As a small business owner surrounded by countless options, you may find yourself wondering which accounting software is best for your organization. This week, our team breaks down the differences between the three most popular options on the market: FreshBooks, QuickBooks, and Xero.

As is usually the case in small business, the answer to which accounting software is best for your business is that it depends.

Before you make any decisions, you should take time to assess your business needs. FreshBooks, QuickBooks, and Xero contain several similar features, but at the end of the day, your decision should come down to a) what they do differently, and b) which one does exactly what your business needs. Some of the software packages have more features than others, but that may be irrelevant if your business doesn’t need the additional features. The more expensive plans also have more features, so you have to also know what you can afford.

FreshBooks has time-tracking and invoicing capabilities.

For instance, FreshBooks is not a full accounting system because you cannot generate financial statements. But, if you’re just starting your business or have an accountant, that feature may not be important to you right now. On the other hand, if you have plans for growing your small business, you may want an accounting software package that can grow with your business. With FreshBooks, because it’s not a full accounting software, you cannot tell the cash position of your business. That being said, a nifty feature is that you can track time and turn it into a client invoice. It’s worth noting that the company is always adding new accounting features and has strong phone support.

QuickBooks can grow with your business.

QuickBooks is a full accounting software package that has two different programs. One is a standalone that’s on your desktop and the other is cloud-based. The cloud-based program is a monthly subscription based one. You also have to pay for each additional user. It’s not easy or seamless to move between both programs, but as your small business grows, you won’t outgrow this accounting software package. It’s worth noting that QuickBooks can get very pricey as you have additional users – with the desktop version any user can log in.

Xero integrates with PayPal and Stripe.

Xero is a full accounting cloud-based software package that works well with different invoicing, project management, and payment processors. If you use PayPal and Stripe to accept a lot of payments in your small business, they integrate seamlessly with Xero. This accounting package also works well with merchant accounts from individual banks. This is also an accounting software package that can grow with your business because of its many features and integrations – but it doesn’t offer phone support.

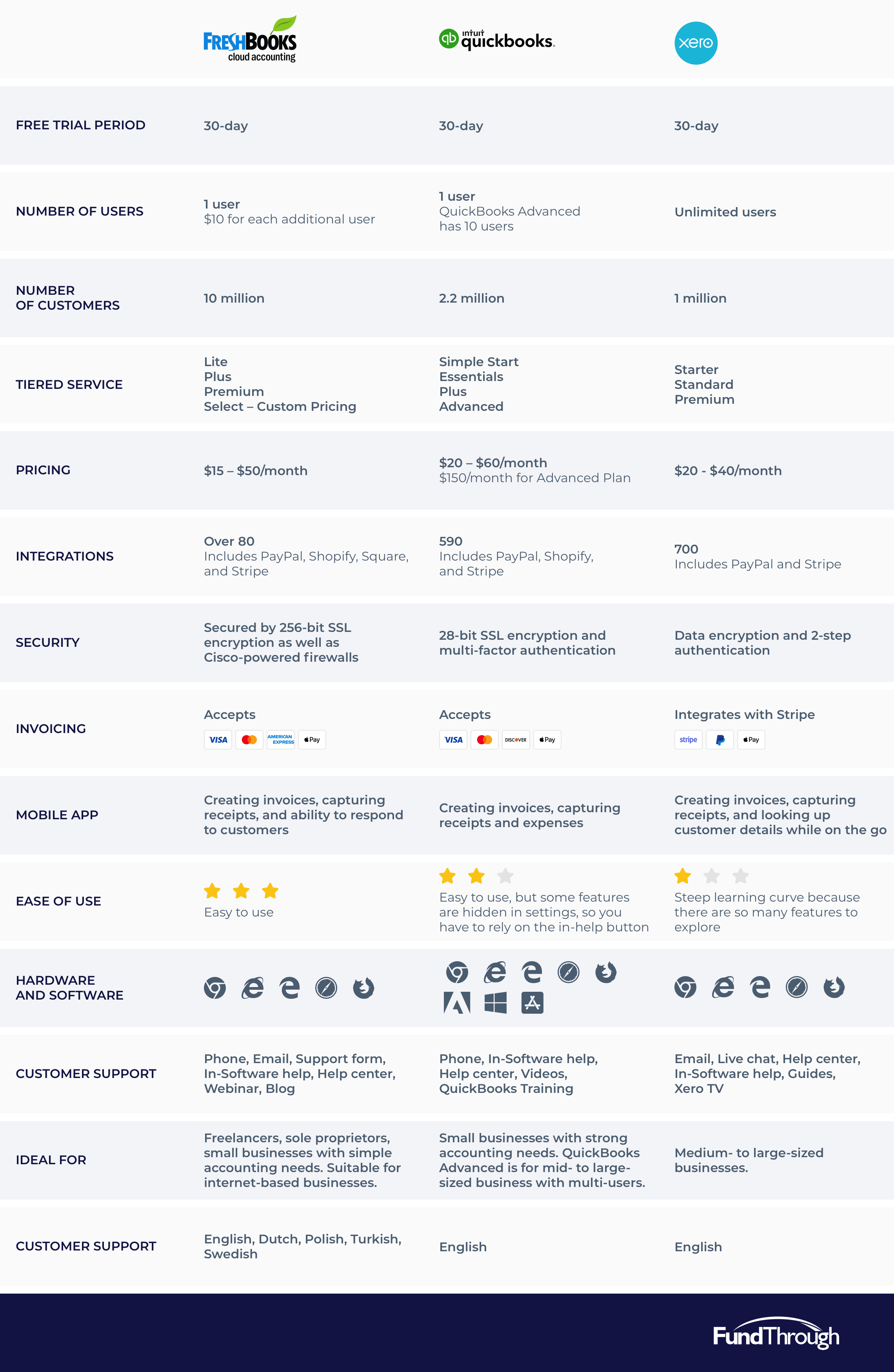

Below is a table with some of the key features for the three accounting software packages, but please take the time to visit each of the three websites to see what they have to offer.