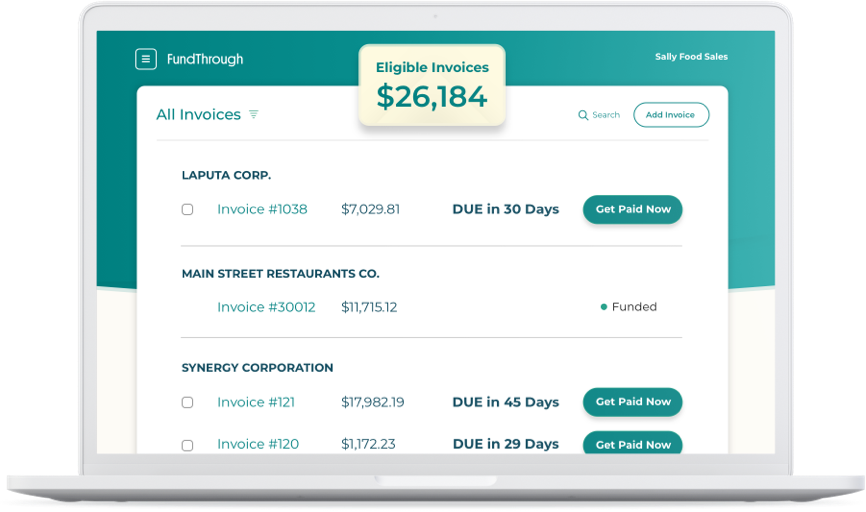

“There is definitely a sense of peace of mind knowing that if the client doesn’t pay the invoice, we can factor it, and we can make our payments. There is definitely peace of mind when we think about FundThrough.”

Kevan Mikkelsen, Finance Lead,

Steel River