Invoice Factoring

Advancing Your Cash Flow: Should You Opt for Early Invoice Payments from Your Client?

By FundThrough

For small and medium-sized businesses (SMBs), maintaining a healthy cash flow is often one of the most challenging aspects of running a company. Because many of us at FundThrough have been entrepreneurs before, we understand firsthand what it’s like to struggle with unpaid invoices. Late payments or even standard-length payment terms can have serious impacts on small businesses. They can tie up working capital, affecting your ability to manage day-to-day operations, invest in growth, or even cover basic expenses like payroll. The solution seems straightforward—get paid sooner. But how? While many businesses are increasingly opting for early payment discounts, it’s crucial to fully understand the pros and cons of this method before deciding it’s the right approach for your business. This article explores two primary methods: early payment discounts and invoice funding, helping you decide which option might suit your business best.

What are early invoice payments and how do they work?

Early invoice payments, also known as prompt payment discounts, involve offering your customers a discount to incentivize them to pay their invoices ahead of the agreed-upon terms. For instance, you might offer a 2% discount if the invoice is paid within 10 days, rather than the standard 30 days. This method can accelerate cash flow and reduce the burden on your accounts receivable (AR) team. However, it’s not without its downsides, such as potentially higher annual percentage rates (APR) when the cost of the discount is annualized.

Pros:

- Direct payment for invoices you choose to discount.

Cons:

- Higher effective APR than anticipated.

- Continual management of AR is required.

- Serves as a one-time cash flow solution per invoice.

What is invoice funding and how does it work?

Invoice funding, also known as invoice factoring, allows businesses to sell their outstanding invoices to a third party, like FundThrough, at a discount. In return, they receive the majority of the invoice value upfront, while the remainder, minus a fee, is paid once the customer settles the invoice. This not only provides immediate cash flow relief but also offloads the burden of collections, as the factor typically assumes the responsibility of securing payment from the customer.

Pros:

- Access early payments from multiple customers.

- Consultative approach to maintaining healthy capital levels.

- Insights into customer credit ratings.

- Support with collections, reducing time spent managing AR.

Cons:

- Accounting for factoring can be more complex.

- Customer contact is required. (If that concerns you, see how we work with your customer.)

Early payments vs invoice funding: pros and cons

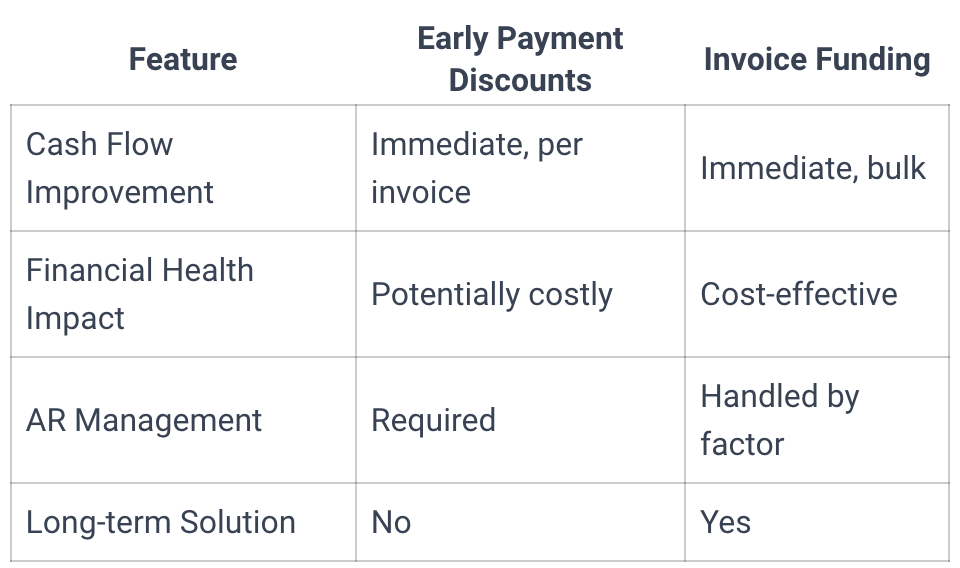

Choosing the right approach to manage and improve your cash flow is critical for any small business. While early payment discounts offer a quick fix by speeding up cash from selected invoices, they often come with hidden costs and require continuous management of accounts receivable (AR). On the other hand, invoice funding not only provides immediate cash flow enhancement by advancing funds on multiple invoices at once but also offers a suite of additional benefits. This choice includes a consultative approach to maintaining your financial health, managing credit risks, and handling collections—thereby allowing you to focus more on growing your business rather than on day-to-day financial operations. Below, we compare these two options side by side to help you understand which solution might be best for your business needs.

The bottom line is that early payment discounts might seem appealing for their simplicity, but they can end up costing more in the long run without adding additional value. In contrast, invoice funding provides a comprehensive solution not just for improving cash flow but also for managing credit risk and collections, freeing up valuable time and resources while giving you a partner dedicated to your success.

Early Invoice Payments Give Away More Than You Think

Early invoice payments can seem like a quick fix for cash flow issues by offering customers discounts for prompt payments. For example, a 2% discount for paying within 10 days translates to an annual percentage rate (APR) of about 36%, significantly higher than many credit card rates. Based on our experience running small businesses and consulting for our clients, we caution against relying too heavily on this method without considering how much you’re really giving away.

However, there are scenarios where the benefits might outweigh the costs. If your business is in a tight spot and needs immediate cash, or if your customers aren’t open to other financing methods like invoice factoring, accepting early payments can be a practical option. This approach ensures operational continuity when traditional funding options are too slow or unavailable, providing a necessary stopgap in critical situations.

In contrast, invoice factoring offers a more comprehensive solution. It allows businesses to convert outstanding invoices into immediate cash without sacrificing a portion of their revenue through discounts. This method also alleviates the administrative burden of chasing payments, enabling businesses to maintain a healthier cash flow and focus on growth and operational efficiencies.

Drawing from our extensive experience, we’ve seen many businesses benefit from the strategic application of invoice factoring to stabilize their finances and support sustainable growth. Hear it from Bob Jameh, owner of CANARU Enterprises.

“…The supplier often can’t wait for the buyer’s payment terms, which can easily range between 30 and 90 days. Without factoring, those cash flow pausing days can be crippling or even fatal to wholesale businesses like mine. FundThrough uses a unique technological platform to process the financing of my open invoices, giving me the cash flow to keep my high–volume procurement moving forward.”

How Invoice Funding Gives You More for Your Money

While early payment options may seem appealing for their simplicity and immediate cash flow benefits, they often overlook the broader, long-term impacts on your business’s financial management. Invoice funding, on the other hand, offers a more holistic approach: not only are you getting quick cash flow for a specific need, you’re investing in a long-term solution to cash flow challenges and investing in the financial health of your business through strategic support and services:

- Staying Well-Capitalized: Our team actively works to address the broader challenges of cash flow by providing funding that keeps your operations running smoothly without the dependency on payment cycles.

- Collections Support: With our comprehensive invoice funding solution, we handle the collections for you. This means you won’t have to deal with the hassle of chasing down payments, allowing you to maintain better customer relationships without compromising on payment timelines. We never contact your customer without contacting you first.

- Freed-Up Time: Less time managing accounts receivable means more time to focus on your business growth. Our services free up your schedule, so you can concentrate on what you do best—running your business.

This comprehensive approach not only ensures immediate financial relief but also builds a foundation for sustained financial health. By choosing invoice funding, you’re opting for a service that extends beyond simple cash flow improvements. It strategically positions your business for growth and stability, making it a superior choice for businesses looking to optimize their financial operations. We are committed to not just funding your invoices but also supporting the journey towards your long-term business success.

Ready to get paid early?

FundThrough's Approach to Getting you Paid Early

At FundThrough, our mission is to empower businesses by eliminating the wait associated with unpaid invoices, ensuring that your cash flow remains robust. Our solutions are tailored to meet the specific needs of each business, emphasizing flexibility, rapid funding, and ease of integration with your existing accounting software.

How FundThrough Works

FundThrough’s platform simplifies the process of getting paid early on outstanding invoices. Here’s how we make it happen:

Create or Connect Your Account: Signing up is quick and easy. You can create a free account or connect your existing accounting software, like QuickBooks or OpenInvoice, to seamlessly integrate your invoicing system with our platform.

Select Invoices to Fund: Once your account is set up, choose which invoices you want to get paid early. Our system allows for automatic syncing with QuickBooks, Xero, or OpenInvoice, making the selection process straightforward and efficient.

Get Paid: After selecting your invoices, FundThrough works directly with your customers to arrange payment redirection to our platform. Verification is swift, ensuring that you receive the funds in your bank account by the next business day (after approval).

Get Back to Business: Once your customer settles the invoice according to the original terms, your commitment ends. There’s no debt on your balance sheet, and you can request funding for new invoices at any time.

Pros of Choosing FundThrough

Quick Funding: Access funds in days, not months. Rapid funding can be a game-changer for businesses looking to capitalize on growth opportunities or manage everyday expenses efficiently.

- Transparent Fees: We charge a clear, single percentage fee based on the net terms of your invoice. Our pricing is designed to be transparent with no hidden fees, ensuring you know exactly what the funding costs upfront. This transparency helps you manage your finances more effectively and make informed decisions about your cash flow solutions.

Flexible Funding: With no minimum credit score or annual revenue requirements, FundThrough offers a level of flexibility that traditional banks can’t match. You control when and how much of your receivables to fund.

No Long-Term Debt: Unlike traditional loans, invoice factoring with FundThrough does not add debt to your balance sheet. This setup can enhance your financial statements, making your business more attractive to investors.

Save Time on Accounts Receivable: Our platform handles the collection of funded invoices, freeing up your resources to focus on core business activities rather than chasing down payments.

Integrations with Major Accounting Software: FundThrough integrates with tools like QuickBooks and OpenInvoice, and syncs invoices from Xero, streamlining your financial operations and minimizing manual entry by pulling eligible invoices into our platform.

Non-Dilutive Funding: You maintain complete ownership of your business. Funding through FundThrough doesn’t involve selling equity or sharing decision-making power.

Professional AR Management: Our expert team manages communications with your customers regarding payments (with your permission), ensuring professionalism and preserving your relationships.

FundThrough isn’t just about funding invoices; it’s about understanding and solving the deeper cash flow challenges that businesses face. Our approach is consultative—our experts look at your overall business health and work with you to find the best solutions to support your long-term success.

In conclusion, choosing the right payment method and approach to invoicing is essential for the financial health and operational efficiency of your business. Invoice funding stands out as a strategic choice for businesses that value both immediate cash flow improvement and long-term financial stability. With benefits like advanced payment processing, reduced late payment fees, and support in managing common forms of payment, it’s clear why so many business owners are turning to factoring. By integrating solutions like billing software and leveraging different forms of payment, you can keep your business well-capitalized and ahead of the average costs associated with traditional 30-day billing periods. Choose invoice funding for a comprehensive, cost-effective approach to keeping your business thriving in competitive markets.