Grow My Business

How 3 Entrepreneurs Grew Their Businesses with Cash Flow They Can Count On

By FundThrough

The business owners we talk to day-to-day work in different industries, offer different products, and face different challenges. What do they have in common? A couple things. The first is the dream to grow their businesses. The second is a lack of fast cash flow that slows down that growth.

That’s one reason we enjoy our work so much. With invoice funding, B2B business owners get cash for their accounts receivable in a few days, rather than a few months (or 30 to 90 days to be specific). Because their customer pays the invoice total to the factoring company, business owners get extra cash without debt, equity, or the obligation of a bank loan. Reliable cash flow enables them to easily make payroll and other operating expenses while taking on large contracts and more customers. In other words, accelerating cash flow accelerates growth.

But don’t take our word for it. Recently, Intuit QuickBooks recently caught up with a few of our shared customers to talk about how boosting their cash inflow boosted their ability to grow and achieve their goals. Hear them tell their stories in their own words in the videos below. You might just recognize yourself in some of the cash flow challenges they faced and how they’ve overcome them.

Entrepreneur Story #1: Nurses at Heart Spreads the Love With More Contracts

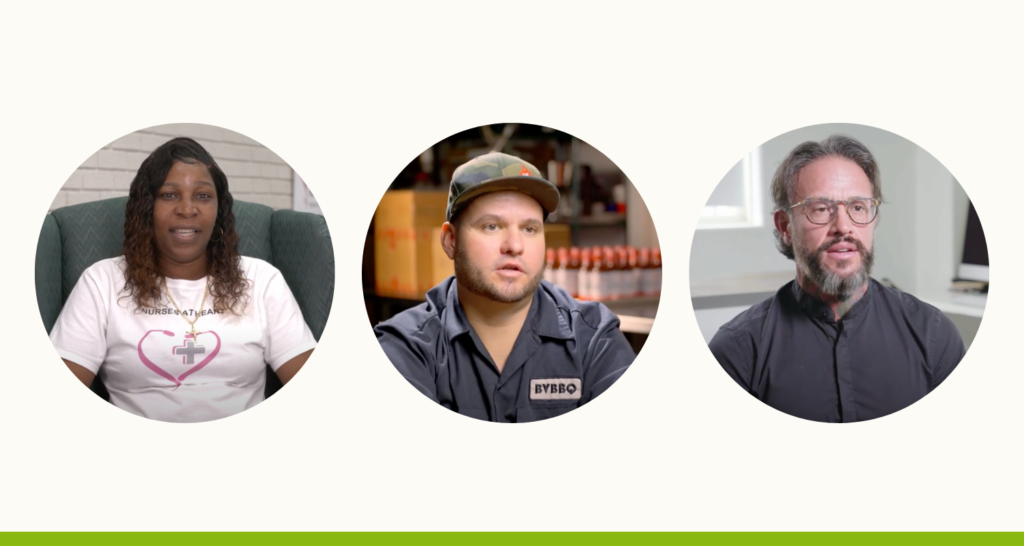

Meet LeQuitha Simmons, registered nurse and CEO-owner of nurse staffing agency Nurses at Heart. As demand for nursing staff ramped up during the pandemic, and with one facility six to eight months late on payments, she knew she needed quick cash flow. LeQuitha unlocked the ability to make hires and take on all the clients and contracts she wanted by unblocking cash stuck in unpaid invoices – all with minimal admin work because of FundThrough’s integration with QuickBooks Online. Watch her story.

Entrepreneur Story #2: Bow Valley BBQ Discovers their Secret Ingredients for Success

Jamie Ayles tells the story of how Bow Valley BBQ, Inc. has rapidly grown and shares an exciting accomplishment: their high-quality sauces and condiments are now listed with major retailers. With the need to maintain the current business and invest in R&D for new products, cash flow has been a constant challenge along the way. Data and quick cash flow became the secret sauce in their recipe for success. Watch his story.

Entrepreneur Story #3: 5Fort Contractors Builds Business Without Delays

Long payment terms and a lack of funding are common in the construction industry. No one knows that better than Dax Castro, CEO of 5Fort Contractors. If he had to rely on the bank, the wait for funding would’ve caused him go bankrupt. Cash flow he can count on means he can pay his crews quickly, continue daily operations with peace of mind, and take on new jobs for custom home construction. Watch his story.

Small Business Cash Flow Management FAQs

Cash flow is the measurement of net cash and cash equivalents flowing in and out of your business during a specific period of time. Your cash flow status indicates whether your company is able to pay its current liabilities and is an important aspect in determining the company’s financial health. For more on the basics of cash flow, check out our Ultimate Cash Flow Guide.

Can cash flow management affect our financial performance?

Absolutely. Regular cash flow analysis and management are critical to your company’s financial performance, growth, and even reputation. The inability to meet your financial obligations can cripple your business in a number of ways; from preventing investment and growth, to hurting your employees, to causing your suppliers to stop doing business with you.

How does stable cash flow help with growth?

Stable cash flow is key to your business’s growth and ability to plan ahead. Cash flow can help with growth by attracting investment, funding new equipment and capital asset purchases, increasing payroll to help you attract and retain talent, covering an expanded inventory, and more. A stable cash flow lets you respond to problems quickly and with ready, available capital.

As an individual, just having the reassurance of a stable and predictable cash flow can present serious benefits to your ability to think strategically and plan ahead. A cash flow problem is typically a short-term crisis, which can distract you from thinking strategically and taking calculated risks to grow your business.

How does your cash flow affect your customers?

You might be surprised at the number of ways your cash flow can affect your customers. With positive cash flow you can scale to meet demand. You can ship sooner. You’re more able to extend credit to your customers. You can honor payment terms, or even look the other way for the occasional late-paying customer.

Conversely, negative cash flow might mean losing key accounts, the inability to fulfill a large order, or having a supplier cancel a customer’s order because you are behind on payments. Having too little cash could mean you’re understaffed and unable to provide adequate customer service.

Cash Flow Management Tips

How small business owners manage cash flow

Small business owners manage cash flow on an ongoing basis by forecasting cash flow and making sure they’re collecting enough payments from revenue generating activities to cover their expenses. Maintaining an up-to-date cash flow statement can help you see where your business stands at a given time. Despite their best efforts and intentions, this simply isn’t always possible. When cash flow is negative in the short term, solutions like cost cutting and invoice financing can help. Over the longer term, invoice funding can ensure a steady stream of operational cash flow, freeing up funds for investment, inventory and assets, and other revenue generators.

Cash flow management strategies

Cash flow forecasting, invoicing immediately and using short payment terms, monitoring expenditures, and invoice factoring are all effective cash flow management strategies for small businesses.

What are the best cash flow management models?

The best cash flow management model is the one you’re actively involved in. Even if you have an accountant or bookkeeper to manage your financial records, make sure you are regularly seeing a cash flow statement and cash flow forecast so you can anticipate potential cash flow issues and put your management strategies to work.

Best cash flow processes

The best cash flow habits are: a) cash flow forecasting, to keep you one step ahead of negative cash flow issues; b) a cash flow management business strategy with pre-approved policies and procedures, to empower you to prevent or resolve negative cash flow quickly; and c) cash flow solutions like invoice factoring, to give your business operations an immediate injection of cash for payroll, supplier invoices, and growth activities.

How to manage cash flow day to day

Work your way through our Ultimate Cash Flow Guide, practicing the cash flow forecasting and management techniques you learn along the way. If you find yourself craving an in-depth, instructor-led course, try Running a Profitable Business: Understanding Cash Flow. It’s led by Jim Stice, Distinguished Teaching Professor of Accounting in the School of Accountancy at BYU, and Earl Kay Stice, PricewaterhouseCoopers Professor of Accounting at the Marriott School of Management.

Are there free cash flow solutions?

Absolutely. In fact, FundThrough accounts are free forever, with an innovative repayment structure designed to suit the unique needs of small businesses. You pay a small fee for our invoice financing service, which boosts cash flow quickly rather than making you wait 30, 60 or 90 days for client payment. Right away, you can process payroll, buy inventory, advertise and more.

Get Cash Flow Fast With Invoice Factoring

You’re getting ready to launch a new product and really want to make a splash in your target markets. It’s time to strike while the iron’s hot. Unfortunately, your largest customer has a 60-day payment cycle. Your cash flow is dead in the water for at least another month…

Your business is a constant juggling act. You can see that there are sales opportunities there if you can increase your inventory, but it’s so hard when you need to make payroll and your cash flow is dependent on how long it takes clients to pay you…

If you’re experiencing challenges like this in your own business, you’re not alone. Having access to fast cash flow is critical not only to the growth of your business, but to its very survival. Running out of cash is one of the top reasons small businesses fail; in fact, 27% of startups die at the hands of a cash crisis.

Bank loans and investors can help fund your company’s growth, but they tend to want to see a pattern of profitable business history before they’ll get behind your business. And while crowdfunding is great for those whose campaigns go viral, they’re but a tiny minority.

Invoice factoring is a cash flow strategy that works by converting your outstanding invoices or accounts payable into immediate payments. You can end the nail-biting, hair-pulling cycle of stress that is trying to predict and plan around when your customers might pay their invoices.

You don’t have to wait to buy inventory, take on new business, or cover your payroll.

FundThrough’s invoice factoring solution empowers you to access your money when you need it, to fund the business activities that sustain and grow your business.

Ready to Get Growing With Fast Cash Flow?

Get started by creating a free FundThrough account, or connecting your QuickBooks, WorkBench, or OpenInvoice account to start funding an invoice. Or contact us today if you have questions about invoice funding for your business.