This is another entry in our experts series! We ask entrepreneurs for time- and money-saving tips from their area of expertise to help small business owners create powerful financial habits and strengthen their business muscles.

Cash Flow Forecasting

Today’s topic is all about seeing into the future. Cash flow forecasting is the practice of looking ahead to predict your monthly cash balance after making and receiving scheduled payments. Habitual forecasting not only alerts you to potential cash gaps, but ultimately helps you make decisions with a more informed perspective. Just like driving a car – looking further down the road to where you’re headed is much safer than steering from just beneath the dashboard.

We asked Colin Hewitt, the CEO of Float, about forecasting and where small businesses can make the biggest impact on their cash flow position. His answer is to treat forecasting like a muscle – the more you train, the better you become at using it when you need it most.

RM: Hi Colin, thanks for sharing your experience with us today. Your team at Float have learned a lot about cash management for small and growing businesses since you started in 2010. For our readers new to Float, would you explain what Float has built and what you’re trying to accomplish for small business owners?

CH: Thanks for having me, Rhys! Our mission at Float is to help businesses build forecasts they can depend on. We also recognise that the tools that do this need to be in a language that business owners can understand. So we took a step back, scrapped the jargon, and built something that everybody could us, regardless of their background.

Float is an intuitive and visual solution to cash flow forecasting. We integrate with your accounting software to pull through your invoices and bills to populate your forecast.

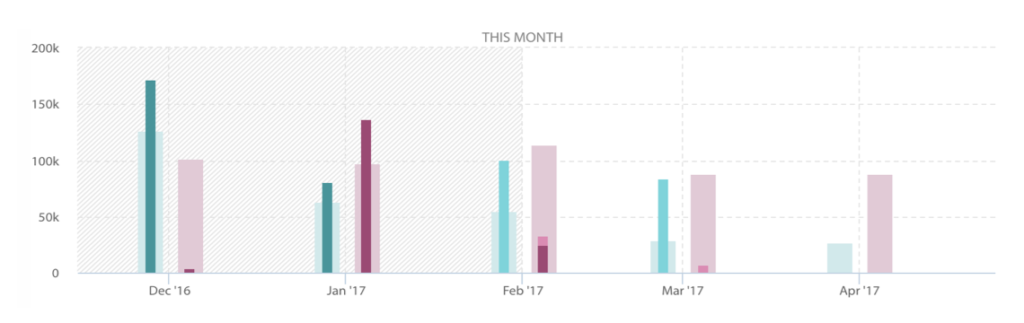

Monthly cash forecasting with Float

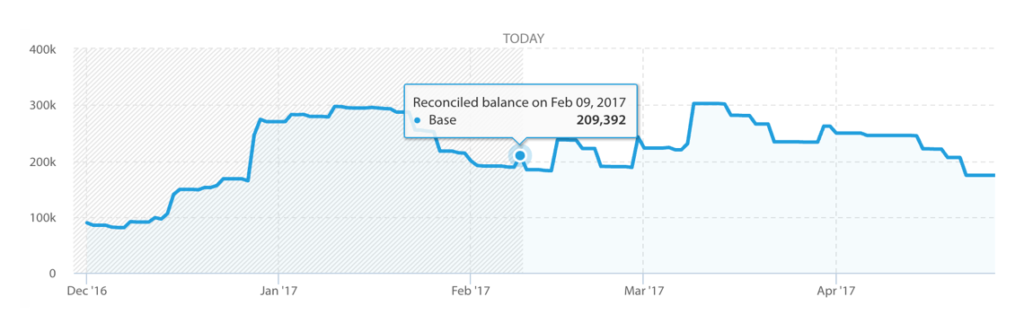

Daily cash forecasting with Float

Forecasting has been a difficult problem for so many businesses for such a long time. With cloud accounting coming of age, we’re determined to build the most intuitive solution for businesses, and we’re just getting started!

Confidence is key, and cash is king. I know they’re cliches but they’re cliches for a reason. At Float we want to empower our customers to have confidence in every decision they make for their business. Understanding your cash position now, and in the future, is vital to the success of your business.

RM: Let’s start with the basics: what is forecasting and how does it influence financial decision-making?

CH: A cash flow forecast is a prediction of money in vs money out – sales vs overheads. For very small businesses, forecasting could be as simple as counting up the money you expect in a given period and subtracting the money you owe. As the business grows, so does the complexity of your accounts. Multiple bank accounts, more staff, more bills! It can soon add up.

Traditionally, spreadsheets were used to forecast your cash. Spreadsheets are great for looking backwards at cash payments but they can make it difficult to visualize a future scenario. Sheets are also very time-consuming and as a business owner myself, I know time-management is one of my biggest challenges. Believe me.

Looking to save time with your cash flow spreadsheet, like Colin says? Download FundThrough’s free Cash Flow Statement template for both Google Sheets and Microsoft Excel.

A big hurdle for me as a business owner is to understand what the outcome of a cost will be. If I decide to spend money on something, where will that leave me in a few months time? Forecasting allows me to understand the journey my cash will take. And it’s exactly why we created Float.

RM: It is like a journey! Staying with that analogy, can owners plan their forecasts using historical information (maps) or is real-time digital financial data (GPS) necessary?

CH: If things get tight on available cash, there is a danger that a business won’t be able to pay the bills, taxes or make the payroll. This can keep business owners up at night, and so getting on top of it with the most up-to-date information possible is super important. Knowing exactly where the cash in the business is going means that over-committing, or overspending just doesn’t happen. And business decisions can be made with confidence.

Familiarity with your bookkeeping systems is also really important. Understanding where cash is coming from and where it’s going should become as natural as a reflex.

Understanding, too, when you’re in a healthy cash position is so important. Keeping cash in the bank is the same as keeping that fancy set of plates for when the Queen comes over. [Editor’s note: Float HQ is in Edinburgh, Scotland. The Queen very well could visit. Always be prepared.] It’ll just never happen! Instead, knowing you have cash in the bank means that you can seek out investment opportunities, or else increase your marketing budget, buy yourself that new car! Perhaps that last one isn’t sound financial advice… But it’s an option!

With real-time data you’ll never have another sleepless night worrying about whether you’ll make payroll; you either will or you won’t. That indisputable information lets you begin doing something about it, rather than losing sleep wondering.

The foundations of Float are built on our mission to give business owners all the confidence they need to run their business efficiently. To grow it, and to move it in any direction they please. We believe that having a live and accurate forecast means they can make the best decisions possible.

“Forecasting allows me to understand the journey my cash will take”

RM: So how much lead time does a business owner realistically need to ‘right the ship’ from a negative cash flow forecast?

CH: Depends on what’s causing the gap in the first place. If you have confidence in your customers it could be as simple as improving the credit control process, or chasing down overdue invoices, or getting some grace time from your suppliers paying your owing bills. Dealing directly with your customers can often be the fastest mode of recovery but it isn’t necessarily the most reliable.

The good news is there are many new cash flow options available on the market that finding a viable short-term solution should only take days, rather than weeks. Using an invoice advancing service like FundThrough, for example, takes a day. Finding and consulting with an accountant or virtual CFO would help identify the underlying issue and establish whether it’s just a cash flow hiccup, or whether there are deeper issues with the forecast.

RM: On those deeper issues creating cash gaps; can business owners anticipate these or are we talking about an exercise in response time? What makes a successful cash strategy?

CH: It’s discipline. The difference between proactive and reactive cash strategy is the difference between training for a marathon and just, entering a marathon sans preparation. Learning the route, setting a goal, knowing where you’re headed and keeping pace along the way all but guarantee you’ll reach the finish line with a respectable time.

Joining the race unprepared means you won’t have the foggiest idea whether, midway, you’re even on track to finish. You could burn out before reaching the finish line or you could finish with plenty of gas in the tank – hours after everyone else. Reaching the finish line requires discipline.

“Understanding where cash is coming from and where it’s going should become as natural as a reflex.”

RM: Okay. Teach me how to be disciplined about my cash flow, then. **Puts on headband**

CH: Start with making cash reconciliation a regular habit. Schedule recurring calendar appointments (and don’t skip them) to review payments and invoices.

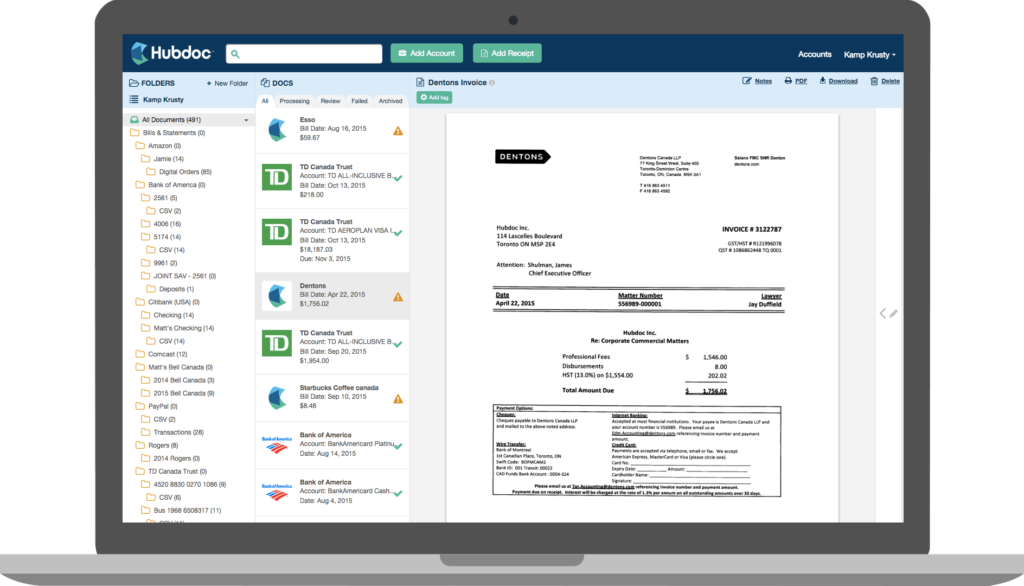

Next, automate parts of your accounting process. If you have your system set up properly, updates will be sent to your accounting software daily or weekly. (Any update over a week old is old news.) Tools like Receipt Bank and HubDoc help hugely to automate this process and save time on bookkeeping overall. Definitely check those guys out.

Invoice management with HubDoc

A massive part of the bookkeeping process is bank reconciliation – knowing where your cash is going and where it’s coming from is critical to keeping your bookkeeping current. Float thrives with accurate reconciliation!

Anyway – being armed with up-to-date books means you’re all set to start looking ahead at your cash flow by at least 4 to 8 weeks. Depending on your net terms, and those of your supplier, you might want to look even further out to be sure you’ll have enough lead time to react.

Float makes it easy to plot and plan a cash forecast visually, so as long as your bank accounts are frequently reconciled then it’ll take no time at all to enter your cash budgets into Float.

RM: How much time each week should owners be dedicating to cash flow forecasting?

CH: That really depends on the business. Obviously, the more you look at your Float the better the understanding you’ll have of your cash position. For most, it’s an if-and-when type of situation. We find that the people who check Float regularly have a better grasp on their cash flow and can solve on-the-spot-decisions and “what if” experiments quickly.

RM: So small businesses can experiment using “What if?” scenarios?

CH: Yes! Easily. Probably more easily operating as a smaller business than a large one. “What if” analysis is the ability to predict what effect a business change will have on your cash forecast. For example, what if your marketing budget increases? What if you hire a new employee? What if you have a sudden dip in sales? Usually, small businesses have fewer variables to take into account, compared with large corporations. Because of this reason, it’s not uncommon for small businesses to be able to experiment more easily than larger companies.

RM: What if you could solve any cash problem in a day? There’s FundThrough. #shamelessplug

It’s a skill itself. “What if” analysis or “Scenario Planning” as we call it in Float, is really just the ability to plan alternative roadmaps for your business. Try to imagine it as Google Maps for your business. You can see the different routes you might take to a certain destination. Some may take longer. Some may involve detours. All routes get you to your destination but having options gives you security.

Spreadsheets aren’t built for alternative scenarios. They’re not intuitive enough and for most people that aren’t wizards at maths, including myself, it’s too fiddly to do. It’s one of the reasons I love Float. And actually another one of the reasons why we created it in the first place! It’s so easy to launch a new scenario, make a few changes, and plan for whatever future you want – or don’t want, as the case may be.

RM: Would you be willing to show owners how to get started with experiments in Float? Maybe a demo?

CH: Naturally. 🙂

RM: A bit of a ‘gimme’ question for you but here goes – are there specific tools you’d recommend for small business owners to strengthen their cash forecasting muscles?

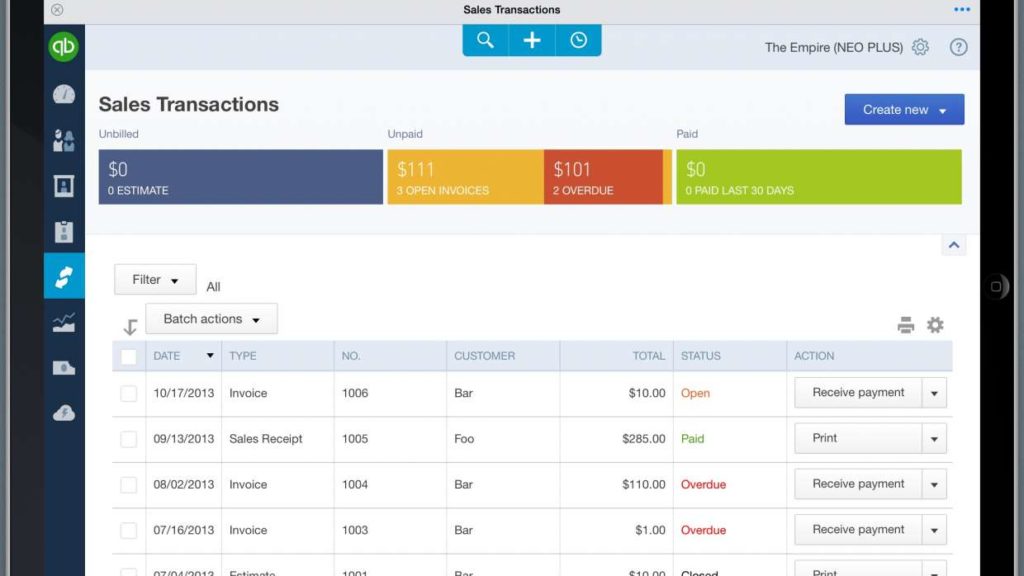

Hopefully most owners are using an accounting platform to manage their finances. We integrate with QuickBooks Online, Xero, and FreeAgent. So we’re big champions of them. Cloud accounting software has proven time and time again to be invaluable to most, if not all, business owners. Ask our users. It’s pretty much standard practice now, regardless of which platform. You should be tracking payments somewhere centrally.

Invoicing with QuickBooks Online

Integrated apps like ReceiptBank and Hubdoc, I think I mentioned those earlier, can really help to keep on track of finances and automate some of the time-consuming parts. They will connect to your accounting platform and make updates unbelievably easy.

Honestly funding services like FundThrough (shout out to you guys!) can really, truly, save your cash flow with minimal effort and is so worthwhile in the long run. You’re solving a really critical problem for owners so cheers.

What kind of CEO would I be if I didn’t mention Float? We really do save our users hours of time! We’ve actually found that our customers save up to eight hours a month by using Float for their cash forecasts. We’re pretty proud of that statistic.

Really, it comes down to “what will scale with you as you grow?” What do these apps allow you to do that you couldn’t do without? If you can’t answer these questions for 2-3 years ahead then they’re probably not the tools you want to be using.

RM: Colin, final question – if you could leave business owners with one single golden rule for small business success – what would it be? This is your chance to have your legacy immortalized in writing…

CH: I’ll give you three!

1. Hire people that are smarter than you.

2. Aim to have no operational responsibility in the company.

3. Treat all the people you work with really well.

And, remember to breathe.

RM: That was actually four and I’m going to allow it. Colin – thank you so much for spending time with us and sharing your experience with our readers. Very, very actionable suggestions! Where can I direct readers who want to get in touch with you and the Float team?

CH: My pleasure! Of course, our excellent Support team are always available for any questions or queries that anyone may have. You can connect with them by sending an email to [email protected]. Or check out our website and use the chat button in the bottom right hand corner!

Want to learn more?