Newsroom

Amplifying Funding Speed & Ease for All SMBs: Accounting Connections Expanded with QuickBooks Desktop and NetSuite

By FundThrough

We’re on a mission to make invoice factoring as fast and effortless as possible for small and mid-sized businesses. How? By enabling you to connect with any accounting platform. That’s why we’re excited to announce two major additions to our integration lineup: QuickBooks Desktop and NetSuite.

Now, even more businesses can now enjoy a seamless funding experience that comes from connecting their accounting systems directly to FundThrough. Read on to discover why it’s worth considering an accounting connection if you don’t have one and how to get started.

How Accounting Connections Maximize Speed and Minimize Effort

Connecting your accounting platform to FundThrough gives you the best of both worlds: you get cash flow in your bank account sooner while spending less time on the funding process and ongoing account management. You’ll experience the improvements to the workflow for yourself through:

- Eliminated duplicate invoice data entry in your accounting software and your FundThrough account (i.e., manual invoice uploads).

- Fewer errors and reconciliation headaches.

- Quicker funding as a result of starting the approval process right away.

- Fast-tracked review and fewer documents to provide, for new clients.

- No time spent preparing and providing ongoing financials to your account manager.

In short: accounting integrations increase the speed and ease of tech-enabled invoice factoring. Spend less time on getting funded and more time putting your funding to work through four popular integrations (and counting!)

FundThrough Integrates with Major Accounting Platforms

You can currently connect your FundThrough account to:

- QuickBooks Online (Canada and the U.S.)

- Sage ⏳

- Xero

- QuickBooks Desktop (New)

- NetSuite (New)

What’s New: QuickBooks Desktop & NetSuite

Thousands of SMBs rely on QuickBooks Desktop and NetSuite for day-to-day accounting. Now, you can connect it directly to FundThrough and:

- Sync eligible invoices instantly

- Submit them for funding in one click

- Keep financials up-to-date

- eSkip submitting ongoing financials

How to Connect

Getting started is simple:

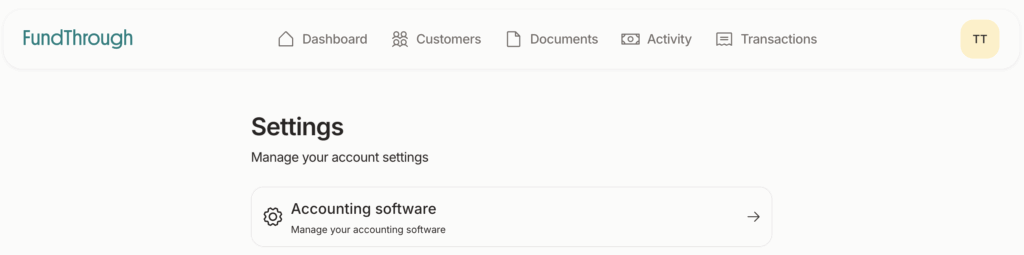

1. Log in to your FundThrough account.

2. Select your initials in the upper right corner and select “Settings”

3. Click “Accounting software” on the next screen.

4. Select QuickBooks Desktop or NetSuite from the list of supported platforms, and follow the prompts to connect your account.

5. Once connected, eligible invoices will appear automatically for funding.

What This Means for You

These new integrations are part of a larger effort: building out a network of accounting connections that empower small and mid-sized businesses everywhere to take control of their cash flow.

Whether you’re using QuickBooks, NetSuite, or another system we’re working to support, our goal is the same: to get you paid faster, with less friction, and more flexibility. Because when you spend less time on getting paid early, you can spend more time growing your business.

Ready to Get Started?

Connect your QuickBooks Desktop or NetSuite account today. You can also contact client support or your account manager with any questions.