Home » FundThrough for Partners » Overview » Branding Referral Pages

Branding a Referral Page

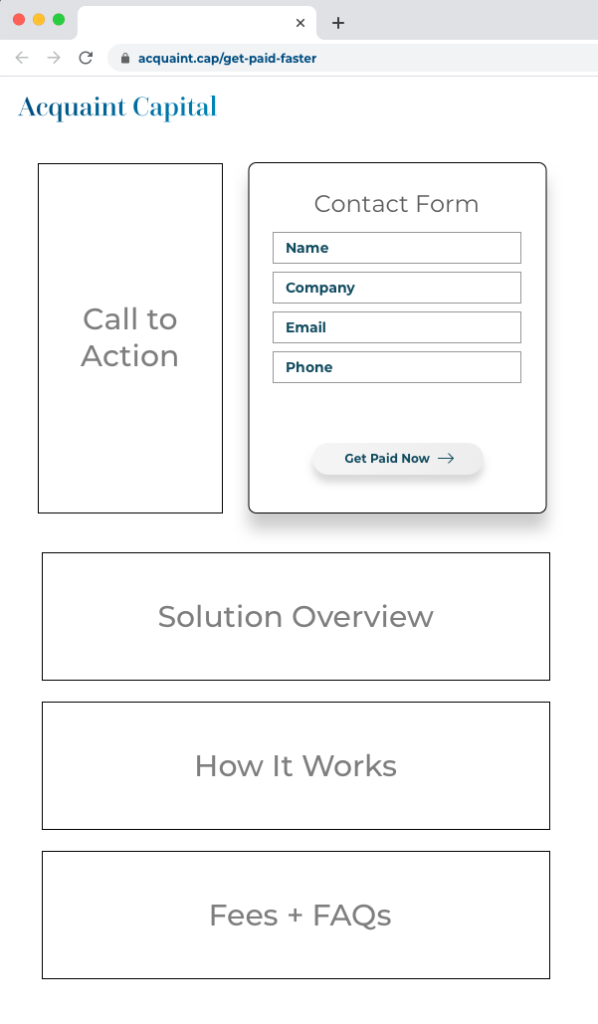

A Referral Page tells your customers about FundThrough, the benefits they get from funding invoices, and shows them how to get started with a funding.

If you’re planning to build and host your own referral page, read on for recommendations about what kind of content that page could contain.

Content Guidelines

- Short explanation of service/call-to-action

- Contact form

- Benefits/solution overview

- How it works

- Funding options (incl. fees)

- FAQs

Read more about optionally passing information from your contact form to the FundThrough Sign Up form here.

Ready-to-use Copy for Your Referral Page

Grow Your Business by Getting Invoices Paid Faster

Stop waiting 30, 60, 90 or more days for customers to pay. Start funding invoices to get cash now for making payroll, taking on large orders, or simply having peace of mind about your cash flow.

Ready to get funded?

Create your free account in less than 5 minutes.

We recommend asking for:

• First name

• Last name

• Company name

• Business email

• Phone number

Never worry about your cash flow again

Funding unpaid invoices allows you to use your own money on your terms.

No funding limits

Fund invoices of any amount

Receive cash fast

Get funds in as little as 24 hours after approval.

Keep equity & ownership

Get funding without giving up parts of your company

Get growing

Buy equipment, bid on large projects, and take on more work

1. Sign up with FundThrough

Sign-up is quick and easy. You create an account, upload invoices and link a bank account and we get to work.

2. Select the invoices you want to advance

Fund as little or as much as you need, with any buyer. Advance specific invoices or your entire book of receivables.

3. Get your funds, less fees, within one business day

You get the full face value of your invoice, less fees, right away while we wait for your customer to pay us directly.

“FundThrough has been instrumental in helping my company meet its cash flow needs quickly, easily and at a low cost. A few clicks and funds are on their way.”

Mark Baker, Google Review

FundThrough is rated 4.8 on Google Reviews

Read more reviews here →

No surprises or hidden fees

You’ll always see the full cost of funding upfront before you decide to fund. Plus, there are no monthly or annual fees — your account is free forever.

No obligations

Fund as little or much as you need. There are no minimums or limits on how much funding you can advance.

Flat upfront fee and flexible repayment options

For each invoice you choose to advance, you’ll pay a small monthly fee of 2.5% per 30 days. For more information, refer to FundThrough’s pricing page or call us at 1-800-766-0460.

Is there a limit to the value of the invoices I can fund? Is there a minimum or a maximum?

We have no upper or lower limit on invoices that you can fund — we’ve funded invoices as small as $15 and as large as $2 million.

How does pricing work? Is the cost a flat rate?

We charge a flat fee of 2 to 5 percent, so you immediately receive the net 95-98% of the invoice value with no other fees.

The exact price for a given invoice is based on three factors:

1. Who is your customer?

2. What are your terms/relationship with them?

3. How long do they typically take to pay?

Once you have enabled a connection to an invoicing system [this could be your platform name], we’ll be able to assess the three factors above to determine your specific rate (on a per buyer basis) within the 2 to 5 percent range. This rate will be communicated and displayed up front before you decide to fund.

Are my buyers eligible for this program?

Yes, invoices to any of your buyers are eligible for this program.

FundThrough will work with you and your individual buyers to get you set up and enable funding. We already have relationships with many large buyers.

What happens if my buyer does not pay the invoice on time? Do I have to pay the invoice back myself?

Sometimes buyers don’t pay on time. As long as there’s a clear expected pay date, we wait for your buyer to pay. If the invoice remains unpaid for an extended period, we may ask you to substitute another invoice for the value of the missing payment or pay the outstanding balance.

Assets

Download FundThrough’s logo and approved stock photography from:

https://www.fundthrough.com/brand-assets/

Password: aaamazing

Note that usage of the FundThrough brand must conform to FundThrough’s Corporate Brand Guidelines.

If you would like to use other images not provided here, please contact your Partner Manager with what you have in mind.