Access your grant awards and funding when you need it

FundThrough provides Young Associates' clients early access to funding so your organization can jump cash flow gaps and focus on what you do best.

FundThrough is a trusted Young Associates partner

FundThrough advances thousands of dollars to organizations across the U.S & Canada who are awaiting the release of funding from grants and awards.

Use your funding confirmation letters to get early access to your grants so you can jump cash flow gaps

Manage cash flow

Maintain a smooth, predictable cash flow schedule on your terms.

Pay on time

Payroll, expenses, and supplies paid promptly. Watch your suppliers smile.

Expand operations

Hire more employees, upgrade your space, and start orders right away.

Getting started with FundThrough

1. Create a free account

No obligations, just a free and simple sign-up. Connections are secured with 256-bit encryption, just like your bank.

2. Connect your organization’s accounting software and bank account

A read-only connection lets us verify your unpaid invoices, evaluate your funding limit, and deposit funds into your account.

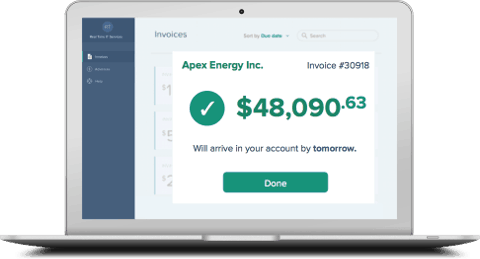

3. Choose which grants or invoices to fund

Fund any number of grants or invoices up to an approved limit – or factor large invoices at a preferred rate with no limit.

4. Celebrate cash flow freedom

We deposit the funds into your organization’s bank account within 24-48 hours so you can focus on getting down to business

Pricing

No cost to maintain an account

Creating an account, getting set up after approval, and uploading invoices are always free. No contracts, no obligations, and no annual fee.

Preferred rates for invoices totalling over $50,000

Receive an advance of up to 95% of your confirmed funding. Terms are tailored to the needs of your organization. Contact our funding team to discuss your options.

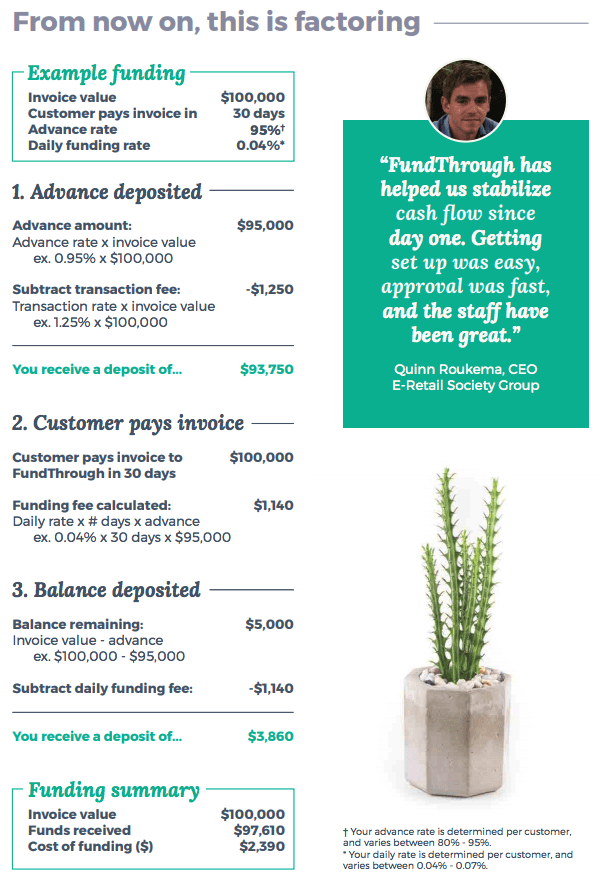

When funding invoices totalling more than $50,000, FundThrough sets up an invoice eFactoring account for you. Advance up to 95% of your invoice value and receive funds the next day. Your advance is repaid when your customer pays the invoice.

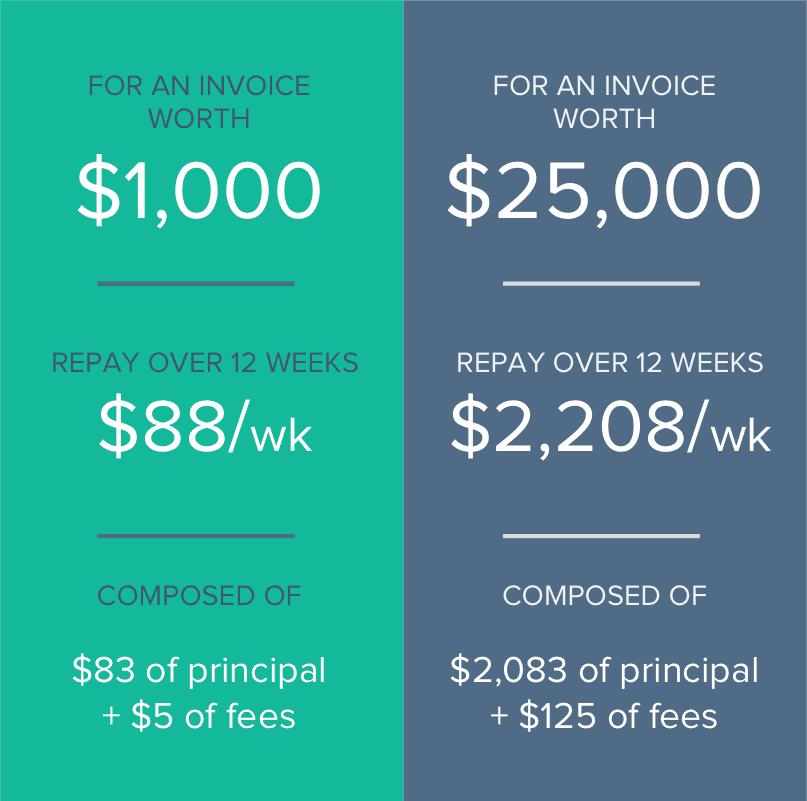

When funding invoices totalling less than $50,000, FundThrough gives you a line of credit backed by your outstanding invoices. FundThrough collects a 0.5% weekly fee on the invoice value, spread over 12 small automatic weekly repayments.

Create a free account to access cash flow freedom

No annual fees — pay only when you fund.

Get access to your funding today

Keeping your on-demand funding account is free forever.

“FundThrough solves a problem that keeps entrepreneurs up at night.”

– Mariam, Koa Natural Foods

Frequently Asked Questions

When using our invoice-backed credit line (for invoices totalling less than $50,000), your FundThrough funding limit is determined by looking at your invoicing history and the credit strength of your customers.

When using our eFactoring (for invoices totalling over $50,000) there is no limit whatsoever on your funding – we look at your invoicing history with specific customers to determine your advance rate (80-95%) and your funding fee (1-6%) and that’s it!

What isn’t required? No matter how you fund, we do not ask for lengthy business history, a business plan, minimum funding, or contract terms. As such, FundThrough does not impact your personal or business credit score.

FundThrough funding limits are designed to work for organizations of all sizes – regardless of whether you’re looking for $500, $50,000, or $5 million. Furthermore, your ability to fund grows automatically as you fund invoices and demonstrate strong repayment ability.

Traditional financial institutions generally want to see that you are an established business with a lengthy, positive business and personal credit history. At FundThrough, we’ve developed a model to evaluate your fundability using different criteria like your invoicing history and the credit strength of your customers to provide you with a funding limit. In addition to not affecting your personal or business credit score, our model enables us to provide financial access to businesses that have been underserved and overlooked by banks.

After completing your account, FundThrough will provide you with a decision within one business day.