateral arrangements. (But not always. If you’re not sure if your invoices qualify, check with us.)

5. Funding: Once the financing provider verifies the invoices and the associated customer creditworthiness, it provides a cash advance for a percentage of the invoice value in days. This upfront funding provides immediate cash flow to the company.

6. Collection process: The financing provider takes over the responsibility of collecting the full payment from the customers. The customers redirect the payment to the financing provider or a designated account.

7. Payment settlement: After collecting the payment, the financing provider deducts its fees or discount rate, along with any other agreed-upon charges, and remits the remaining balance to the company. The payment settlement may occur in one or multiple installments, depending on the terms of the agreement.

8. Ongoing process: The company continues to sell goods or services to its customers and generate new accounts receivable. It can choose to finance all or a portion of the new invoices, depending on its cash flow needs and the terms of the receivable financing agreement, enjoying more predictable cash flow.

It’s important to note that the specific details and procedures of accounts receivable financing can vary depending on the financing provider and the agreement terms.

An example of receivables financing can help you understand how the process works more easily. Let’s consider the following example to illustrate how accounts receivable financing works:

Suppose ABC Manufacturing is a company that produces and sells electronic goods to various retailers. ABC Manufacturing has several outstanding invoices totalling $100,000 from its customers, with payment terms of 30 days. However, ABC Manufacturing is in need of immediate cash flow to cover operational expenses and invest in new equipment.

ABC Manufacturing approaches an invoice factoring company, XYZ Financing, for accounts receivable financing. After conducting due diligence on ABC Manufacturing’s financials and the creditworthiness of its customers, XYZ Financing agrees to provide financing at an advance rate of 80% and charges a discount rate of 5% on the face value of the invoices.

ABC Manufacturing submits an eligible invoice valued at $100,000 to XYZ Financing. Upon verification, XYZ Financing advances 80% of the invoice value upfront, which amounts to $80,000. This immediate funding provides ABC Manufacturing with the necessary cash flow to meet its financial obligations.

XYZ Financing takes over the responsibility of collecting the payment from ABC Manufacturing’s customer. Once the customer makes the payment, XYZ Financing deducts its invoice factoring fee of 5% ($5,000) and remits the remaining balance ($15,000) to ABC Manufacturing.

ABC Manufacturing continues to sell goods to its customers and generates new invoices. It can choose to finance all or a portion of the new invoices, depending on its cash flow requirements. The process of submitting invoices, receiving funding, and collecting payments continues as per the payment terms agreed upon in the financing agreement.

Borrowing against receivables in this way allows ABC Manufacturing to access immediate cash flow by converting its outstanding invoices into upfront funding. It helps the company meet its financial needs without waiting for customers to pay their invoices within the 30-day payment term.

Accounts receivable financing offers a straightforward way to enhance cash flow, providing a flexible alternative to traditional bank loans for businesses in urgent need of capital. This approach allows companies to immediately tap into the value of outstanding invoices, ensuring timely access to working capital for critical needs like payroll, all while ensuring no impact on your credit score. When it comes to approval, the focus here is on the creditworthiness of your customers rather than your own business, which typically leads to higher approval rates and avoids the long wait times and strict requirements of traditional loans or asset-based lending.

Yet, this financial strategy comes with its own set of considerations. The cost of factoring, for instance, can include various fees that reduce the overall value received from your invoices. It’s essential to have a clear grasp of the terms of your agreement to effectively manage your financial planning. Moreover, choosing this financing route means you’ll have to give up control over the collection of your invoices. This shift is significant for businesses that value direct interaction with their customers or are concerned about the impact of third-party collection efforts on their customer relationships. Check out this guide for an in-depth explanation.

Typical accounts receivable (AR) financing rates often range between 1% and 6%, primarily determined by the transaction fee or discount rate, which is the percentage retained by the financing company as their fee for advancing cash on your behalf. However, it’s crucial to consider more than just the base rate when evaluating AR financing offers. Transparency in pricing is essential, as additional fees can significantly impact the total cost. Flexible contract terms can also offer significant benefits, allowing for more control over your cash flow without being tied to long-term commitments or unnecessary costs. To find the best factoring rates for your business, have a look at our updated blog.

When selecting the best accounts receivable financing company in Canada or the US, prioritize funding limits to match your cash flow needs, look at advance rates to ensure sufficient upfront capital, and understand all associated fees to avoid surprises. Flexibility in contract terms and the ability to select specific invoices for financing can give you crucial control over your how much you pay for AR financing. Also, consider the company’s industry experience and how they use technology to ensure a smooth process. FundThrough is known for its 100% advance rates, no funding limits, and a simple, no-hidden-fee pricing structure, supported by an AI-powered accounts receivable financing platform that integrates seamlessly with major accounting software, making it a strong contender for businesses seeking reliable and adaptable financing solutions.

The key difference between accounts receivable financing and accounts receivable factoring lies in the involvement of your customers and the handling of payments. In accounts receivable financing, you receive an advance on your invoices but remain responsible for collecting payments from your customers and repaying the financing company yourself according to a set schedule, much like a loan. This method keeps the financing arrangement discreet from your customers. On the other hand, accounts receivable factoring involves selling your outstanding invoices to a factoring company, which then advances you a percentage of the invoice value. The factoring company takes on the role of collecting payments directly from your customers, relieving you of that task while improving your cash flow. Factoring can offer higher capital limits and removes the burden of payment collection, but it makes your customers aware of the third-party involvement, which can influence your business relationships. Working with a professional factoring company who is transparent about how they work with your customers can ensure those relationships stay strong.

Questions About Accounts Receivable Financing?

Speak with your dedicated account manager on the phone or online.

+1 (800) 766-0460

Toll-free Mon-Fri 9am-5pm ET

Chat online

Use the chat icon below