Invoice funding for the staffing industry

Speed up cash flow. Speed up growth.

Get your invoices paid in days - instead of months - to unlock working capital to grow your staffing business.

Why Work with FundThrough?

FundThrough has funded more than a billion dollars to thousands of businesses across the U.S. and Canada, including staffing companies.

Quick Process

Apply in less than 5 minutes. Our online platform gives you access to funds from outstanding invoices in days.

Simple Pricing

Instant funding with one flat fee. No hidden fees or obligation to fund. Fund the invoices you want, and only pay when you fund.

Dedicated Support

Quickbooks Integration

FundThrough is a trusted partner for growing staffing companies

No obligation to fund, no application fee, no annual fee. Pay only when you fund.

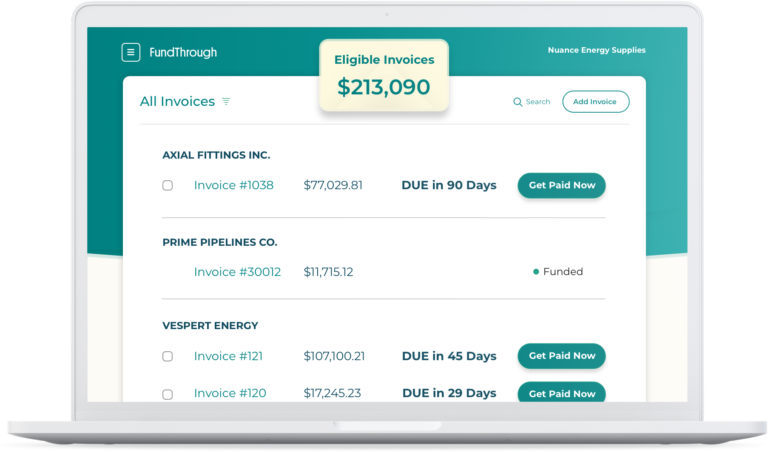

How it Works

- Connect or create your account

Sign-up is quick and easy. You can link your QuickBooks Online account to automatically pull in your invoices, or create an account without a connection.

- Select the invoices you want to advance

Fund as little or as much as you need. Advance specific invoices or your entire book of receivables. Only pay when you fund.

- Get your funds, less fees, in days

You get the full face value of your invoice, less a fee, while we wait for your customer to pay us directly.

Ready to Turn Outstanding Invoices into Cash Flow?

- +1-877-843-0531

- [email protected]

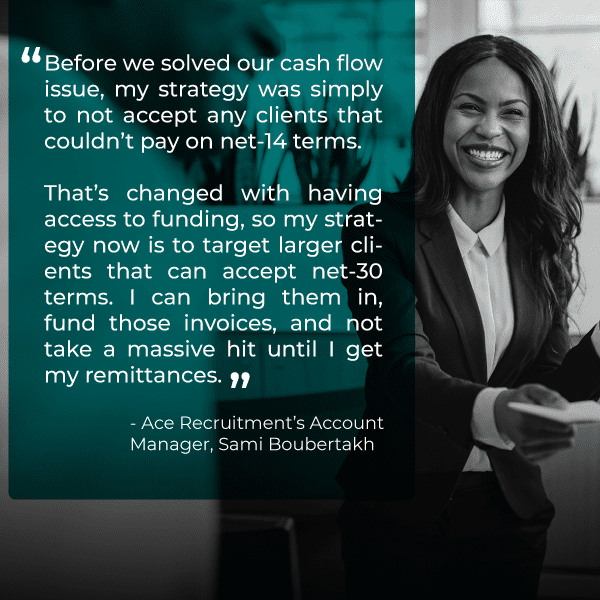

Case Study

Ace Recruitment Targets Large Clients with Invoice Funding

Like many staffing companies, Ace Recruitment sees cash leave the business faster than it comes back in. Workers expect to be paid a week after they’re sent out, which is when Ace invoices the client. It takes at least four weeks to get paid, even though Ace covers all costs up to that point. Partnering with FundThrough has given them opportunities with a wider range of clients.

– ACE RECRUITMENT

Frequently Asked Questions

Users have the ability to fund invoices of any size on FundThrough’s platform. Invoices must be less than 90 days old to be eligible for funding. If you use QuickBooks or OpenInvoice, eligible invoices will be pulled into your account.

Innovation is one of our company values! FundThrough leverages technology to automate many of the manual processes that traditional financial institutions still use today. This allows us to pay your invoices in as little as one business day (after setup and approval).

FundThrough analyzes provided or publicly available information about you and your customer’s business along with information from your accounting software to assess your cash flow (if applicable).

No. Creating a FundThrough account and advancing invoices will not affect your credit score.

We are obligated to report any bad-faith or fraudulent activity to the appropriate credit bureau.

Yes. FundThrough uses secure, bank-grade, 256-bit encryption to protect your data. We never see or store third-party usernames or passwords.

Yes, opening and keeping a funding account doesn’t cost a thing. We don’t charge hidden fees, and you’re never obligated to advance invoices.

Yes, you can cancel your account so long as you don’t have any open requests or outstanding balances. Please connect your account manager or our client support, and they will assist you in canceling your account.

FundThrough was launched in 2014 and has since shot up to become a leader in the financial technology space, funding tens of millions of dollars in invoices every month. We’re backed by some amazing VC and angel investors and are continuously developing new products to serve under-banked small businesses across the U.S. and Canada.

We advance you the full value of your invoice minus one fee based on your invoice terms. That’s it: no hidden fees. You’ll always see your fees before agreeing to fund an invoice. Learn more on our pricing page.

No obligation to fund, no application fee, no annual fee. Pay only when you fund.

Got Questions?

We’re here to help! Our dedicated support team can answer all of your questions and get you on your way to cash flow freedom.

Call +1 877-843-0531

Toll-free Mon-Fri 9am-5pm ET