*FundThrough is an Enverus-supported product, however please note that some of our buyers may not be opted in to this program and therefore will not accept invoice factoring requests.

Please contact FundThrough to determine if your buyer is opted in to the program.

Get Your Invoices

Paid in a Day

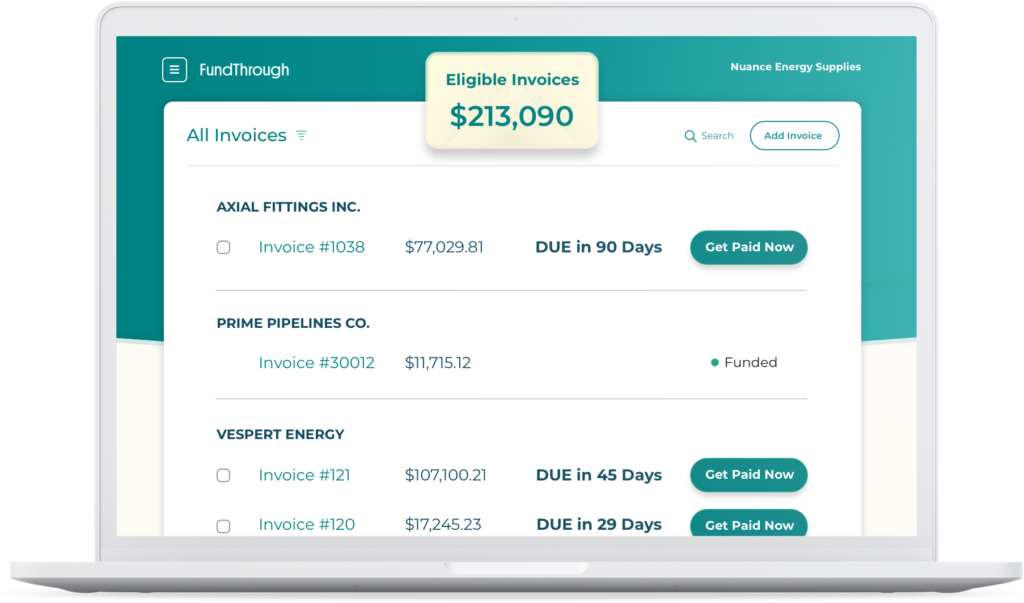

Workbench has partnered with FundThrough to help you eliminate cash flow gaps with easy, affordable funding.

- Get 94-98% of your invoices advanced in 24 hrs

- You choose which invoices to which buyers you want to fund - whether it's on Workbench, OpenInvoice, or other systems*!

- Discuss your funding options and rates with a funding specialist

Enable FundThrough today so you can use it when you need it

By clicking ‘✓ Enable FundThrough’ you authorize Enverus to release relevant data to FundThrough to enable its services as defined in its terms and conditions.

Already use FundThrough? Log in here

for free

* For a limited time, FundThrough will reimburse qualified Workbench or Cortex users on all funding fees for their first $25,000 in funding once invoices are paid to FundThrough.

Flat upfront fee

For each invoice you choose to advance, you’ll pay a small fee equal to 2% to 6% of the invoice value.

No surprises or hidden fees

You’ll always see the full cost of funding before you decide to fund. There are no additional fees for opening a FundThrough account.

No obligations or contracts

Fund as little or much as you need, when you need it. There are no contracts, minimums, or limits to your funding.

Over

to more than

with more than

Already have an account? Log in here

*Promotion applies to newly approved FundThrough fundings on accounts in good standing, on eligible invoices only. To qualify for this offer you must be a Workbench or Cortex user with a FundThrough-enabled account. Funding fees will be charged on the funding initially and rebated once all funded invoices during the promotional period have been paid to FundThrough. For further information on this promotion please contact FundThrough directly at +1877-843-0531.